Answered step by step

Verified Expert Solution

Question

1 Approved Answer

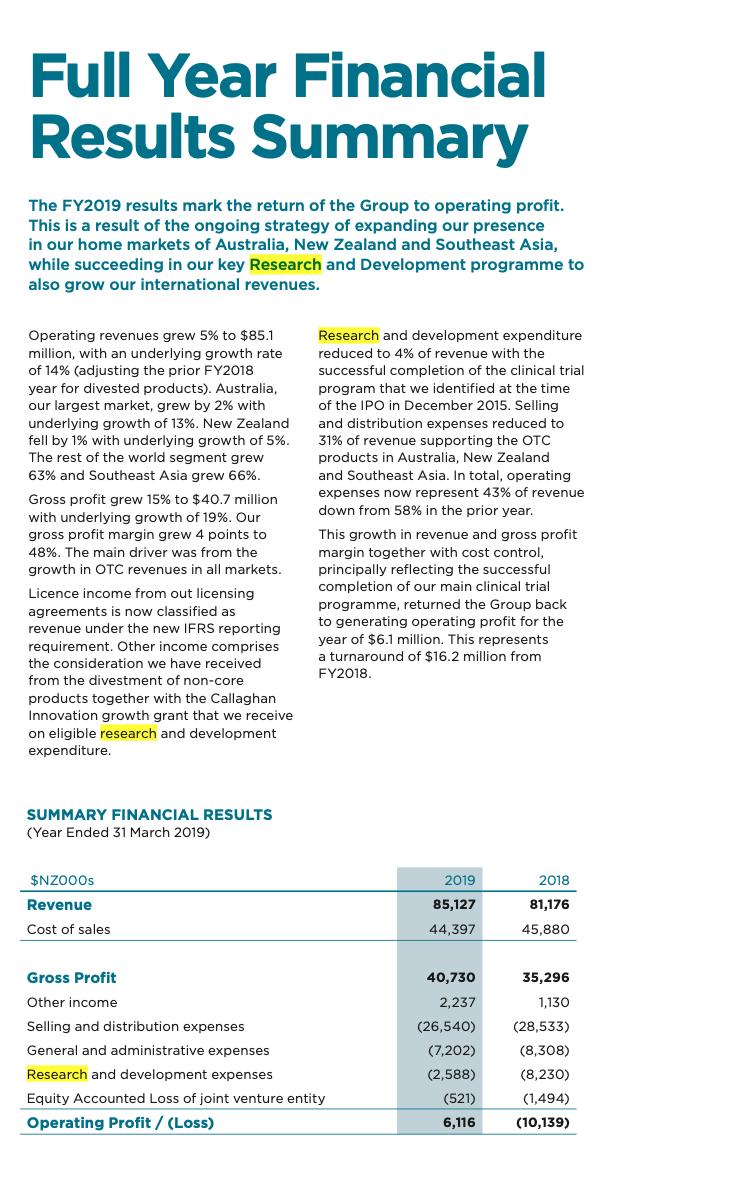

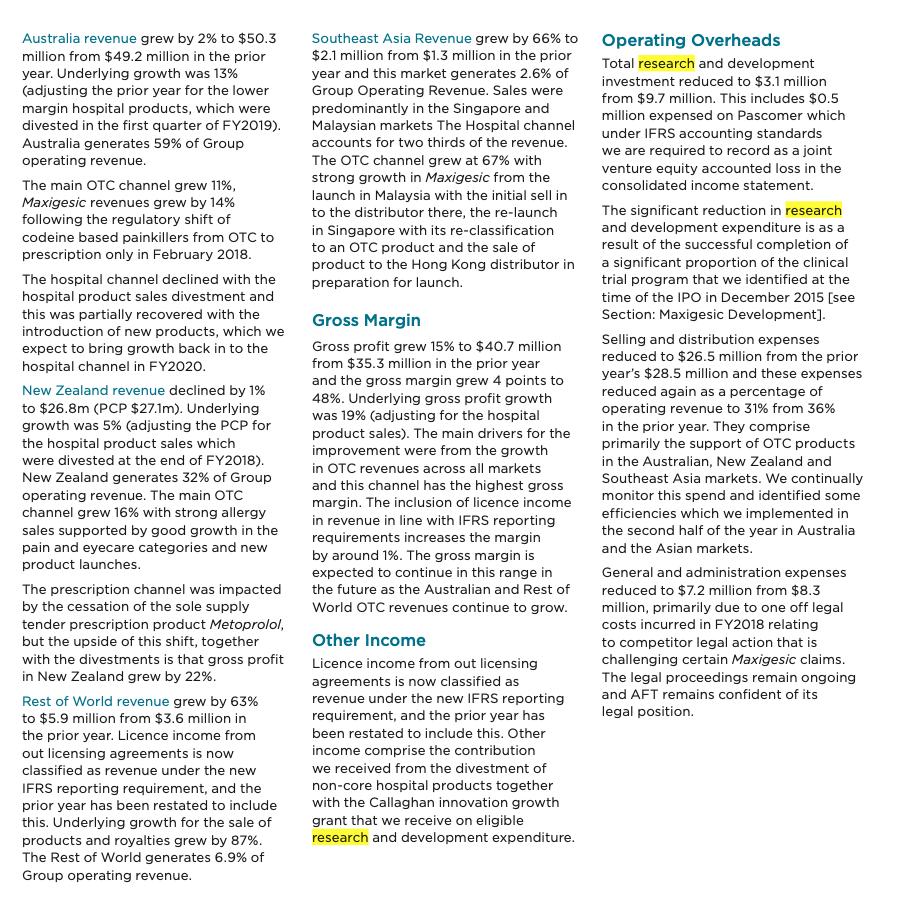

Do you think that the expensing of R&D expenditure causes any damage to the company? Support your answer with relevant financial/non-financial figures. And How does

- Do you think that the expensing of R&D expenditure causes any damage to the company? Support your answer with relevant financial/non-financial figures. And How does the company attempt to overcome any potential damage created by the NZ IAS 38 requirement to expense research expenditure immediately? please use the company's figures to support the answer.

How to overcome r&d expensed damage

What info do u need?

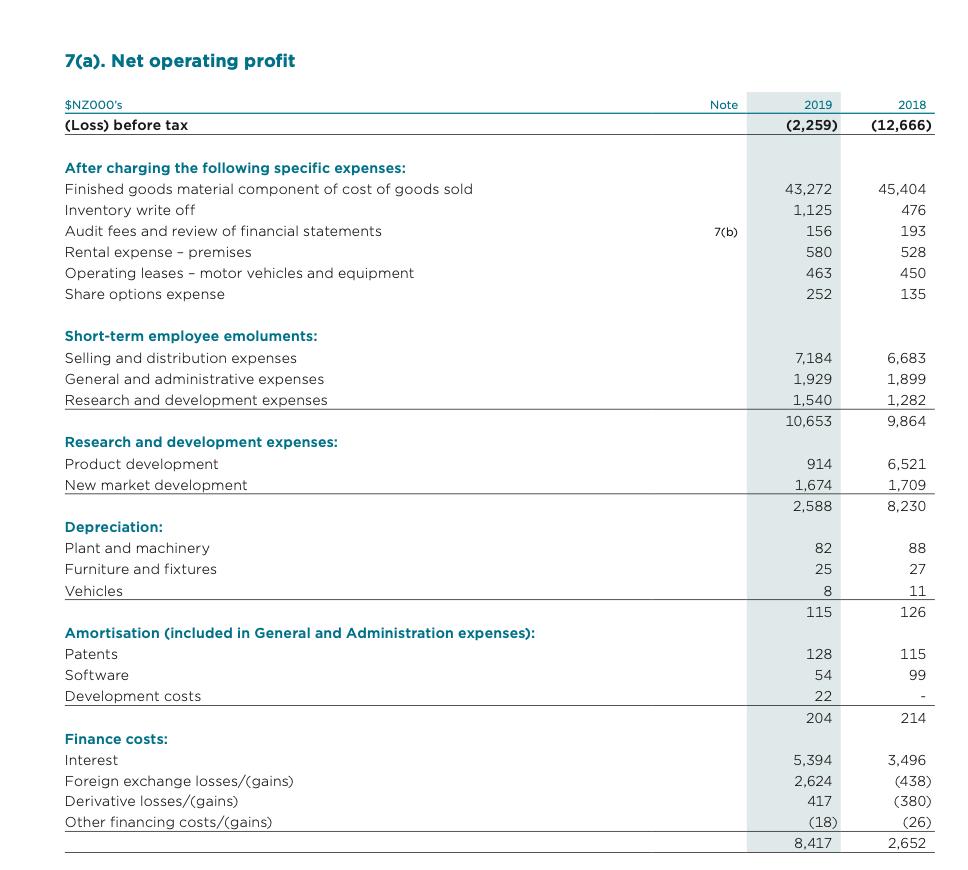

7(a). Net operating profit $NZ000's Note 2019 2018 (Loss) before tax (2,259) (12,666) After charging the following specific expenses: Finished goods material component of cost of goods sold 43,272 45,404 Inventory write off 1,125 476 Audit fees and review of financial statements 7(b) 156 193 Rental expense - premises 580 528 Operating leases motor vehicles and equipment 463 450 Share options expense 252 135 Short-term employee emoluments: Selling and distribution expenses 7,184 6,683 General and administrative expenses 1,929 1,899 Research and development expenses 1,540 1,282 10,653 9,864 Research and development expenses: Product development 914 6,521 New market development 1,674 1,709 2,588 8,230 Depreciation: Plant and machinery 82 88 Furniture and fixtures 25 27 Vehicles 8 11 115 126 Amortisation (included in General and Administration expenses): Patents 128 115 Software 54 99 Development costs 22 204 214 Finance costs: Interest 5,394 3,496 Foreign exchange losses/(gains) Derivative losses/(gains) Other financing costs/(gains) 2,624 (438) 417 (380) (18) (26) 8,417 2,652

Step by Step Solution

★★★★★

3.52 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started