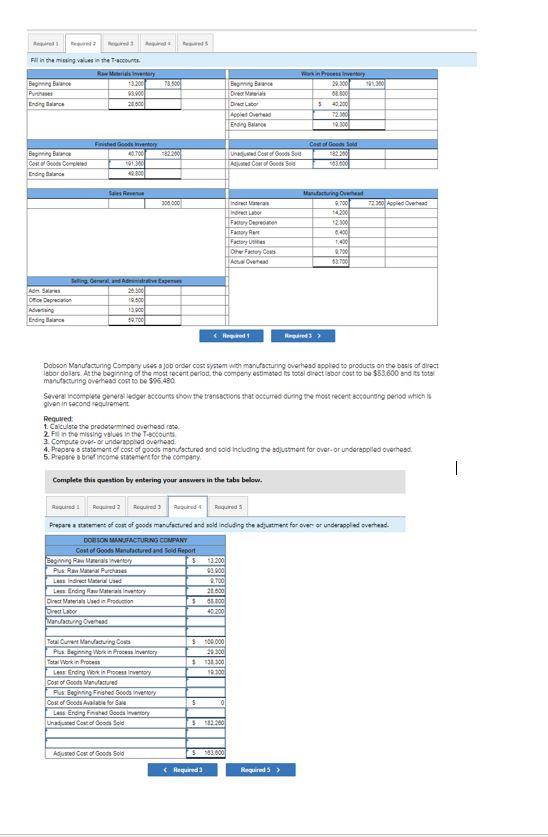

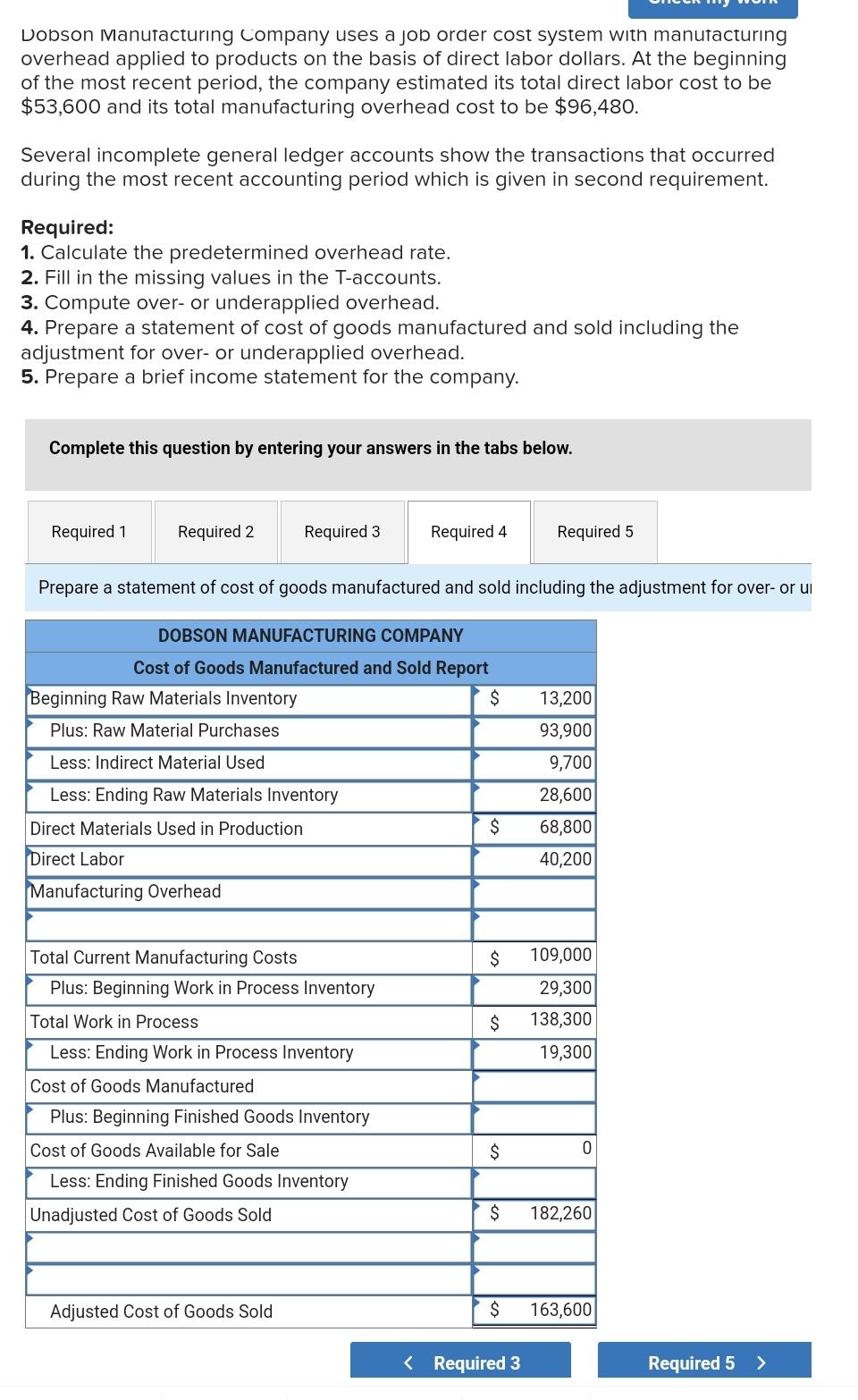

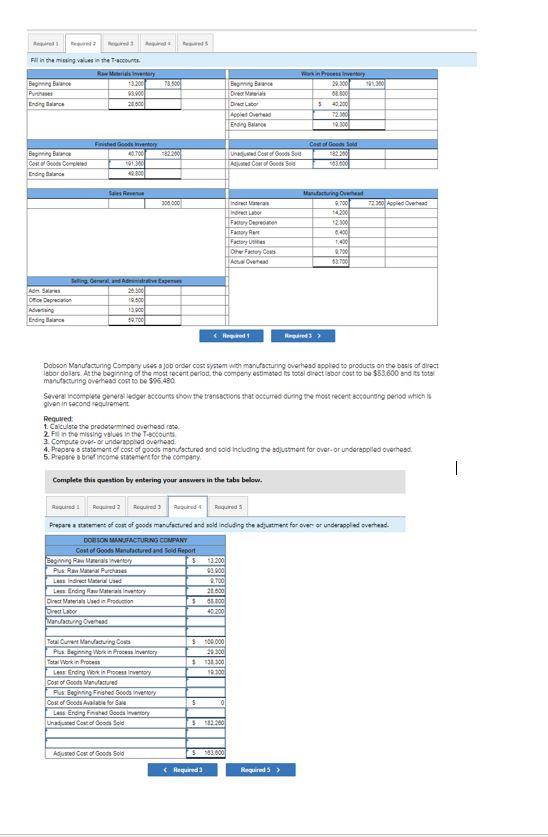

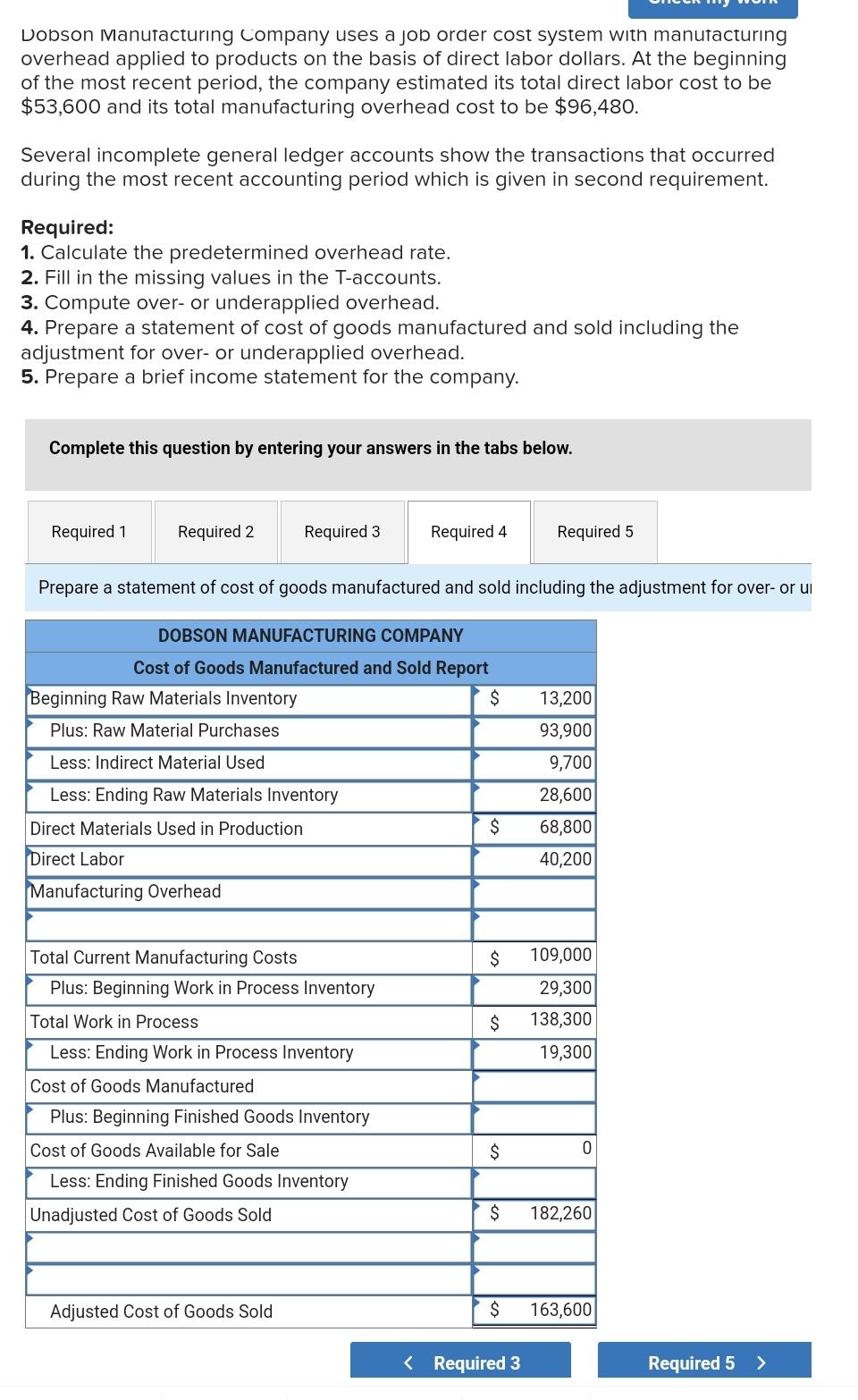

Dobson Manulacturing Compony uaes a job ardsr cost syckent with monufochuring overhesd epplied to products on the bacis of duect lebor dolers. At the beginnhg of the most tecent deriod. the compeny estimated ias totsi disect labot cost to be 553.600 snd its tots minutiknaring ovirthas cori to be $55.490. given in pecond rea-tremint: Requued: 1. Caiculete the predeterminsd ovechesd rose. 2. Fil in the missing values 10 the Trebsourt. 3. Compute over- or underacplod overhad. 5. Prepure obrefinsome stachmen for the company Complete this question by entering your answeers in the tabs below. Presare a rtacemert of eals of goods manufactured and nold induding the adturtment for pver or underapplitd fveithead. vobson I Manutacturing company uses a job order cost system with manutacturing overhead applied to products on the basis of direct labor dollars. At the beginning of the most recent period, the company estimated its total direct labor cost to be $53,600 and its total manufacturing overhead cost to be $96,480. Several incomplete general ledger accounts show the transactions that occurred during the most recent accounting period which is given in second requirement. Required: 1. Calculate the predetermined overhead rate. 2. Fill in the missing values in the T-accounts. 3. Compute over- or underapplied overhead. 4. Prepare a statement of cost of goods manufactured and sold including the adjustment for over- or underapplied overhead. 5. Prepare a brief income statement for the company. Complete this question by entering your answers in the tabs below. Prepare a statement of cost of goods manufactured and sold including the adjustment for over- or L Dobson Manulacturing Compony uaes a job ardsr cost syckent with monufochuring overhesd epplied to products on the bacis of duect lebor dolers. At the beginnhg of the most tecent deriod. the compeny estimated ias totsi disect labot cost to be 553.600 snd its tots minutiknaring ovirthas cori to be $55.490. given in pecond rea-tremint: Requued: 1. Caiculete the predeterminsd ovechesd rose. 2. Fil in the missing values 10 the Trebsourt. 3. Compute over- or underacplod overhad. 5. Prepure obrefinsome stachmen for the company Complete this question by entering your answeers in the tabs below. Presare a rtacemert of eals of goods manufactured and nold induding the adturtment for pver or underapplitd fveithead. vobson I Manutacturing company uses a job order cost system with manutacturing overhead applied to products on the basis of direct labor dollars. At the beginning of the most recent period, the company estimated its total direct labor cost to be $53,600 and its total manufacturing overhead cost to be $96,480. Several incomplete general ledger accounts show the transactions that occurred during the most recent accounting period which is given in second requirement. Required: 1. Calculate the predetermined overhead rate. 2. Fill in the missing values in the T-accounts. 3. Compute over- or underapplied overhead. 4. Prepare a statement of cost of goods manufactured and sold including the adjustment for over- or underapplied overhead. 5. Prepare a brief income statement for the company. Complete this question by entering your answers in the tabs below. Prepare a statement of cost of goods manufactured and sold including the adjustment for over- or L