Answered step by step

Verified Expert Solution

Question

1 Approved Answer

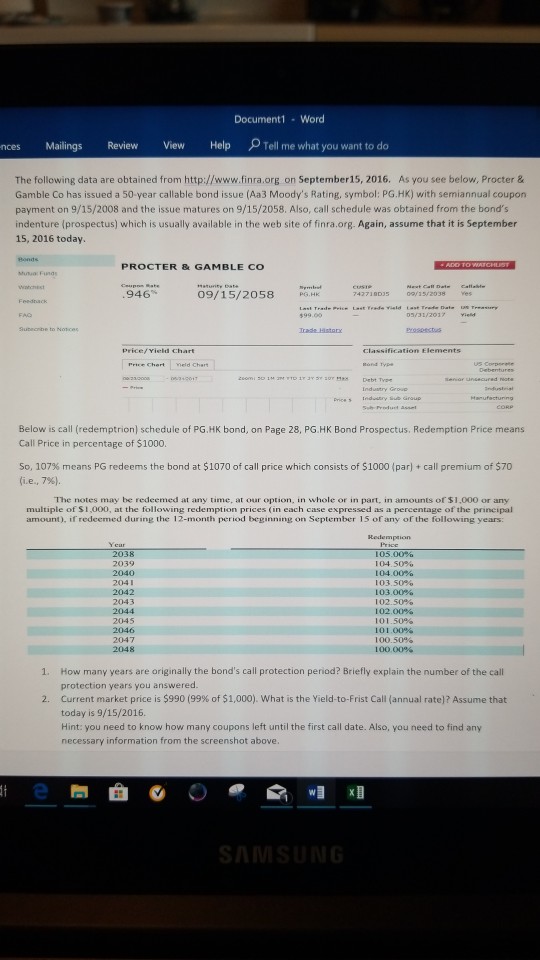

Document1 Word nces Mailings Review View Help Tell me what you want to do The following data are obtained from http://www.finra.org on September15, 2016. As

Document1 Word nces Mailings Review View Help Tell me what you want to do The following data are obtained from http://www.finra.org on September15, 2016. As you see below, Procter & Gamble Co has issued a 50-year callable bond issue (Aa3 Moody's Rating, symbol: PG.HK) with semiannual coupon payment on 9/15/2008 and the issue matures on 9/15/2058. Also, call schedule was obtained from the bond's indenture (prospectus) which is usually available in the web site of finra.org. Again, assume that it is September 15, 2016 today. PROCTER & GAMBLE CO 946% 09/15/2058243172 Feedhack Subecibe to Nosces Price/Yield Chart Debt Tva Below is call (redemptrion) schedule of PG.HK bond, on Page 28, PG.HK Bond Prospectus. Redemption Price means Call Price in percentage of $1000. So, 107% means PG redeems the bond at $1070 of call price which consists of Sool parl . call premium of (ie, 796). The notes may be redeemed at any time, at our option, in whole or in part, in amounts of $1,000 or any multiple of S .00, at the following redemption prices (in each case expressed as a percentage of the pranepal amount)-if redeemed dunng the 12 month period begnning on September 15 of any of the following years: 2038 2039 2040 2041 2042 2043 2044 2045 2046 2047 2048 105 00% 104 50% 104 00% 103 50% 103 00% 102 50% 102 00% 101.50% 101.00% 100.506 100 00% 1. How many years are originally the bond's call protection period? Briefly explain the number of the call protection years you answered Current market price is $990 (99%of$1,000). what is the Yield-to-Frist Call annual rate)? Assume that today is 9/15/2016. Hint: you need to know how many coupons left until the first call date. Also, you need to find any 2. information from the screenshot above

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started