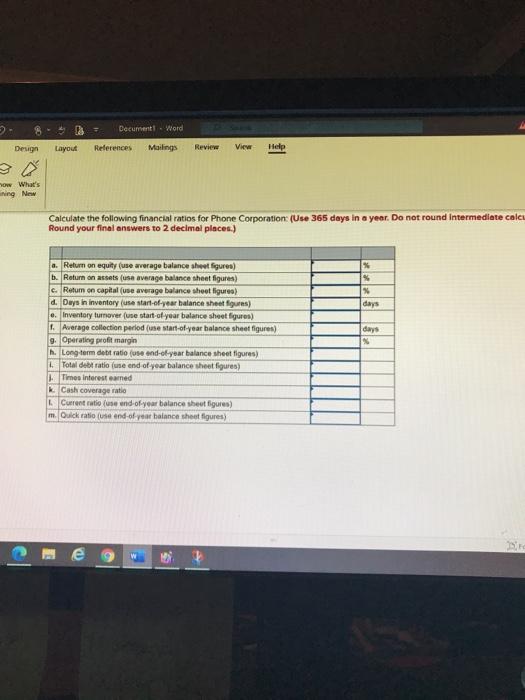

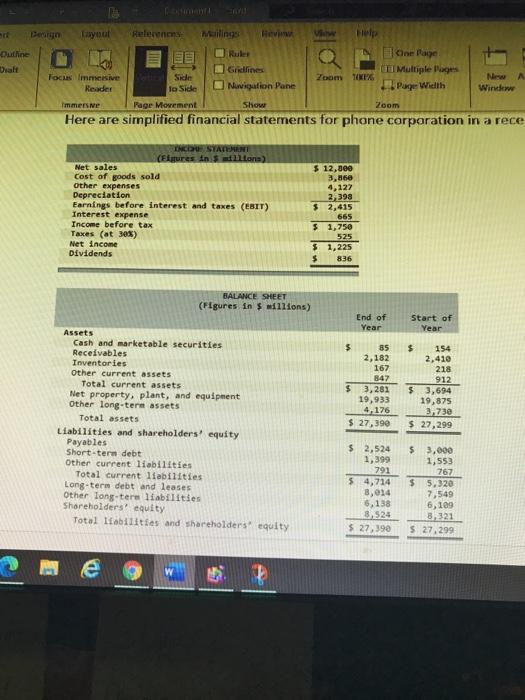

Documenti Word Design Layout References Mailings Review View Help w What's ning New Calculate the following financial ratios for Phone Corporation: (Use 365 days in a year. Do not round Intermediate calci Round your final answers to 2 decimal places.) days a. Return on equity (use average balance sheet figures) b. Return on assets (una average balance sheet figures) c. Retum on capital (se average balance sheet figures) d. Days in inventory (use start-of-year balance sheet figures) e. Inventory turnover (use start of your balance sheet figures) 1. Average collection periode start-of-year balance sheet figures) g. Operating profit margin . Long term debit ratio (use end-of-year balance sheet figures) Total debt ratio (une end of year balance sheet figures) Times interest and k Cash coverage ratio Current ratio (use end-of-year balance sheet figures) m. Quick ratione end-of-year balance sheet figures) days % Deran Layout Referens Mailings Outline Dalt Help One Page CEI Multiple Pages Zoom TKTX Page Wielth Grelines Niigation Pane Focus Immesive Reader Immersie Side to sice Page Movement A Wird Show Zoom Here are simplified financial statements for phone corporation in a rece INDUSTATIENT (Figures in one) Net sales Cost of goods sold other expenses Depreciation Earnings before interest and taxes (EBIT) Interest expense Income before tax Taxes (at 30%) Net Income Dividends $ 12,300 3,860 4,127 2.398 $ 2,415 665 $ 1,750 525 $ 1,225 $ 836 BALANCE SHEET (Figures in $ millions) End of Year Start of Year Assets Cash and marketable securities Receivables Inventories Other current assets Total current assets Net property, plant, and equipment Other long-term assets Total assets Liabilities and shareholders' equity Payables Short-tern debt Other current liabilities Total current liabilities Long-term debt and leases Other long-term liabilities Shareholders' equity Total liabilities and shareholders equity $ 85 2,182 167 847 $ 3,281 19,933 4,176 $ 27, 390 $ 154 2,410 218 912 $ 3,694 19,875 3,730 $ 27,299 $ 2,524 1,399 791 54,714 B,014 6,138 3,524 $ 27,390 $ 3,000 1,553 767 $ 5,320 7,549 6,109 8,321 $ 27.299 w