Question: Does Broadway benefit from acquiring Landmark? How can Harris justify a $120 million bid for Landmark? If Harris were to proceed with the acquisition, which

Does Broadway benefit from acquiring Landmark? How can Harris justify a $120 million bid for Landmark?

- If Harris were to proceed with the acquisition, which financing alternative should be chosen, and why? Would Broadway be capable of servicing its debt after the acquisition?

- Does Harris give up shareholder value by opting for the mix of debt & equity financing alternatives? What is the real cost of equity dilution?

- How do the two financing methods affect the value of the acquisition to existing shareholders of Broadway?

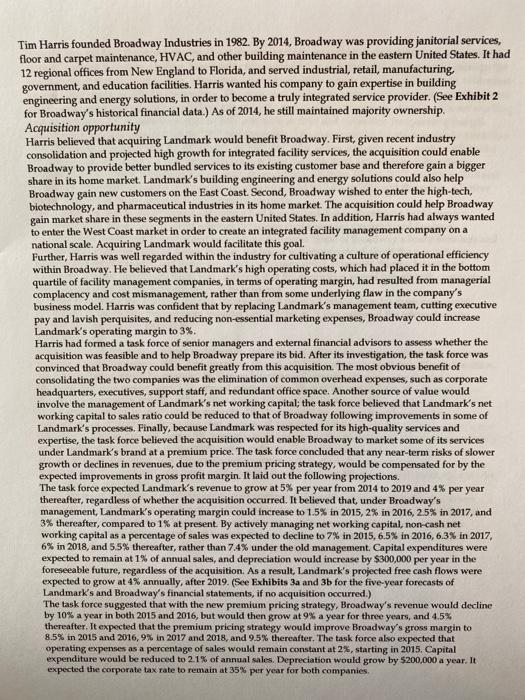

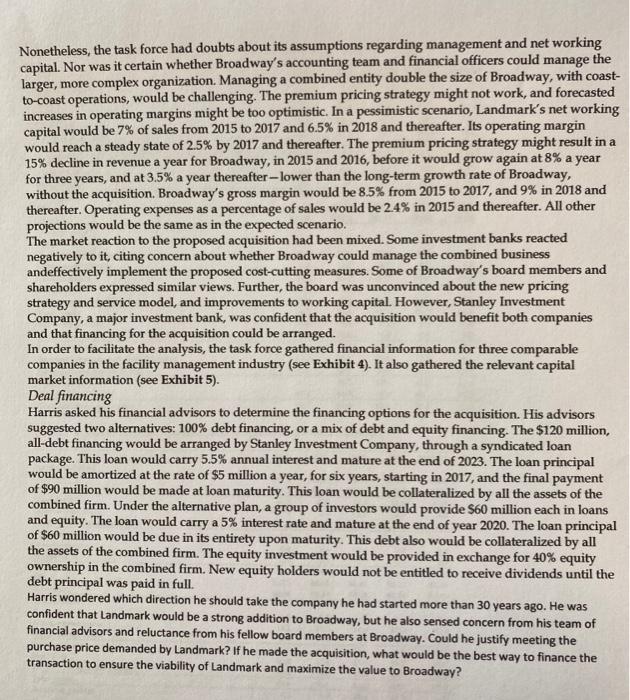

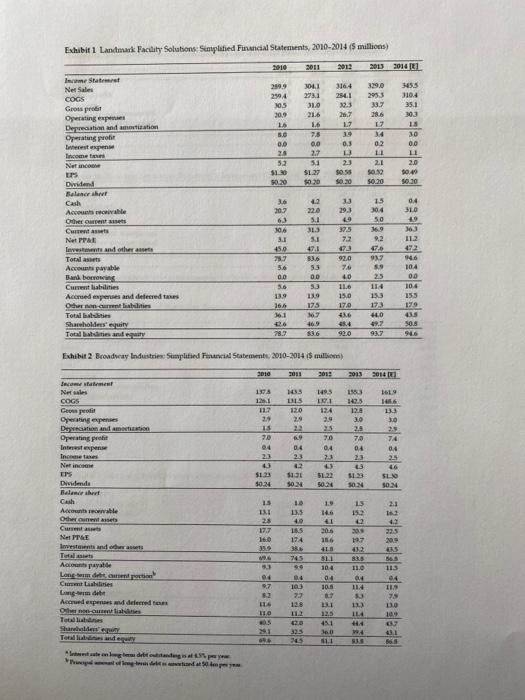

Tim Harris founded Broadway Industries in 1982. By 2014, Broadway was providing janitorial services, floor and carpet maintenance, HVAC, and other building maintenance in the eastern United States. It had 12 regional offices from New England to Florida, and served industrial, retail, manufacturing, government, and education facilities. Harris wanted his company to gain expertise in building engineering and energy solutions, in order to become a truly integrated service provider. (See Exhibit 2 for Broadway's historical financial data.) As of 2014, he still maintained majority ownership. Acquisition opportunity Harris believed that acquiring Landmark would benefit Broadway. First, given recent industry consolidation and projected high growth for integrated facility services, the acquisition could enable Broadway to provide better bundled services to its existing customer base and therefore gain a bigger share in its home market. Landmark's building engineering and energy solutions could also help Broadway gain new customers on the East Coast. Second, Broadway wished to enter the high-tech, biotechnology, and pharmaceutical industries in its home market. The acquisition could help Broadway gain market share in these segments in the eastern United States. In addition, Harris had always wanted to enter the West Coa market in order to create an integrated facility management company on a national scale. Acquiring Landmark would facilitate this goal. Further, Harris was well regarded within the industry for cultivating a culture of operational efficiency within Broadway. He believed that Landmark's high operating costs, which had placed it in the bottom quartile of facility management companies, in terms of operating margin, had resulted from managerial complacency and cost mismanagement, rather than from some underlying flaw in the company's business model. Harris was confident that by replacing Landmark's management team, cutting executive pay and lavish perquisites, and reducing non-essential marketing expenses, Broadway could increase Landmark's operating margin to 3%. Harris had formed a task force of senior managers and external financial advisors to assess whether the acquisition was feasible and to help Broadway prepare its bid. After its investigation, the task force was convinced that Broadway could benefit greatly from this acquisition. The most obvious benefit of consolidating the two companies was the elimination of common overhead expenses, such as corporate headquarters, executives, support staff, and redundant office space. Another source of value would involve the management of Landmark's net working capital; the task force believed that Landmark's net working capital to sales ratio could be reduced to that of Broadway following improvements in some of Landmark's processes. Finally, because Landmark was respected for its high-quality services and expertise, the task force believed the acquisition would enable Broadway to market some of its services under Landmark's brand at a premium price. The task force concluded that any near-term risks of slower growth or declines in revenues, due to the premium pricing strategy, would be compensated for by the expected improvements in gross profit margin. It laid out the following projections. The task force expected Landmark's revenue to grow at 5% per year from 2014 to 2019 and 4% per year thereafter, regardless of whether the acquisition occurred. It believed that, under Broadway's management, Landmark's operating margin could increase to 1.5% in 2015, 2% in 2016, 25% in 2017, and 3% thereafter, compared to 1% at present. By actively managing net working capital, non-cash net working capital as a percentage of sales was expected to decline to 7% in 2015, 6.5% in 2016, 6.3% in 2017, 6% in 2018, and 5.5% thereafter, rather than 7.4% under the old management. Capital expenditures were expected to remain at 1% of annual sales, and depreciation would increase by $300,000 per year in the foreseeable future, regardless of the acquisition. As a result, Landmark's projected free cash flows were expected to grow at 4% annually, after 2019. (See Exhibits 3a and 3b for the five-year forecasts of Landmark's and Broadway's financial statements, if no acquisition occurred.) The task force suggested that with the new premium pricing strategy, Broadway's revenue would decline by 10% a year in both 2015 and 2016, but would then grow at 9% a year for three years, and 4.5% thereafter. It expected that the premium pricing strategy would improve Broadway's gross margin to 8.5% in 2015 and 2016, 9% in 2017 and 2018, and 9.5% thereafter. The task force also expected that operating expenses as a percentage of sales would remain constant at 2%, starting in 2015. Capital expenditure would be reduced to 2.1% of annual sales. Depreciation would grow by $200,000 a year. It expected the corporate tax rate to remain at 35% per year for both companies.

Step by Step Solution

3.46 Rating (146 Votes )

There are 3 Steps involved in it

1 Acquiring Landmark is the key to growth for Broadway It is a cheaper and faster way to increase sales and expand the company by opening new branches This will also help Broadway to achieve economies ... View full answer

Get step-by-step solutions from verified subject matter experts