Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Does this company have healthy liuqidity? Is it improving? What is the assessment of turnover ratio? What risks do they face? Is it a good

Does this company have healthy liuqidity? Is it improving?

What is the assessment of turnover ratio? What risks do they face?

Is it a good time to invest in this company?

How can this company improve its performance in areas of liquidity, profitability, and solvency?

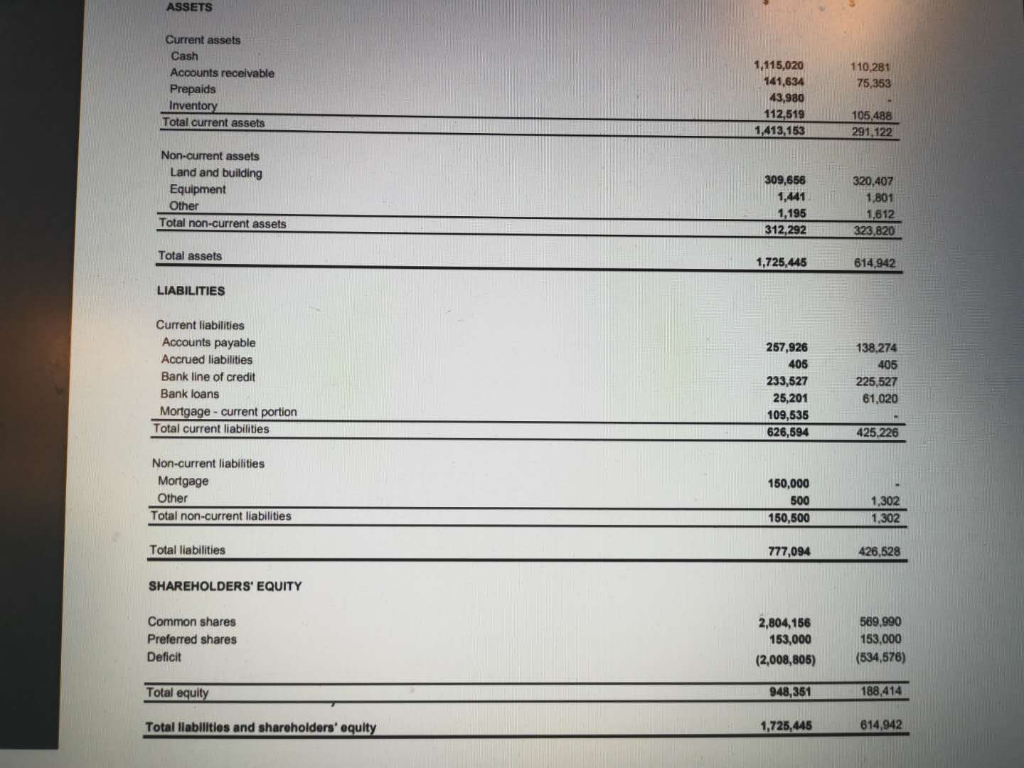

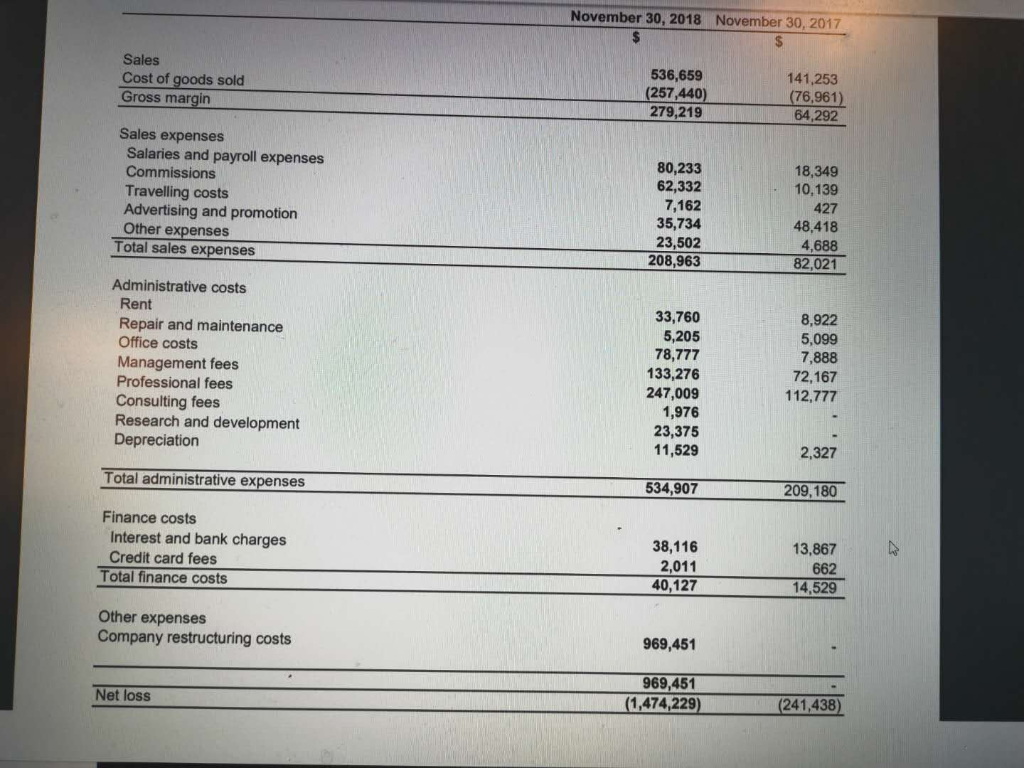

ASSETS Current assets Cash Accounts receivable Prepaids Inventory Total current assets 110,281 75,353 1.115,020 141,634 43,980 112,519 1,413,153 105,488 291, 122 Non-current assets Land and building Equipment Other Total non-current assets 309,656 1,441 1,195 312,292 320,407 1,801 1.612 323,820 Total assets 1,725,445 614,942 LIABILITIES Current liabilities Accounts payable Accrued liabilities Bank line of credit Bank loans Mortgage - current portion Total current liabilities 257,926 406 233,527 25,201 109,535 626,694 138,274 405 225,527 61,020 425 226 Non-current liabilities Mortgage Other Total non-current liabilities 150,000 500 150,500 1,302 1,302 Total liabilities 777,094 426,528 SHAREHOLDERS' EQUITY Common shares Preferred shares Deficit 2,804,156 153,000 (2,008,805) 589,990 153,000 (534,576) Total equity 948,351 188,414 Total liabilities and shareholders' equity 1,725,445 614,942 November 30, 2018 November 30, 2017 Sales Cost of goods sold Gross margin 536,659 (257,440) 279,219 141,253 (76,961) 64,292 18,349 10,139 Sales expenses Salaries and payroll expenses Commissions Travelling costs Advertising and promotion Other expenses Total sales expenses 80,233 62,332 7,162 35,734 23,502 208,963 427 48,418 4,688 82,021 8.922 Administrative costs Rent Repair and maintenance Office costs Management fees Professional fees Consulting fees Research and development Depreciation 33,760 5,205 78,777 133,276 247,009 1,976 23,375 11,529 5,099 7,888 72,167 112,777 2,327 Total administrative expenses 534,907 209,180 13,867 Finance costs Interest and bank charges Credit card fees Total finance costs 38,116 2,011 40,127 662 14,529 Other expenses Company restructuring costs 969,451 969,451 Net loss (1,474,229) (241,438)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started