Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Dolittle, Fishmore and Watchtv is a partnership that provides retirement planning consulting services. The partners began the business by each contributing $50,000 to start

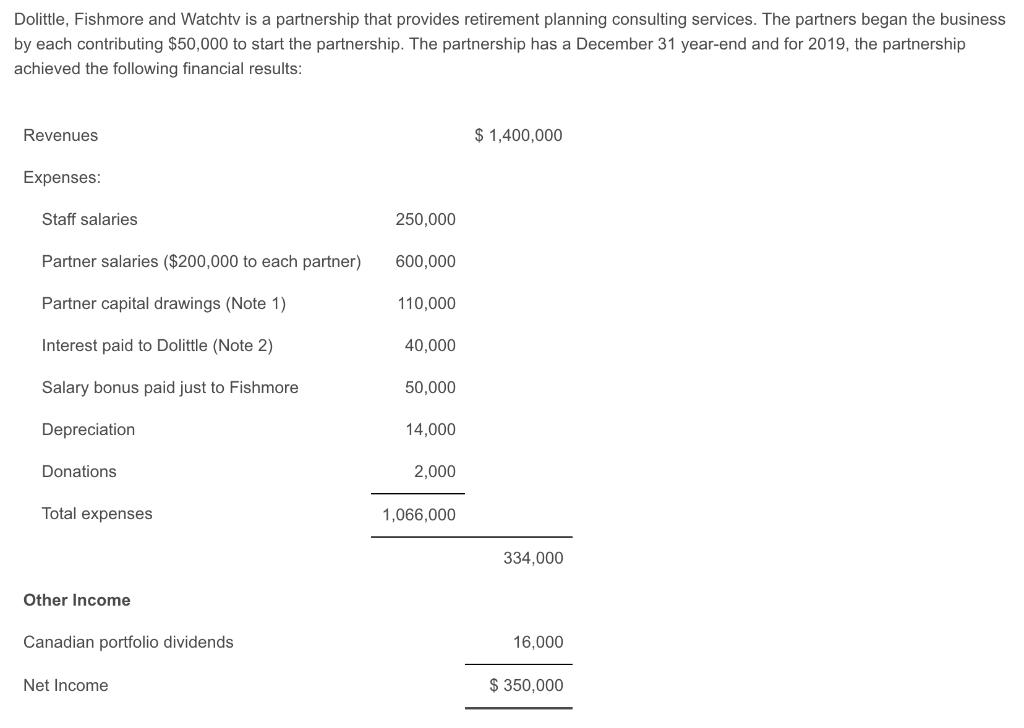

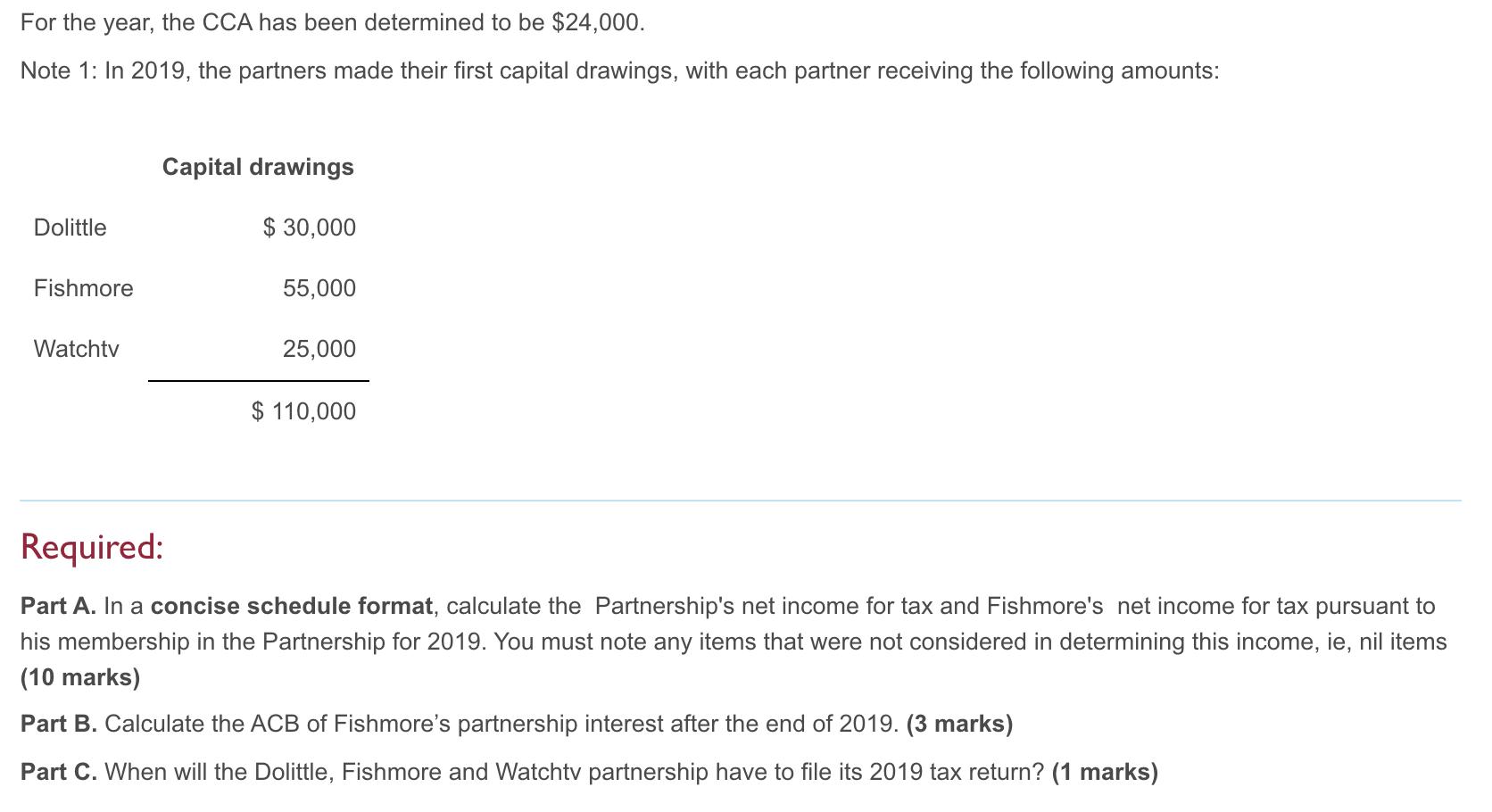

Dolittle, Fishmore and Watchtv is a partnership that provides retirement planning consulting services. The partners began the business by each contributing $50,000 to start the partnership. The partnership has a December 31 year-end and for 2019, the partnership achieved the following financial results: Revenues Expenses: Staff salaries Partner salaries ($200,000 to each partner) Partner capital drawings (Note 1) Interest paid to Dolittle (Note 2) Salary bonus paid just to Fishmore Depreciation Donations Total expenses Other Income Canadian portfolio dividends Net Income 250,000 600,000 110,000 40,000 50,000 14,000 2,000 1,066,000 $ 1,400,000 334,000 16,000 $ 350,000 For the year, the CCA has been determined to be $24,000. Note 1: In 2019, the partners made their first capital drawings, with each partner receiving the following amounts: Dolittle Fishmore Watchtv Capital drawings $30,000 55,000 25,000 $ 110,00 Required: Part A. In a concise schedule format, calculate the Partnership's net income for tax and Fishmore's net income for tax pursuant to his membership in the Partnership for 2019. You must note any items that were not considered in determining this income, ie, nil items (10 marks) Part B. Calculate the ACB of Fishmore's partnership interest after the end of 2019. (3 marks) Part C. When will the Dolittle, Fishmore and Watchtv partnership have to file its 2019 tax return? (1 marks)

Step by Step Solution

★★★★★

3.34 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

Part A Dolittle Fishmore and Watchtv Partnership Net Income for Tax 2019 Revenues 1400000 Expenses ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started