Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Dollar General operates a chain of discount variety stores. It has over 16,000 locations across the United States. Using the Consolidated Statements of Shareholders'

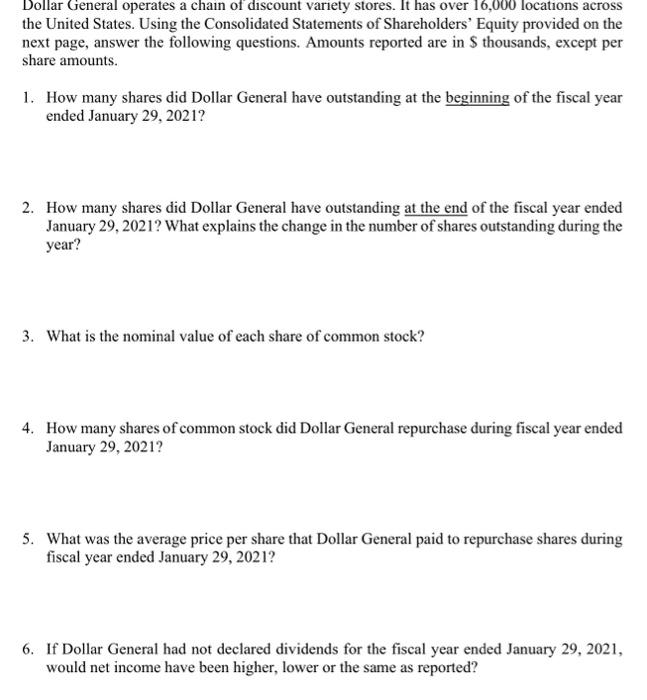

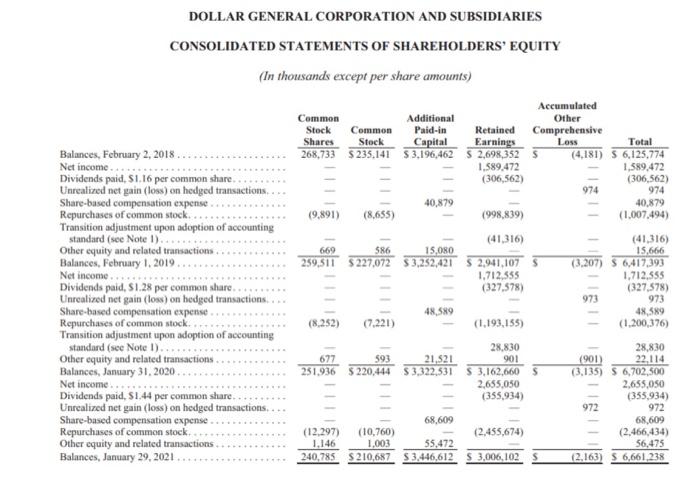

Dollar General operates a chain of discount variety stores. It has over 16,000 locations across the United States. Using the Consolidated Statements of Shareholders' Equity provided on the next page, answer the following questions. Amounts reported are in $ thousands, except per share amounts. 1. How many shares did Dollar General have outstanding at the beginning of the fiscal year ended January 29, 2021? 2. How many shares did Dollar General have outstanding at the end of the fiscal year ended January 29, 2021? What explains the change in the number of shares outstanding during the year? 3. What is the nominal value of each share of common stock? 4. How many shares of common stock did Dollar General repurchase during fiscal year ended January 29, 2021? 5. What was the average price per share that Dollar General paid to repurchase shares during fiscal year ended January 29, 2021? 6. If Dollar General had not declared dividends for the fiscal year ended January 29, 2021, would net income have been higher, lower or the same as reported? DOLLAR GENERAL CORPORATION AND SUBSIDIARIES CONSOLIDATED STATEMENTS OF SHAREHOLDERS' EQUITY (In thousands except per share amounts) Balances, February 2, 2018. Net income... Dividends paid, $1.16 per common share. Unrealized net gain (loss) on hedged transactions.. Share-based compensation expense... Repurchases of common stock... Transition adjustment upon adoption of accounting standard (see Note 1)..... Other equity and related transactions.. Balances, February 1, 2019. Net income... Dividends paid, $1.28 per common share... Unrealized net gain (loss) on hedged transactions... Share-based compensation expense. Repurchases of common stock... Transition adjustment upon adoption of accounting standard (see Note 1).. Other equity and related transactions. Balances, January 31, 2020. Net income... Dividends paid, $1.44 per common share. Unrealized net gain (loss) on hedged transactions.. Share-based compensation expense. Repurchases of common stock.. Other equity and related transactions. Balances, January 29, 2021. Additional Common Stock Common Paid-in Retained Shares Stock Capital Earnings 268,733 $235.141 $3,196,462 $2,698,352 S 1,589,472 (306,562) (9,891) (8,655) 586 15,080 669 259,511 $227,072 $3,252,421 (8,252) (7,221) 40,879 677 593 251,936 $220,444 48,589 21,521 $3,322,531 (998,839) (41,316) Accumulated Other Comprehensive Loss $2,941,107 S 1,712,555 (327,578) (1,193,155) 28,830 901 S 3,162,660 S 2,655,050 (355,934) 68,609 (2,455,674) (12,297) (10,760) 1,146 1,003 240,785 $210,687 $3,446,612 $ 3,006,102 S 55,472 Total (4,181) S 6,125,774 1,589,472 (306,562) 974 40,879 (1,007,494) 974 (3,207) S 6,417,393 1,712,555 (327,578) 973 48,589 (1,200,376) 973 (41,316) 15,666 972 28,830 22,114 (901) (3,135) S6,702,500 2,655,050 (355,934) 972 68,609 (2,466,434) 56,475 (2,163) S6,661,238

Step by Step Solution

★★★★★

3.44 Rating (147 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started