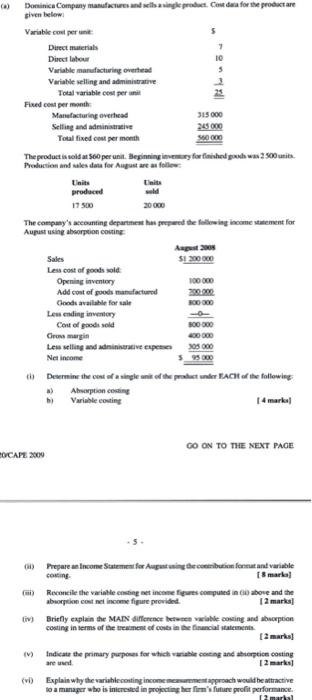

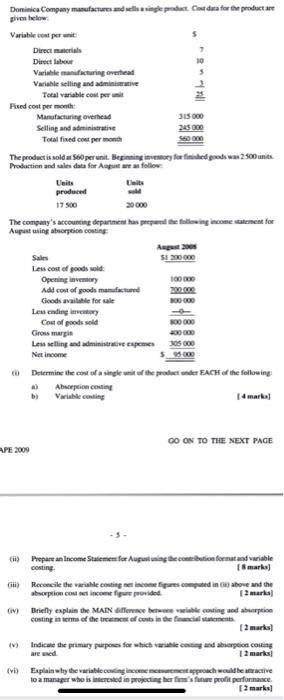

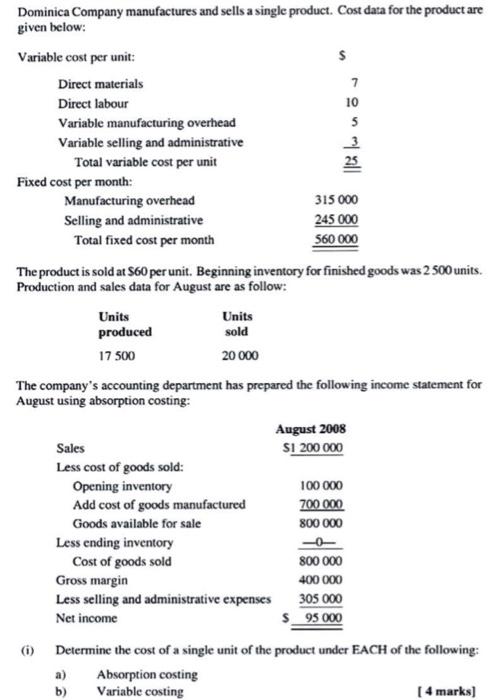

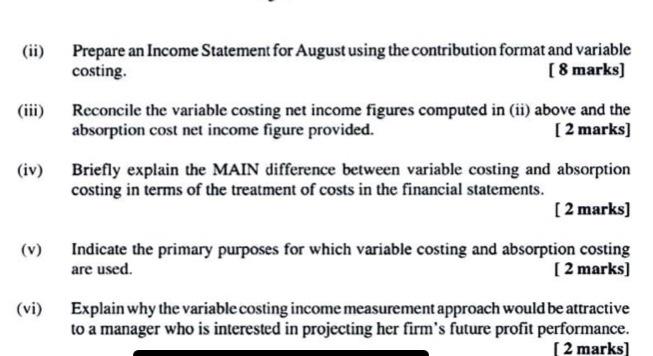

Dominic Company manufactures and setting product. Clost data for the product are Variable con per Direct materials Direct later Variable manufacturing overhead Variable selling and administrative Total variable cost per Fired.com per month Manufacturing overhead 315000 Selling and administrative 245.000 Totalfined cont per month S0000 The product a soldats per unit. Beginninzinemary for finished pashwa 2500 units Production and sales data for August are as follow produced 17500 2000 The company's accounting department has prepared the fullewing income statement for Aupust using absorption costing August 2008 Sales $1 200 000 Les cost of goods sold Opening inventory 100 000 Add cont of goods manufactured Gendewalle for sale 300000 Les ending inventory Cost of goods sold 100 000 Cum margin Les selling and administrative Express Net income 5. Dexermine the cost of a single unit of the pretender EACH of the following Absorption costing b) Variable conting GO ON TO THE NEXT PAGE POCAPE 2009 00 Prepare an Income Statement for Augusting the corbution format and variable COM [8 markal m Reconcile the variable casting net income is computed in above and the absorption contre income figure provided [2 markal iv) Briefly explain the MAIN difference between able costing and brorption costing in terms of the treatment of costs in the financial statements (V) Indicate the primary puposes for which becoming and shiption costing are und [2 marks Explain why the variable costing incomecen approach would be attractive to a manager who is interested in projecting her ms future profit performance, (vi) Dominic Company manufactures and spendet Closet data for the produtare give low Variable cont permit Director Direct labour Variable manufacturing overhead Variable selling and administive Total variable cont permit Fixed cost per month Manufacturing overhead 35000 Selling and administrative 285000 Total fixed cost per month The product is sold Opetunit. Bergery for finished goods was 2500 units Production and ales data for August follow Uits produced 17500 20 000 The company's accounting department has prepared the following income statement for Aupast using absorption costing August 2005 Sales $ 270 000 Le cost of goods old Opening inventory 10000 Add cost of goods manufactured Goods available for sale Lending Cost of goods sold 300 000 Grossmarin Les selling and administrative spesso Net Income 53.000 Determine the cost of a single mit of the protectie EACH of the following Absorption coin Variable in 4 market GO ON TO THE NEXT PAGE PE 2009 contin Prepare an Income Statement for Augusting becombinformated viable [8 marks] G) Reconcile the variable costing set income frescompted in above and the absorption control income provided [2 marks (W) Biely explain the MAIN afference becoming and brin costing in terms of the treatment of cost efectements [2 marks] Indicate the primary purposes for which will conting and abroncong 12 marks (vi) Explain why the variable contingent aproach would be active to a manager who is interested in projecting her fire profit performance [2 marks Breed $ lwn Dominica Company manufactures and sells a single product. Cost data for the product are given below: Variable cost per unit: Direct materials 7 Direct labour 10 Variable manufacturing overhead 5 Variable selling and administrative Total variable cost per unit Fixed cost per month: Manufacturing overhead 315 000 Selling and administrative 245 000 Total fixed cost per month 560 000 The product is sold at $60 per unit. Beginning inventory for finished goods was 2500 units. Production and sales data for August are as follow: Units Units produced sold 20 000 The company's accounting department has prepared the following income statem August using absorption costing: August 2008 Sales SI 200 000 Less cost of goods sold: Opening inventory 100 000 Add cost of goods manufactured 700 000 Goods available for sale 800 000 Less ending inventory -O- Cost of goods sold 800 000 Gross margin 400 000 Less selling and administrative expenses 305 000 Net income $95 000 17 500 tement for (1) Determine the cost of a single unit of the product under EACH of the following: Absorption costing b) Variable costing [ 4 marks) a) (ii) Prepare an Income Statement for August using the contribution format and variable costing. [ 8 marks) (iii) Reconcile the variable costing net income figures computed in (ii) above and the absorption cost net income figure provided. [2 marks] (iv) Briefly explain the MAIN difference between variable costing and absorption costing in terms of the treatment of costs in the financial statements. [2 marks] Indicate the primary purposes for which variable costing and absorption costing are used. [2 marks) (vi) Explain why the variable costing income measurement approach would be attractive to a manager who is interested in projecting her firm's future profit performance. [2 marks]