Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Don and Joe went into business together as equal co-owners. Joe had a lot of money but l no business sense and Don had

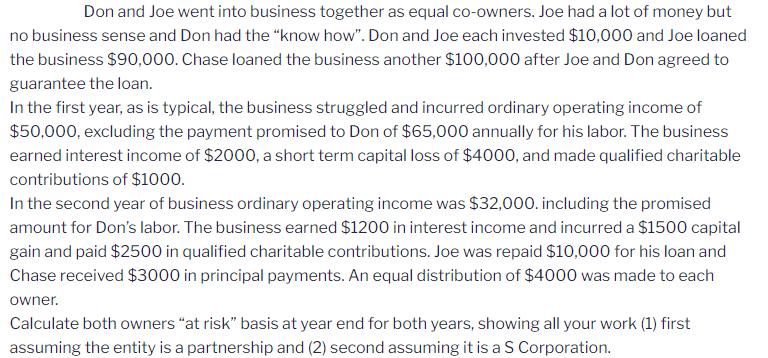

Don and Joe went into business together as equal co-owners. Joe had a lot of money but l no business sense and Don had the "know how". Don and Joe each invested $10,000 and Joe loaned the business $90,000. Chase loaned the business another $100,000 after Joe and Don agreed to guarantee the loan. In the first year, as is typical, the business struggled and incurred ordinary operating income of $50,000, excluding the payment promised to Don of $65,000 annually for his labor. The business earned interest income of $2000, a short term capital loss of $4000, and made qualified charitable contributions of $1000. In the second year of business ordinary operating income was $32,000. including the promised amount for Don's labor. The business earned $1200 in interest income and incurred a $1500 capital gain and paid $2500 in qualified charitable contributions. Joe was repaid $10,000 for his loan and Chase received $3000 in principal payments. An equal distribution of $4000 was made to each owner. Calculate both owners "at risk" basis at year end for both years, showing all your work (1) first assuming the entity is a partnership and (2) second assuming it is a S Corporation.

Step by Step Solution

★★★★★

3.37 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

Partnership i The partners liability for the businesss debts is infinite ii Each partner is jointly ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started