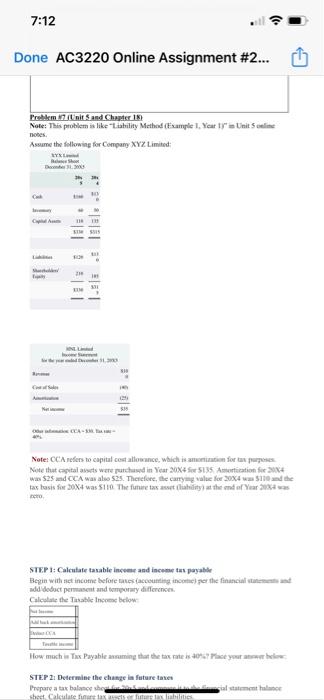

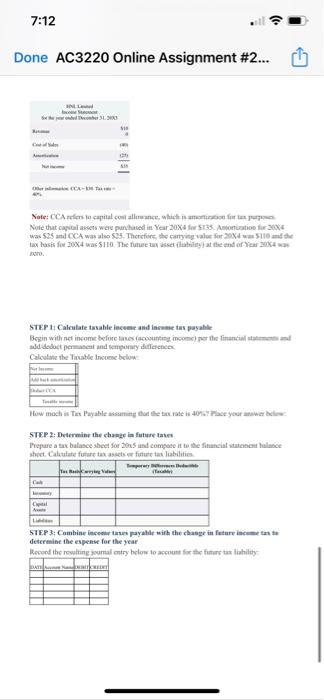

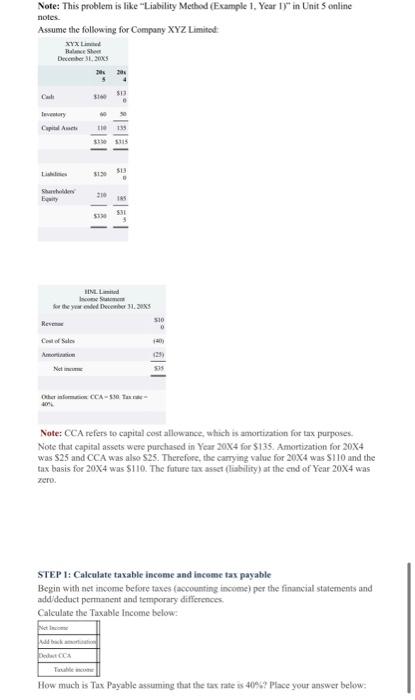

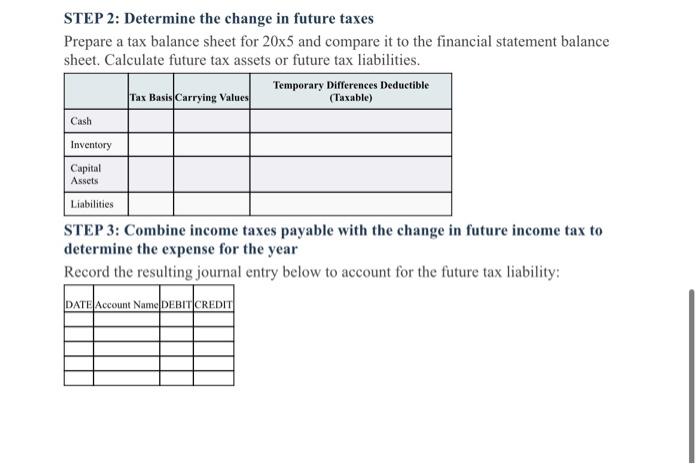

Done AC3220 Online Assignment \#2... Preskem in it nit 5 and Chander 17. nobes. Assame the followine for Cempany XYZ Limited: Note: CCAN refers wo capital cest allosunce, which is amonimaion for an parpess Note that capital absets were purtand in Year 204 for 5135 . Aezortication fer XuX4 was 525 and CCA was also 525 . Therefore, dhe carryine value for 204 was $120 and the tas tasis for 20X4 was $110. The funere tas asset (hatuinty) at the and of Yiar 2ood was atrer. SIEP 1: Calculate tasable inceen and inceme tan parable add dodoct pernascut and worporary differences. Calculate the Jasatle thsoene below: How mosh in Twx Payahle asmaming that the tax rate is aofsi frase yoar atswn hrlow: STE.P 21 Determine the change in future tases Done AC3220 Online Assignment \#2... Note that cagital assens were punhated in Year 204 for 5135 . Amontuation fir 304 was 535 atil CCA was alio 535. Therefore, the carrying value fer 3084 was 3116 amd the tax hasis fou JoX4 was 5110 . The fimee tex asset (lathinty ) at the end of lear Jiocd was wro. STEP I. Calculare tasable iaceme and incane tas pasahe Bcgin with red income before tases (accounting inoone) por the financial atalemens and ald dedoct permaseat and semperazy diferences. Calculale the Tauble Incueve below? Hew moch is Tax Payable assuming that the bis rate is 40 ha? Fhac your anawar heles: STEP 2: Determine the change ia future tases shect. Calcuiate future tax assets er fuduer tan liabilities STEP 3: Cambine inceetr taris payahle wirh the chater in foture inceme tas to determine the evpense for the year Recond the resulting jsurnal entry below to ascoutt for the finters tas liahiltyy Note: This problem is like "Liability Method (Example 1, Year 1)" in Unit 5 online notes. Assume the following for Company XYZ Limitod. Note: CCA refers to capital cost allowance, which is amortiration for tax purposes. Note that capital assets were purchased in Year 2044 for $135. Amortization for 20X4 was $25 and CCA was also $25. Therefore, the canrying value for 204 was 5110 and the tax basis for 20X4 was $110. The future tax asset (liability) at the end of Year 20X4 was xare. STEP 1: Calculate taxable inceme and inceme tax payable Begin with net income before taxes (accounting incumel per the financial statements and add/dedoct permanent and temporary differences. Calculate the Taxable Income below: How mach is Tax Payable assuming that the tax rate is 40% ? Place your answer below: STEP 2: Determine the change in future taxes sheet. Calculate future tax assets or future tax liabilities. STEP 3: Combine income taxes payable with the change in future income tax to determine the expense for the year Record the resulting journal entry below to account for the future tax liability: Done AC3220 Online Assignment \#2... Preskem in it nit 5 and Chander 17. nobes. Assame the followine for Cempany XYZ Limited: Note: CCAN refers wo capital cest allosunce, which is amonimaion for an parpess Note that capital absets were purtand in Year 204 for 5135 . Aezortication fer XuX4 was 525 and CCA was also 525 . Therefore, dhe carryine value for 204 was $120 and the tas tasis for 20X4 was $110. The funere tas asset (hatuinty) at the and of Yiar 2ood was atrer. SIEP 1: Calculate tasable inceen and inceme tan parable add dodoct pernascut and worporary differences. Calculate the Jasatle thsoene below: How mosh in Twx Payahle asmaming that the tax rate is aofsi frase yoar atswn hrlow: STE.P 21 Determine the change in future tases Done AC3220 Online Assignment \#2... Note that cagital assens were punhated in Year 204 for 5135 . Amontuation fir 304 was 535 atil CCA was alio 535. Therefore, the carrying value fer 3084 was 3116 amd the tax hasis fou JoX4 was 5110 . The fimee tex asset (lathinty ) at the end of lear Jiocd was wro. STEP I. Calculare tasable iaceme and incane tas pasahe Bcgin with red income before tases (accounting inoone) por the financial atalemens and ald dedoct permaseat and semperazy diferences. Calculale the Tauble Incueve below? Hew moch is Tax Payable assuming that the bis rate is 40 ha? Fhac your anawar heles: STEP 2: Determine the change ia future tases shect. Calcuiate future tax assets er fuduer tan liabilities STEP 3: Cambine inceetr taris payahle wirh the chater in foture inceme tas to determine the evpense for the year Recond the resulting jsurnal entry below to ascoutt for the finters tas liahiltyy Note: This problem is like "Liability Method (Example 1, Year 1)" in Unit 5 online notes. Assume the following for Company XYZ Limitod. Note: CCA refers to capital cost allowance, which is amortiration for tax purposes. Note that capital assets were purchased in Year 2044 for $135. Amortization for 20X4 was $25 and CCA was also $25. Therefore, the canrying value for 204 was 5110 and the tax basis for 20X4 was $110. The future tax asset (liability) at the end of Year 20X4 was xare. STEP 1: Calculate taxable inceme and inceme tax payable Begin with net income before taxes (accounting incumel per the financial statements and add/dedoct permanent and temporary differences. Calculate the Taxable Income below: How mach is Tax Payable assuming that the tax rate is 40% ? Place your answer below: STEP 2: Determine the change in future taxes sheet. Calculate future tax assets or future tax liabilities. STEP 3: Combine income taxes payable with the change in future income tax to determine the expense for the year Record the resulting journal entry below to account for the future tax liability