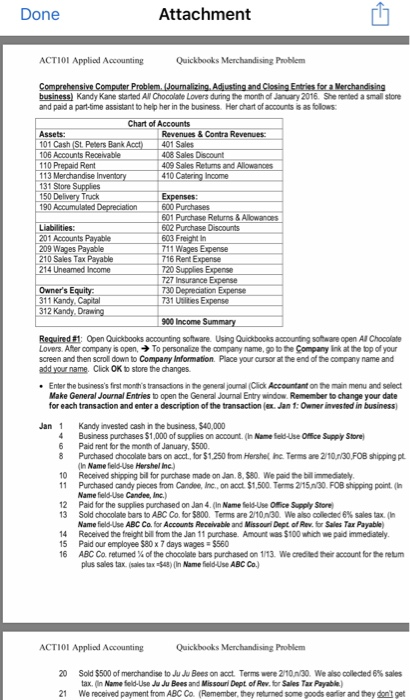

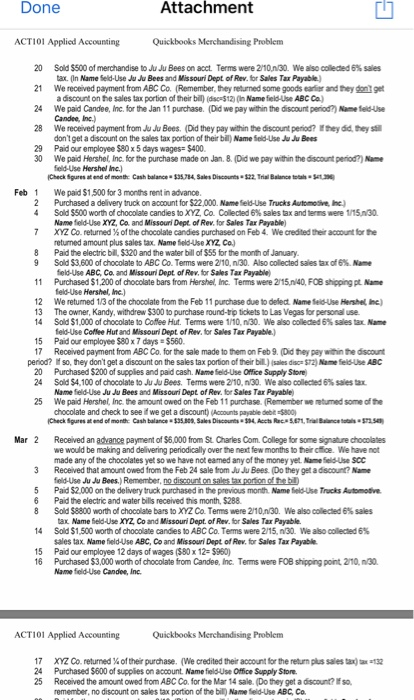

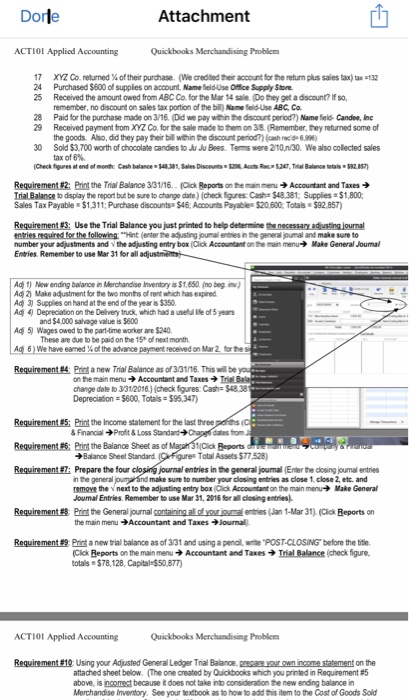

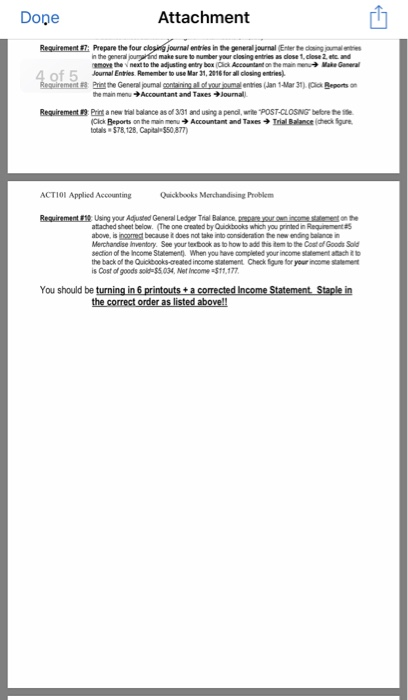

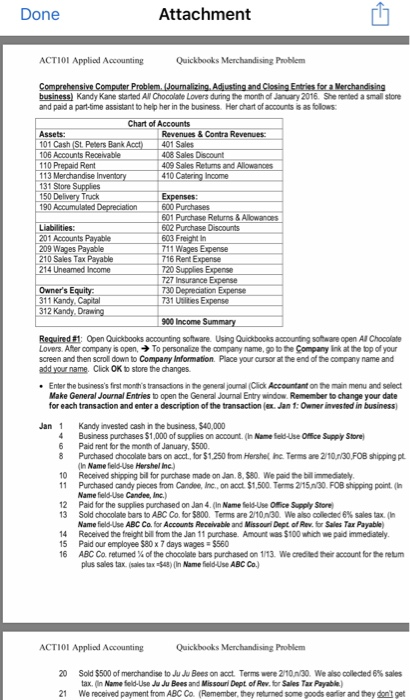

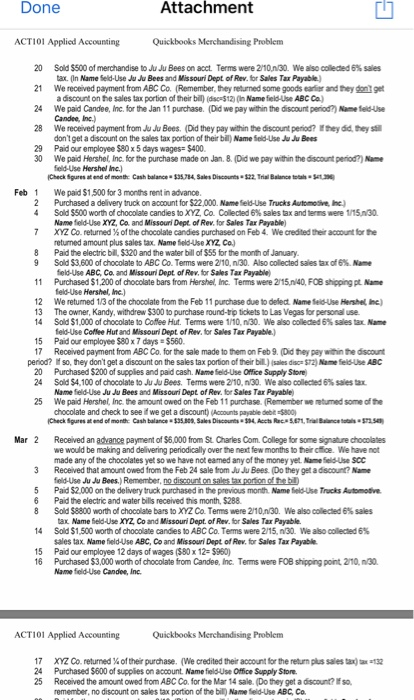

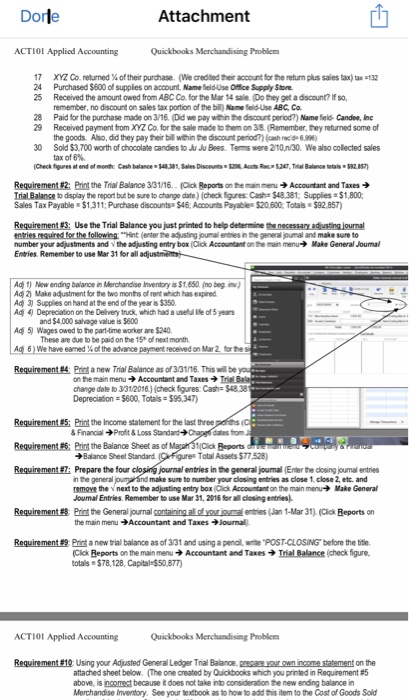

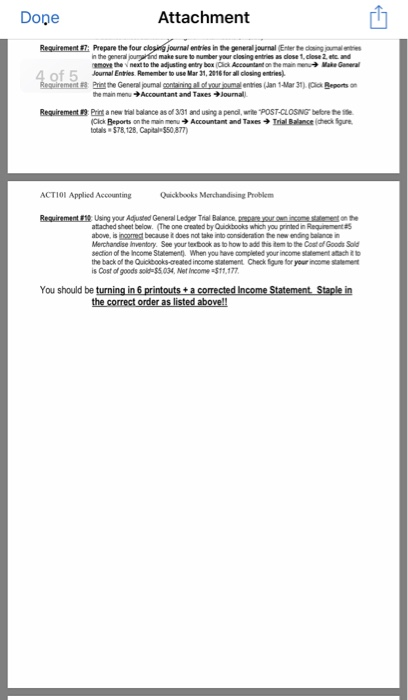

Done Attachment ACTIOl Applied Accounting Quickbooks Merchandising Problem business) Kandy Kane started Al Chocolate Lovers during the month of January 2016. Sherented a smll store and paid a part-time assistant to help her in the business. Her chart of accounts is as followS Chart of Accounts Revenues&Contra Revenues 401 Sales 408 Sales Discount 409 Sales Retuns and Allowances 10 Catering Income 101 Cash (St Peters Bank 106 Accounts Receivable 110 Prepaid Rent 113 Merchandise 31 Store Supplies 150 Delivery Truck 190 Accumulated Depreciation 600 Purchases 601 Purchase Returns& Allowances 602 Purchase Discounts 603 Freight in 711 Wages Expense 716 Rent Expense 720 Supplies Expense 727 Insurance Expense 730 Depreaation Expense 731 Usities Expense 201 Accounts 209 Wages Payable 210 Sales Tax Payable 214 Uneamed Income Owner's Equity 311 Kandy Capital 900 Incom Required #t:Open Quickbooks accounting software. Using Quickbooks accounting sofhware open Au Chocolate Lovers. After company ispen, To personalize the company name, go to the Company lnk at the top of your screen and then scroll down to Company Information. Place your cursor at the end of the company name and add your name, Click OK to store the changes. Enter the business's frst months transactions in the general journal (Click Accountant on the main menu and select Make General Journal Entries to open the General Journal Entry window. Remember to change your date for each transaction and enter a description of the transaction (ex. Jan 1: Owner invested in business) Jan 1 Kandy invested cash in the business,$40,000 4 Business purchases $1,000 of supplies on account. (h Name feld-Use Office Supply Store 6 Paid rent for the month of January, $500 8 Purchased chocolate bars on acct., for $1,250 from Hershel, Inc. Terms are 2/10r/30 FOB shipping pt In Name field-Use Hershel Ine.) 0 Received shipping bill for purchase made on Jan 8,$80. We paid he billimmediately 11 Purchased candy pieces from Candee, Inc., on acct $1,500. Terms 2/15/30. FOB shipping point. ( Name field-Use Candee, Inc.) 12 Paid for the supplies purchased on Jan 4. (In Name feld-Use Office Supply Store 13 Sold chocolate bars toABC Co.for$800. Terms are 2/10/130Wealso cledec 6% sales tax. (in Name field-Use ABC Co. for Accounts Receivable and Missournl Dept of Rew. for Sales Tax Payable) 14 Received the freight bill from the Jan 11 purchase. Amount was $100 which we paid immediately 15 Paid our employee $80 x 7 days wages $560 16 ABC Ca returned % ofthe chocolate bars purchased on 1/13. We creded teraccontforteretum plus sales tax (sales tax8) (in Name fielduse ABC Co.) ACTIOl Applied Accounting Quickbooks Merchandising Problem 20 Sold $500 of merchandise toJuJuBees on acct. Terms were 2n000 tax. In Name feld-Use Ju Ju Bees and Missouri Dept of Rew. for Sales Tax Payable) We also colected 6% sales 21 We received payment from ABC Co. (Remember, they returned some goods earliar and they donit get Done Attachment ACT101 Applied Accounting Quickbooks Merchandising Problem 20 Sold $500 of merchandise to Ju Ju Bees on acct. Terms were 2mn30. We also cleded 6% sales 21 We received payment from ABC Co (Remember, they neturned some goods earfier and they dont get 24 We paid Candee, Inc. for the Jan 11 purchase. (Did we pay within the discount periodName feld-Use 28 We received payment from Ju Ju Bees. (Did they pay within the discount period? Iif they did, they s 29 Paid our emplayee $80 x 5 days wages $400 tax. (In Name Seld-Use Ju Ju Bees and Missouri Dept of Rev. for Sales Tax Payable a discount on the sales tax portion of their bill) (dsc-$12) Oh Name field-Use ABC Co. Candee, Inc.) don't get a discount on the sales tax portion of their bill) Name Seld-Use Ju Ju Bees 30 We paid Hershel, Inc. for the purchase made on Jan. 8 (Did we pay within the discount period?) Name feld-Use Hershel Inc Check Sgures at end of month Cash balance $35784, Sales Discounts-$22. Trial Balance tolals-Set Feb 1 2 Purchased a delivery truck on account for $22,000. Name feld-Use Trucks Automotive, Inc) 4 Sold S500 worth of chocolate candies to XYZ Co. colected 6% sales tax and terms were 1/15/130. We paid $1 500 for 3 months rent in advance Name feld-Use XYZ, Co and Missouri Dept of Rev. for Sales Tar Payable) XYZCo returned % of the ch colate candies purchased on Feb 4.Wecredtedter accout for the returned amount plus sales tax. Name field-Use XYZ Co) 7 8 Paid the electric bill, $320 and the water bill of $55 for the month of January. 9 sold $3.600 ofchocolate to ABC Co. Terms were 2/10, n30. Also colected sales tax of6% Name feld-Use ABC, Co. and Missouri Dept of Rev.for Sales Tax Payable) 11 Purchased $1,200 of chocolate bars from Hershel, Inc. Terms were 2/15,n 40, FO8 shipping pt. Name feld-Use Hershel, Inc.) 12 We returned 1/3 of the chocolate from the Feb 11 purchase due to defect. Name eid-Use Hershel, Ine) 13 The owner, Kandy, withdrew $300 to purchase round-tip tickets to Las Vegas for personal use 14 Sold $1,000 of chocolate to Coffee Hut. Terms were 1/10, n 30. We also colded 6% sales tar Name feld-Use Coffee Hut and Missouri Dept of Rev, for Sales Tar Payable.) 15 Paid our employee $80 x7 days $560 17 Received payment from ABC Co. for the sale made to them on Feb 9. (Did they pay within the discount pernod? so, they don't get a discount on the sales tax portion of their bill) (sales disce $72) Name felds-Use ABC 20 Purchased $200 of supplies and paid cash. Name Sield-Use Office Supply Store 24 Sold$4-100ofchocolate to JwBees. Terms were2/10, n 30 We also colected 6% sales tax. Name feld-Use Ju Ju Bees and Missouri Dept of Rev. for Sales Tax Payable) 25 We paid Hershel, Inc. the amount owed on the Feb 11 purchase. (Remember we returmed some of the chocolate and check to see ifwe get a discount) (Accounts payable debit-$800) Check Sgures at end of month Cash balance $35 80, Sales Discounts-334 Accts Rac- 5,671, TrialBall$73 5 Mar 2 Received an advance payment of $6,000 from St. Charles Com. College for some signature chocolates we would be making and delivering periodically over the next few months to their cffice. We have not made any of the chocolates yet so we have not eamed any of the money yet. Name fieild-Use SCC 3 Received that amount owed from the Feb 24 sale from Ju Ju Bees. (Do they get adiscount? Name feld-Use Ju Ju Bees.) Remember 5 Paid $2,000 on the delivery truck purchased in the previous month. Name field-Use Trucks Automotive 6 Paid the electric and water bills received this month, $288 8 Sold$8800 worth of chocolate bars to XYZ Ca. Terms were 2/10n30Wealso colected 6% sales tax. Name field-Use XYZ Co and Missouri Dept. of Rev.for Sales Tax Payable Sold $1,500 worth of chocolate candes to ABC Co. Terms were 2/15,n00 14 Wealso cleded6% sales tax. Name field-Use ABC, Co and Missouni Dept of Rev, for Sales Tax Payable 15 Paid our employee 12 days of wages ($80 x 12- $960) 16 Purchased $3,000 worth of chocolate from Candee, Inc. Terms were FOB shipping point 2/10, n30 Name feld-Use Candee, Inc. ACT101 Applied AccountingQuickbooks Merchandising Problem 17 XYZ Co. returned of their purchase. (We credited their account for the return plus sales tax) ta 24 Purchased $600 of supplies on account. Name field Use Office Supply Store 25 Received the amount owed from ABC Co. for the Mar 14 sale. (Do they get a discount? If so 132 remember, no discount on sales tax portion of the bill) Name field-Use ABC, Co 2 Attachment Dorle ACTIO Applied Accounting Quickbooks Merchandising Problem 17 24 Purchased $800 o supplies on account. Name field-Use Office Supply Store. 25 Received the amount owed from ABC Co. for the Mar 14 sale (Do they get a discount? If so, XYZ Co. returned of their purchase. (Wecredtedter account trte retm plus sales taxa.t32 remember, no discount on sales tax portion of the bil Name eld-Use ABC Ca Paid for the purchase made on 3/18. (Did we pay within the 29 28 discount period?) Name field-Candee, Ie Received payment from XVZ Co. for the sale made to them on 38. (Ramember, they returned some of the goods. Also, did they pay heir bill within the discount period?)ash ec o-6.% 30 Sold $3,700 worth of chocolate candies to Ju Ju Bees. Tems were 210n/30. We also collected sales tax of 6%. Check figures at end of month: Cash balance $4831 Sales Disoounts 206 Acts R5247,Tal Balance totals 582 857 Requirement #2: Print the Tial Balance 3/31/16. (Click Reports on the main menu Accountant and Taxes Trial Balance to display the report but be sure to change date)(check figures: Cash $48.381 Supplies-$1,800 Sales Tax Payable $1,311; Purchase discounts $46, Accounts Payable $20,600, Totals $92,857) Requirement 3: Use the Trial Balance you just printed to help determine the necessary adjusting journal entries nequired for the follewing "Hint (enter the ajusting joumalenies in the general joumal and maike sure to number your adjustments and v the adjusting entry box(Cick Accountant on the main menu Make General Journal Entries. Remember to use Mar 31 for all adjustments A 1) New ending balance in Merchandise Inventory s $1,650 no beg inv Adi 2 Make adjustment for the two monts of rent which has expired ) Supplies on hand at the end of the year is $350 Depreciation on the Delivery truck, which had a useful ie of 5 years and $4,000 salage value is $600 Ad 5) Wages owed to the part-time worker are $240 These are due to be paid on the 15 of next month LA46)We have earned % of the advace par e trece ed on Mar 2 tr te Requirement 4: Print a new Trial Balance as of 3/31/16. This will be y onte man menu Accountant and Taxes TritBa change date to 3/31/2016) (check figures Cash $48.38 Depreciation-$600, Totais-$96,347) Requirement 5: Print the Income statement for the last three Requirement:Print the Balanoe Sheet as of Mapah 31(Cick Beports e Requirement : Prepare the four closing journal entries in the general jourmal Enter the closing journal entries &FinanaPrft & Loss Standard+ dates fom Balance Seet Standard. Total Assets $77 528) the general jouma and make sure to number your closing entries as close 1 close 2, etc. and remove the v next to the adjusting entry box (Click Accountant on the main menu Make General Joumal Entries. Remember to use Mar 31, 2016 for all closing etries) Pm Requirement the General prnal granngalofyorwy etes (Jan 1-Mar 31). pk Beports on the main menu Accountant and TaxesJournal). Requirement Print a new trial balance as of 331 and using a penil, wtePOST CLOSING before the title. Click Reports on the main menuAccountant and TaxesTrial Balance (check figure, otals $78,128, Capital-$50 877) ACTIO Applied Accounting Quickbooks Merchandising Proble Requirement #10 Using your Adjusted General Ledger Trial Balanoe precare your cown income statement on the attached sheet below. (The one created by Quickbooks which you printed in Requirement #5 above, is incomect because it does not take into consideration he new ending balance in Merchandise Inventory. See your textbook as to how to add this item to the Cost of Goods Sold Done Attachment Requirement: Prepare the four journal entries in the general journal (Enter he dosing joual in the general jourl and make sure to number your clasing entries as dose 1, clese 2 etc and rmont the "neat to tho adjusting entry ber aa Accoutantante mannev Make Gawad Journal Entries Remember to use Mar 31, 201G for all closing entries) of 5 Printhe General joumal the man men. Accountant and Taes loumau entries (Jan 1-Mar 31) Oa Repotson RequirementPrint a new tial balance as of 3/31 and using a penail, wrhe TPOST-CLOSNG belbre the e TrialBlect (deck fpre. cack Beports on teman renuAccountant and Taxes Itals$78,128. Captal-S50877) ACTIOI Applied Accounting Quickbooks Merchandising Problem Requirement t Using your Adjusted General Ledger Triail Balance atached sheet below. (The one created by Quickbooks which you printed in Requirement s above, is ingorrect because it does not take into consideration the new ending balance n Merchandse inventory. See your tent ook as to how to add t temtote CostofGoods Sold section of the Income Statement). When you have completed your income statement atach t to the back ofbeace owreated inome swement Check fan for your name is Cost of goods sold-$5.034, Net Income-$11,177 Done Attachment ACTIOl Applied Accounting Quickbooks Merchandising Problem business) Kandy Kane started Al Chocolate Lovers during the month of January 2016. Sherented a smll store and paid a part-time assistant to help her in the business. Her chart of accounts is as followS Chart of Accounts Revenues&Contra Revenues 401 Sales 408 Sales Discount 409 Sales Retuns and Allowances 10 Catering Income 101 Cash (St Peters Bank 106 Accounts Receivable 110 Prepaid Rent 113 Merchandise 31 Store Supplies 150 Delivery Truck 190 Accumulated Depreciation 600 Purchases 601 Purchase Returns& Allowances 602 Purchase Discounts 603 Freight in 711 Wages Expense 716 Rent Expense 720 Supplies Expense 727 Insurance Expense 730 Depreaation Expense 731 Usities Expense 201 Accounts 209 Wages Payable 210 Sales Tax Payable 214 Uneamed Income Owner's Equity 311 Kandy Capital 900 Incom Required #t:Open Quickbooks accounting software. Using Quickbooks accounting sofhware open Au Chocolate Lovers. After company ispen, To personalize the company name, go to the Company lnk at the top of your screen and then scroll down to Company Information. Place your cursor at the end of the company name and add your name, Click OK to store the changes. Enter the business's frst months transactions in the general journal (Click Accountant on the main menu and select Make General Journal Entries to open the General Journal Entry window. Remember to change your date for each transaction and enter a description of the transaction (ex. Jan 1: Owner invested in business) Jan 1 Kandy invested cash in the business,$40,000 4 Business purchases $1,000 of supplies on account. (h Name feld-Use Office Supply Store 6 Paid rent for the month of January, $500 8 Purchased chocolate bars on acct., for $1,250 from Hershel, Inc. Terms are 2/10r/30 FOB shipping pt In Name field-Use Hershel Ine.) 0 Received shipping bill for purchase made on Jan 8,$80. We paid he billimmediately 11 Purchased candy pieces from Candee, Inc., on acct $1,500. Terms 2/15/30. FOB shipping point. ( Name field-Use Candee, Inc.) 12 Paid for the supplies purchased on Jan 4. (In Name feld-Use Office Supply Store 13 Sold chocolate bars toABC Co.for$800. Terms are 2/10/130Wealso cledec 6% sales tax. (in Name field-Use ABC Co. for Accounts Receivable and Missournl Dept of Rew. for Sales Tax Payable) 14 Received the freight bill from the Jan 11 purchase. Amount was $100 which we paid immediately 15 Paid our employee $80 x 7 days wages $560 16 ABC Ca returned % ofthe chocolate bars purchased on 1/13. We creded teraccontforteretum plus sales tax (sales tax8) (in Name fielduse ABC Co.) ACTIOl Applied Accounting Quickbooks Merchandising Problem 20 Sold $500 of merchandise toJuJuBees on acct. Terms were 2n000 tax. In Name feld-Use Ju Ju Bees and Missouri Dept of Rew. for Sales Tax Payable) We also colected 6% sales 21 We received payment from ABC Co. (Remember, they returned some goods earliar and they donit get Done Attachment ACT101 Applied Accounting Quickbooks Merchandising Problem 20 Sold $500 of merchandise to Ju Ju Bees on acct. Terms were 2mn30. We also cleded 6% sales 21 We received payment from ABC Co (Remember, they neturned some goods earfier and they dont get 24 We paid Candee, Inc. for the Jan 11 purchase. (Did we pay within the discount periodName feld-Use 28 We received payment from Ju Ju Bees. (Did they pay within the discount period? Iif they did, they s 29 Paid our emplayee $80 x 5 days wages $400 tax. (In Name Seld-Use Ju Ju Bees and Missouri Dept of Rev. for Sales Tax Payable a discount on the sales tax portion of their bill) (dsc-$12) Oh Name field-Use ABC Co. Candee, Inc.) don't get a discount on the sales tax portion of their bill) Name Seld-Use Ju Ju Bees 30 We paid Hershel, Inc. for the purchase made on Jan. 8 (Did we pay within the discount period?) Name feld-Use Hershel Inc Check Sgures at end of month Cash balance $35784, Sales Discounts-$22. Trial Balance tolals-Set Feb 1 2 Purchased a delivery truck on account for $22,000. Name feld-Use Trucks Automotive, Inc) 4 Sold S500 worth of chocolate candies to XYZ Co. colected 6% sales tax and terms were 1/15/130. We paid $1 500 for 3 months rent in advance Name feld-Use XYZ, Co and Missouri Dept of Rev. for Sales Tar Payable) XYZCo returned % of the ch colate candies purchased on Feb 4.Wecredtedter accout for the returned amount plus sales tax. Name field-Use XYZ Co) 7 8 Paid the electric bill, $320 and the water bill of $55 for the month of January. 9 sold $3.600 ofchocolate to ABC Co. Terms were 2/10, n30. Also colected sales tax of6% Name feld-Use ABC, Co. and Missouri Dept of Rev.for Sales Tax Payable) 11 Purchased $1,200 of chocolate bars from Hershel, Inc. Terms were 2/15,n 40, FO8 shipping pt. Name feld-Use Hershel, Inc.) 12 We returned 1/3 of the chocolate from the Feb 11 purchase due to defect. Name eid-Use Hershel, Ine) 13 The owner, Kandy, withdrew $300 to purchase round-tip tickets to Las Vegas for personal use 14 Sold $1,000 of chocolate to Coffee Hut. Terms were 1/10, n 30. We also colded 6% sales tar Name feld-Use Coffee Hut and Missouri Dept of Rev, for Sales Tar Payable.) 15 Paid our employee $80 x7 days $560 17 Received payment from ABC Co. for the sale made to them on Feb 9. (Did they pay within the discount pernod? so, they don't get a discount on the sales tax portion of their bill) (sales disce $72) Name felds-Use ABC 20 Purchased $200 of supplies and paid cash. Name Sield-Use Office Supply Store 24 Sold$4-100ofchocolate to JwBees. Terms were2/10, n 30 We also colected 6% sales tax. Name feld-Use Ju Ju Bees and Missouri Dept of Rev. for Sales Tax Payable) 25 We paid Hershel, Inc. the amount owed on the Feb 11 purchase. (Remember we returmed some of the chocolate and check to see ifwe get a discount) (Accounts payable debit-$800) Check Sgures at end of month Cash balance $35 80, Sales Discounts-334 Accts Rac- 5,671, TrialBall$73 5 Mar 2 Received an advance payment of $6,000 from St. Charles Com. College for some signature chocolates we would be making and delivering periodically over the next few months to their cffice. We have not made any of the chocolates yet so we have not eamed any of the money yet. Name fieild-Use SCC 3 Received that amount owed from the Feb 24 sale from Ju Ju Bees. (Do they get adiscount? Name feld-Use Ju Ju Bees.) Remember 5 Paid $2,000 on the delivery truck purchased in the previous month. Name field-Use Trucks Automotive 6 Paid the electric and water bills received this month, $288 8 Sold$8800 worth of chocolate bars to XYZ Ca. Terms were 2/10n30Wealso colected 6% sales tax. Name field-Use XYZ Co and Missouri Dept. of Rev.for Sales Tax Payable Sold $1,500 worth of chocolate candes to ABC Co. Terms were 2/15,n00 14 Wealso cleded6% sales tax. Name field-Use ABC, Co and Missouni Dept of Rev, for Sales Tax Payable 15 Paid our employee 12 days of wages ($80 x 12- $960) 16 Purchased $3,000 worth of chocolate from Candee, Inc. Terms were FOB shipping point 2/10, n30 Name feld-Use Candee, Inc. ACT101 Applied AccountingQuickbooks Merchandising Problem 17 XYZ Co. returned of their purchase. (We credited their account for the return plus sales tax) ta 24 Purchased $600 of supplies on account. Name field Use Office Supply Store 25 Received the amount owed from ABC Co. for the Mar 14 sale. (Do they get a discount? If so 132 remember, no discount on sales tax portion of the bill) Name field-Use ABC, Co 2 Attachment Dorle ACTIO Applied Accounting Quickbooks Merchandising Problem 17 24 Purchased $800 o supplies on account. Name field-Use Office Supply Store. 25 Received the amount owed from ABC Co. for the Mar 14 sale (Do they get a discount? If so, XYZ Co. returned of their purchase. (Wecredtedter account trte retm plus sales taxa.t32 remember, no discount on sales tax portion of the bil Name eld-Use ABC Ca Paid for the purchase made on 3/18. (Did we pay within the 29 28 discount period?) Name field-Candee, Ie Received payment from XVZ Co. for the sale made to them on 38. (Ramember, they returned some of the goods. Also, did they pay heir bill within the discount period?)ash ec o-6.% 30 Sold $3,700 worth of chocolate candies to Ju Ju Bees. Tems were 210n/30. We also collected sales tax of 6%. Check figures at end of month: Cash balance $4831 Sales Disoounts 206 Acts R5247,Tal Balance totals 582 857 Requirement #2: Print the Tial Balance 3/31/16. (Click Reports on the main menu Accountant and Taxes Trial Balance to display the report but be sure to change date)(check figures: Cash $48.381 Supplies-$1,800 Sales Tax Payable $1,311; Purchase discounts $46, Accounts Payable $20,600, Totals $92,857) Requirement 3: Use the Trial Balance you just printed to help determine the necessary adjusting journal entries nequired for the follewing "Hint (enter the ajusting joumalenies in the general joumal and maike sure to number your adjustments and v the adjusting entry box(Cick Accountant on the main menu Make General Journal Entries. Remember to use Mar 31 for all adjustments A 1) New ending balance in Merchandise Inventory s $1,650 no beg inv Adi 2 Make adjustment for the two monts of rent which has expired ) Supplies on hand at the end of the year is $350 Depreciation on the Delivery truck, which had a useful ie of 5 years and $4,000 salage value is $600 Ad 5) Wages owed to the part-time worker are $240 These are due to be paid on the 15 of next month LA46)We have earned % of the advace par e trece ed on Mar 2 tr te Requirement 4: Print a new Trial Balance as of 3/31/16. This will be y onte man menu Accountant and Taxes TritBa change date to 3/31/2016) (check figures Cash $48.38 Depreciation-$600, Totais-$96,347) Requirement 5: Print the Income statement for the last three Requirement:Print the Balanoe Sheet as of Mapah 31(Cick Beports e Requirement : Prepare the four closing journal entries in the general jourmal Enter the closing journal entries &FinanaPrft & Loss Standard+ dates fom Balance Seet Standard. Total Assets $77 528) the general jouma and make sure to number your closing entries as close 1 close 2, etc. and remove the v next to the adjusting entry box (Click Accountant on the main menu Make General Joumal Entries. Remember to use Mar 31, 2016 for all closing etries) Pm Requirement the General prnal granngalofyorwy etes (Jan 1-Mar 31). pk Beports on the main menu Accountant and TaxesJournal). Requirement Print a new trial balance as of 331 and using a penil, wtePOST CLOSING before the title. Click Reports on the main menuAccountant and TaxesTrial Balance (check figure, otals $78,128, Capital-$50 877) ACTIO Applied Accounting Quickbooks Merchandising Proble Requirement #10 Using your Adjusted General Ledger Trial Balanoe precare your cown income statement on the attached sheet below. (The one created by Quickbooks which you printed in Requirement #5 above, is incomect because it does not take into consideration he new ending balance in Merchandise Inventory. See your textbook as to how to add this item to the Cost of Goods Sold Done Attachment Requirement: Prepare the four journal entries in the general journal (Enter he dosing joual in the general jourl and make sure to number your clasing entries as dose 1, clese 2 etc and rmont the "neat to tho adjusting entry ber aa Accoutantante mannev Make Gawad Journal Entries Remember to use Mar 31, 201G for all closing entries) of 5 Printhe General joumal the man men. Accountant and Taes loumau entries (Jan 1-Mar 31) Oa Repotson RequirementPrint a new tial balance as of 3/31 and using a penail, wrhe TPOST-CLOSNG belbre the e TrialBlect (deck fpre. cack Beports on teman renuAccountant and Taxes Itals$78,128. Captal-S50877) ACTIOI Applied Accounting Quickbooks Merchandising Problem Requirement t Using your Adjusted General Ledger Triail Balance atached sheet below. (The one created by Quickbooks which you printed in Requirement s above, is ingorrect because it does not take into consideration the new ending balance n Merchandse inventory. See your tent ook as to how to add t temtote CostofGoods Sold section of the Income Statement). When you have completed your income statement atach t to the back ofbeace owreated inome swement Check fan for your name is Cost of goods sold-$5.034, Net Income-$11,177