Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Donna, a chartered financial analyst (CFA), is willing to invest in the Alternative Investments Market (AIM) in the United Kingdom. She collected the information

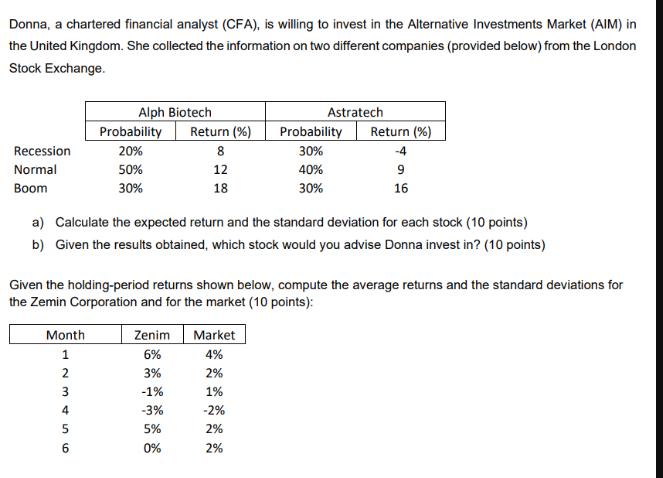

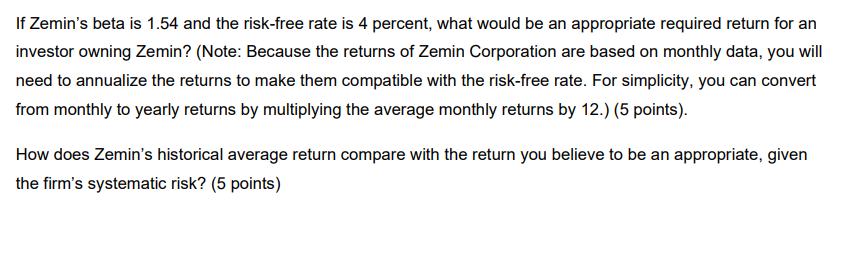

Donna, a chartered financial analyst (CFA), is willing to invest in the Alternative Investments Market (AIM) in the United Kingdom. She collected the information on two different companies (provided below) from the London Stock Exchange. Alph Biotech Return (%) 8 Astratech Probability 30% Return (%) -4 TTY Probability Recession 20% Normal 50% 12 Boom 30% 18 40% 9 30% 16 a) Calculate the expected return and the standard deviation for each stock (10 points) b) Given the results obtained, which stock would you advise Donna invest in? (10 points) Given the holding-period returns shown below, compute the average returns and the standard deviations for the Zemin Corporation and for the market (10 points): Month 123456 Zenim 6% Market 4% 3% 2% -1% 1% -3% -2% 5% 2% 0% 2% If Zemin's beta is 1.54 and the risk-free rate is 4 percent, what would be an appropriate required return for an investor owning Zemin? (Note: Because the returns of Zemin Corporation are based on monthly data, you will need to annualize the returns to make them compatible with the risk-free rate. For simplicity, you can convert from monthly to yearly returns by multiplying the average monthly returns by 12.) (5 points). How does Zemin's historical average return compare with the return you believe to be an appropriate, given the firm's systematic risk? (5 points)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a Calculation of expected return and standard deviation for Alph Biotech and Astratech Alph Biotech Expected return Probability of Recession Return in Recession Probability of Normal Return in Normal ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started