Question

Donna, a chartered financial analyst in London, United Kingdom, is wanting to invest in securities listed on the Alternative Investment Market (AIM) which is

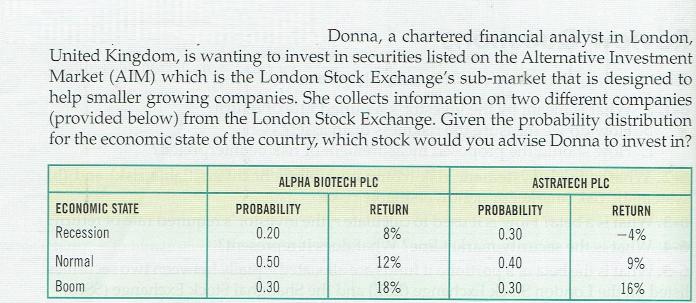

Donna, a chartered financial analyst in London, United Kingdom, is wanting to invest in securities listed on the Alternative Investment Market (AIM) which is the London Stock Exchange's sub-market that is designed to help smaller growing companies. She collects information on two different companies (provided below) from the London Stock Exchange. Given the probability distribution for the economic state of the country, which stock would you advise Donna to invest in? ALPHA BIOTECH PLC ASTRATECH PLC ECONOMIC STATE PROBABILITY RETURN PROBABILITY RETURN Recession 0.20 8% 0.30 -4% Normal 0.50 12% 0.40 9% oom 0.30 18% 0.30 16%

Step by Step Solution

3.45 Rating (165 Votes )

There are 3 Steps involved in it

Step: 1

Answer Solution we have to calculate eupecked Re...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Investments

Authors: Zvi Bodie, Alex Kane, Alan J. Marcus

9th Edition

73530700, 978-0073530703

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App