Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Donna Cheung was assistant to the chairman of ABC Company. She has assumed the current position for three months. It is currently 1 January.

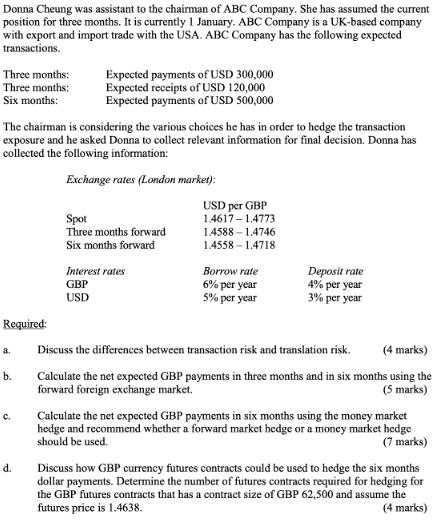

Donna Cheung was assistant to the chairman of ABC Company. She has assumed the current position for three months. It is currently 1 January. ABC Company is a UK-based company with export and import trade with the USA. ABC Company has the following expected transactions. Three months: Three months: Six months: The chairman is considering the various choices he has in order to hedge the transaction exposure and he asked Donna to collect relevant information for final decision. Donna has collected the following information: Exchange rates (London market): Required: a. b. C. Expected payments of USD 300,000 Expected receipts of USD 120,000 Expected payments of USD 500,000 d. Spot Three months forward Six months forward Interest rates GBP USD USD per GBP 1.4617-1.4773 1.4588-1.4746 1.4558-1.4718 Borrow rate 6% per year 5% per year Deposit rate 4% per year 3% per year Discuss the differences between transaction risk and translation risk. (4 marks) Calculate the net expected GBP payments in three months and in six months using the forward foreign exchange market. (5 marks) Calculate the net expected GBP payments in six months using the money market hedge and recommend whether a forward market hedge or a money market hedge should be used. (7 marks) Discuss how GBP currency futures contracts could be used to hedge the six months dollar payments. Determine the number of futures contracts required for hedging for the GBP futures contracts that has a contract size of GBP 62,500 and assume the futures price is 1.4638. (4 marks)

Step by Step Solution

★★★★★

3.28 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

Transaction Risk and Translation Risk Transaction risk refers to the potential loss or gain that can occur due to fluctuations in exchange rates between the time a transaction is initiated and the tim...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started