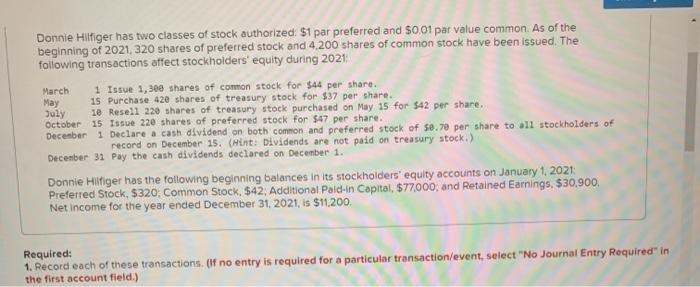

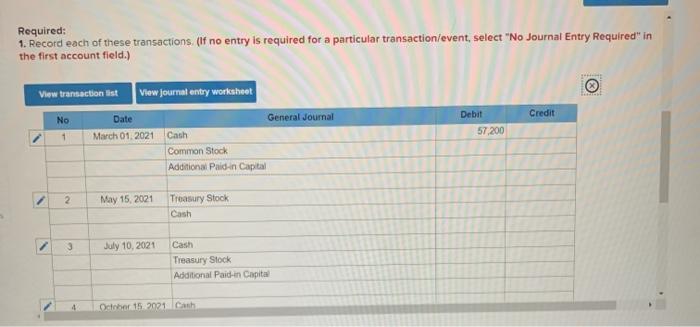

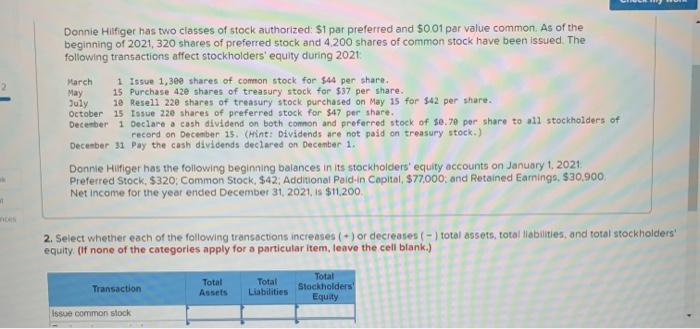

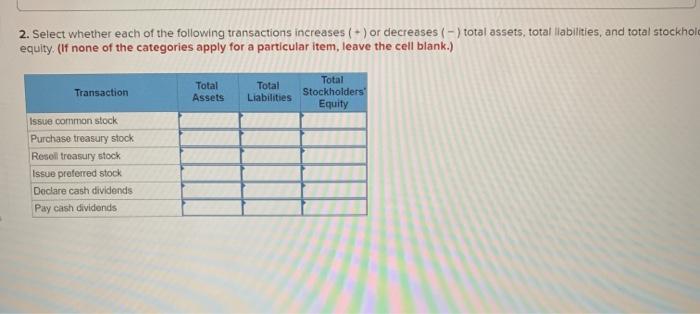

Donnie Hilfiger has two classes of stock authorized: $1 par preferred and $0.01 par value common. As of the beginning of 2021, 320 shares of preferred stock and 4.200 shares of common stock have been issued. The following transactions affect stockholders' equity during 2021 March 1 Issue 1,300 shares of common stock for $44 per share. May 15 Purchase 420 shares of treasury stock for $37 per share. July le Resell 220 shares of treasury stock purchased on May 15 for $42 per share. October 15 Issue 220 shares of preferred stock for $47 per share. December 1 Declare a cash dividend on both common and preferred stock of $0.70 per share to all stockholders of record on December 15. (Hint: Dividends are not paid on treasury stock.) December 31 Pay the cash dividends declared on December 1. Donnie Hilfiger has the following beginning balances in its stockholders' equity accounts on January 1, 2021: Preferred Stock, 5320, Common Stock. $42. Additional Pald-in Capital, $77,000, and retained Earnings, $30,900, Net income for the year ended December 31, 2021, is $11.200, Required: 1. Record each of these transactions. (If no entry is required for a particular transaction/event, select "No Journal Entry Required" in the first account field.) Required: 1. Record each of these transactions. (If no entry is required for a particular transaction/event, select "No Journal Entry Required" in the first account field.) View transaction list View journal entry worksheet Credit No Date March 01, 2021 Debit 57,200 1 General Journal Cash Common Stock Additional Paiden Capital 2 May 15, 2021 Treasury Stock Cash 3 July 10, 2021 Cash Treasury Stock Additional Paid-in Capital 4 October 15 2021 Cath Donnie Hilfiger has two classes of stock authorized: S1 par preferred and $0.01 par value common. As of the beginning of 2021, 320 shares of preferred stock and 4 200 shares of common stock have been issued. The following transactions affect stockholders' equity during 2021 March 1 Issue 1,300 shares of comon stock for $44 per share. May 15 Purchase 420 shares of treasury stock for $37 per share. July 10 Resell 220 shares of treasury stock purchased on May 15 for $42 per share. October 15 Issue 220 shares of preferred stock for $47 per share. December 1 Declare a cash dividend on both common and preferred stock of $0.70 por share to all stockholders of record on December 15. (Hint: Dividends are not paid on treasury stock.) December 31 Pay the cash dividends declared on December 1. Donnie Hilfiger has the following beginning balances in its stockholders' equity accounts on January 1, 2021 Preferred Stock, 5320Common Stock, $42. Additional Paid-in Capital, $77,000, and Retained Earnings, $30,900 Net Income for the year ended December 31, 2021, is $11.200 2. Select whether each of the following transactions increases ( - ) or decreases ( - ) total assets, total abilities, and total stockholders' equity (If none of the categories apply for a particular item, leave the cell blank.) Transaction Total Assets Total Liabilities Total Stockholders Equity Issue common stock 2. Select whether each of the following transactions increases ( - ) or decreases ( - ) total assets, total liabilities, and total stockhold equity. (If none of the categories apply for a particular item, leave the cell blank.) Transaction Total Assets Total Liabilities Total Stockholders Equity Issue common stock Purchase treasury stock Resol treasury stock Issue preferred stock Declare cash dividends Pay cash dividends