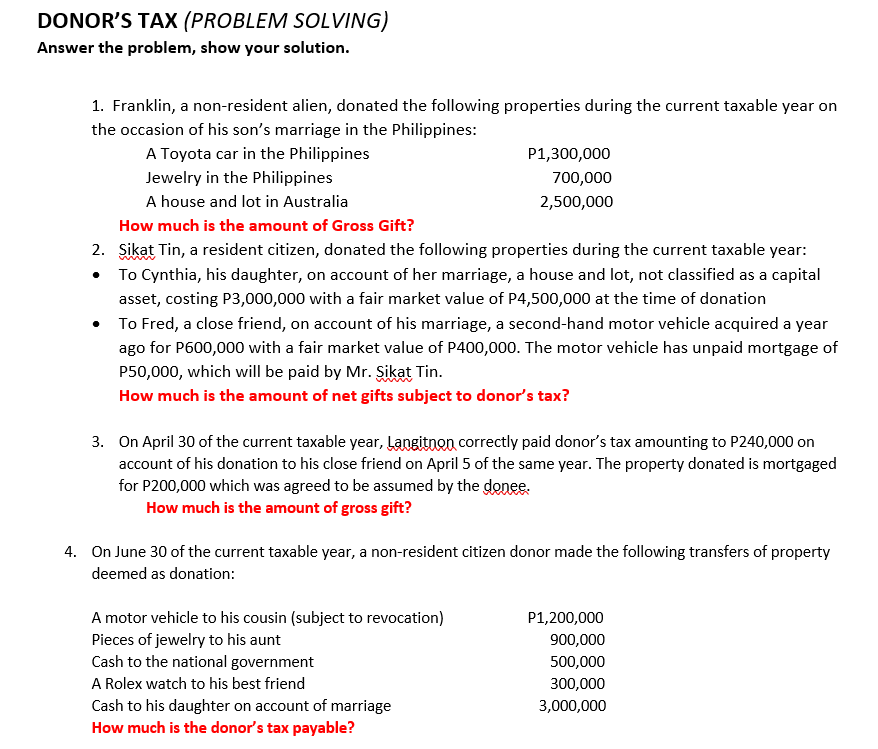

DONOR'S TAX (PROBLEM SOLVING) Answer the problem, show your solution. 1. Franklin, a non-resident alien, donated the following properties during the current taxable year on the occasion of his son's marriage in the Philippines: A Toyota car in the Philippines P1,300,000 Jewelry in the Philippines 700,000 A house and lot in Australia 2,500,000 How much is the amount of Gross Gift? 2. Sikat Tin, a resident citizen, donated the following properties during the current taxable year: To Cynthia, his daughter, on account of her marriage, a house and lot, not classified as a capital asset, costing P3,000,000 with a fair market value of P4,500,000 at the time of donation To Fred, a close friend, on account of his marriage, a second-hand motor vehicle acquired a year ago for P600,000 with a fair market value of P400,000. The motor vehicle has unpaid mortgage of P50,000, which will be paid by Mr. Sikat Tin. How much is the amount of net gifts subject to donor's tax? 3. On April 30 of the current taxable year, Langitnen correctly paid donor's tax amounting to P240,000 on account of his donation to his close friend on April 5 of the same year. The property donated is mortgaged for P200,000 which was agreed to be assumed by the denee. How much is the amount of gross gift? 4. On June 30 of the current taxable year, a non-resident citizen donor made the following transfers of property deemed as donation: A motor vehicle to his cousin (subject to revocation) Pieces of jewelry to his aunt Cash to the national government A Rolex watch to his best friend Cash to his daughter on account of marriage How much is the donor's tax payable? P1,200,000 900,000 500,000 300,000 3,000,000 DONOR'S TAX (PROBLEM SOLVING) Answer the problem, show your solution. 1. Franklin, a non-resident alien, donated the following properties during the current taxable year on the occasion of his son's marriage in the Philippines: A Toyota car in the Philippines P1,300,000 Jewelry in the Philippines 700,000 A house and lot in Australia 2,500,000 How much is the amount of Gross Gift? 2. Sikat Tin, a resident citizen, donated the following properties during the current taxable year: To Cynthia, his daughter, on account of her marriage, a house and lot, not classified as a capital asset, costing P3,000,000 with a fair market value of P4,500,000 at the time of donation To Fred, a close friend, on account of his marriage, a second-hand motor vehicle acquired a year ago for P600,000 with a fair market value of P400,000. The motor vehicle has unpaid mortgage of P50,000, which will be paid by Mr. Sikat Tin. How much is the amount of net gifts subject to donor's tax? 3. On April 30 of the current taxable year, Langitnen correctly paid donor's tax amounting to P240,000 on account of his donation to his close friend on April 5 of the same year. The property donated is mortgaged for P200,000 which was agreed to be assumed by the denee. How much is the amount of gross gift? 4. On June 30 of the current taxable year, a non-resident citizen donor made the following transfers of property deemed as donation: A motor vehicle to his cousin (subject to revocation) Pieces of jewelry to his aunt Cash to the national government A Rolex watch to his best friend Cash to his daughter on account of marriage How much is the donor's tax payable? P1,200,000 900,000 500,000 300,000 3,000,000