Answered step by step

Verified Expert Solution

Question

1 Approved Answer

DON'T ANSWER Only ONE QUESTION I WILL GIVE YOU A BAD REVIEW LEAVE IT ALONE IF YOU CANT ANSWER ALL THE QUESTIONS DONT TELL ME

DON'T ANSWER Only ONE QUESTION I WILL GIVE YOU A BAD REVIEW LEAVE IT ALONE IF YOU CANT ANSWER ALL THE QUESTIONS DONT TELL ME ANSYTHING ABOUT CHEGG GUILDELINES. answer all please

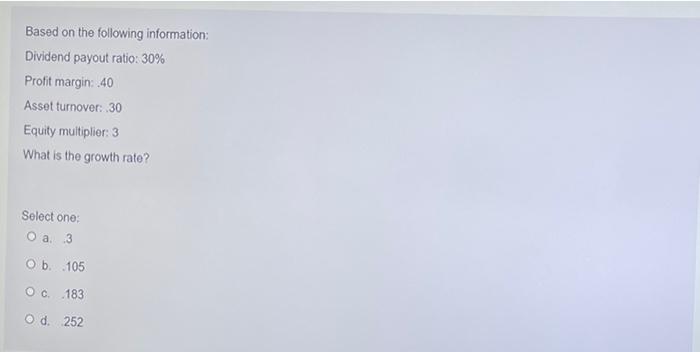

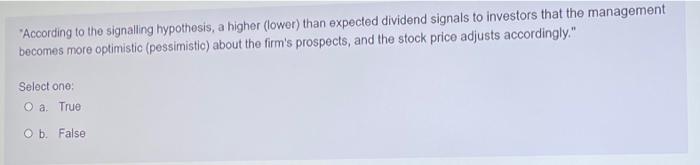

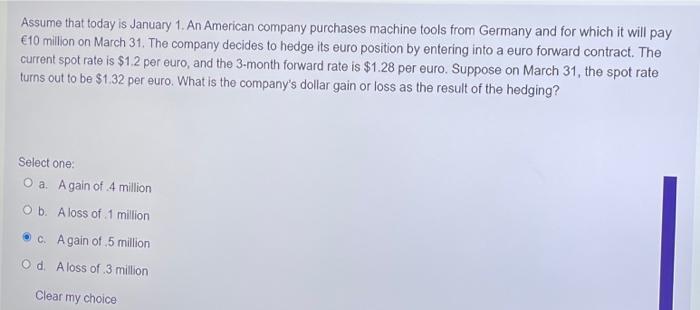

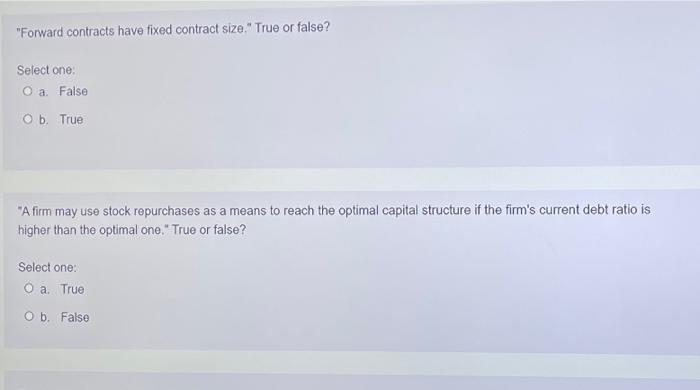

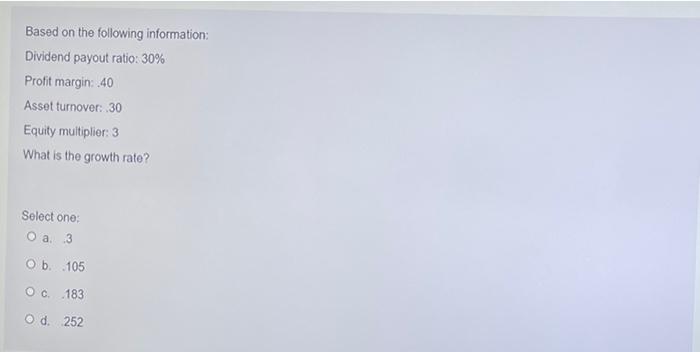

"According to the signalling hypothesis, a higher (lower) than expected dividend signals to investors that the management becomes more optimistic (pessimistic about the firm's prospects, and the stock price adjusts accordingly." Select one: O a. True Ob False Assume that today is January 1, An American company purchases machine tools from Germany and for which it will pay 10 million on March 31. The company decides to hedge its euro position by entering into a euro forward contract. The current spot rate is $1.2 per euro, and the 3-month forward rate is $1.28 per euro. Suppose on March 31, the spot rate turns out to be $1.32 per euro. What is the company's dollar gain or loss as the result of the hedging? Select one: Oa. Again of 4 million O b. A loss of 1 million OC. Again of 5 million Od Aloss of 3 million Clear my choice "Forward contracts have fixed contract size." True or false? Select one: O a False Ob. True "A firm may use stock repurchases as a means to reach the optimal capital structure if the firm's current debt ratio is higher than the optimal one." True or false? Select one: O a. True O b. False Based on the following information: Dividend payout ratio: 30% Profit margin: 40 Asset turnover 30 Equity multiplier: 3 What is the growth rate? Select one: O a 3 Ob. 105 Oc 183 Od 252 "According to the signalling hypothesis, a higher (lower) than expected dividend signals to investors that the management becomes more optimistic (pessimistic about the firm's prospects, and the stock price adjusts accordingly." Select one: O a. True Ob False Assume that today is January 1, An American company purchases machine tools from Germany and for which it will pay 10 million on March 31. The company decides to hedge its euro position by entering into a euro forward contract. The current spot rate is $1.2 per euro, and the 3-month forward rate is $1.28 per euro. Suppose on March 31, the spot rate turns out to be $1.32 per euro. What is the company's dollar gain or loss as the result of the hedging? Select one: Oa. Again of 4 million O b. A loss of 1 million OC. Again of 5 million Od Aloss of 3 million Clear my choice "Forward contracts have fixed contract size." True or false? Select one: O a False Ob. True "A firm may use stock repurchases as a means to reach the optimal capital structure if the firm's current debt ratio is higher than the optimal one." True or false? Select one: O a. True O b. False Based on the following information: Dividend payout ratio: 30% Profit margin: 40 Asset turnover 30 Equity multiplier: 3 What is the growth rate? Select one: O a 3 Ob. 105 Oc 183 Od 252

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started