Answered step by step

Verified Expert Solution

Question

1 Approved Answer

DONT COPY PASTE THE OTHER ANSWER FROM CHEGG ITS WRONG DONT COPY PASTE THE OTHER ANSWER FROM CHEGG ITS WRONG DONT COPY PASTE THE OTHER

DONT COPY PASTE THE OTHER ANSWER FROM CHEGG ITS WRONG

DONT COPY PASTE THE OTHER ANSWER FROM CHEGG ITS WRONG

DONT COPY PASTE THE OTHER ANSWER FROM CHEGG ITS WRONG

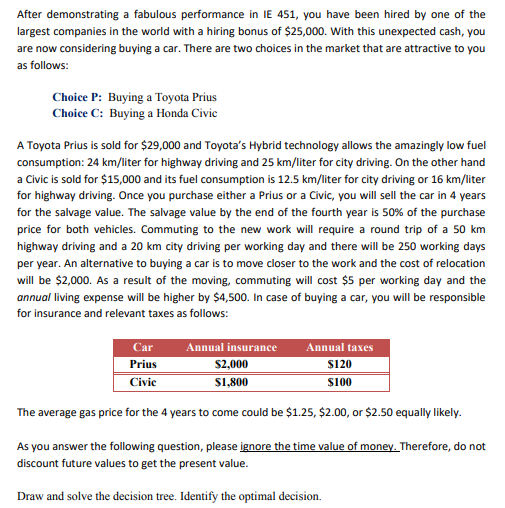

After demonstrating a fabulous performance in IE 451, you have been hired by one of the largest companies in the world with a hiring bonus of $25,000. With this unexpected cash, you are now considering buying a car. There are two choices in the market that are attractive to you as follows: Choice P: Buying a Toyota Prius Choice C: Buying a Honda Civic A Toyota Prius is sold for $29,000 and Toyota's Hybrid technology allows the amazingly low fuel consumption: 24 km/liter for highway driving and 25 km/liter for city driving. On the other hand a Civic is sold for $15,000 and its fuel consumption is 12.5 km/liter for city driving or 16 km/liter for highway driving. Once you purchase either a Prius or a Civic, you will sell the car in 4 years for the salvage value. The salvage value by the end of the fourth year is 50% of the purchase price for both vehicles. Commuting to the new work will require a round trip of a 50 km highway driving and a 20 km city driving per working day and there will be 250 working days per year. An alternative to buying a car is to move closer to the work and the cost of relocation will be $2,000. As a result of the moving, commuting will cost $5 per working day and the annual living expense will be higher by $4,500. In case of buying a car, you will be responsible for insurance and relevant taxes as follows: Car Prius Civic Annual insurance $2,000 $1,800 Annual taxes $120 $100 The average gas price for the 4 years to come could be $1.25, $2.00, or $2.50 equally likely. As you answer the following question, please ignore the time value of money. Therefore, do not discount future values to get the present value. Draw and solve the decision tree. Identify the optimal decisionStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started