Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Don't copy the answer already available on internet.. That's not correct PCmust is a computer company which saw a large expansion in its business, earnings

Don't copy the answer already available on internet.. That's not correct

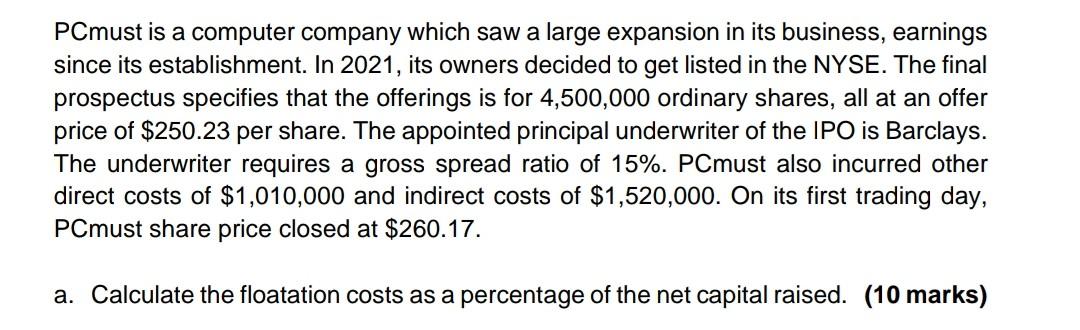

PCmust is a computer company which saw a large expansion in its business, earnings since its establishment. In 2021, its owners decided to get listed in the NYSE. The final prospectus specifies that the offerings is for 4,500,000 ordinary shares, all at an offer price of $250.23 per share. The appointed principal underwriter of the IPO is Barclays. The underwriter requires a gross spread ratio of 15%. PCmust also incurred other direct costs of $1,010,000 and indirect costs of $1,520,000. On its first trading day, PCmust share price closed at $260.17. a. Calculate the floatation costs as a percentage of the net capital raised. (10 marks)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started