Answered step by step

Verified Expert Solution

Question

1 Approved Answer

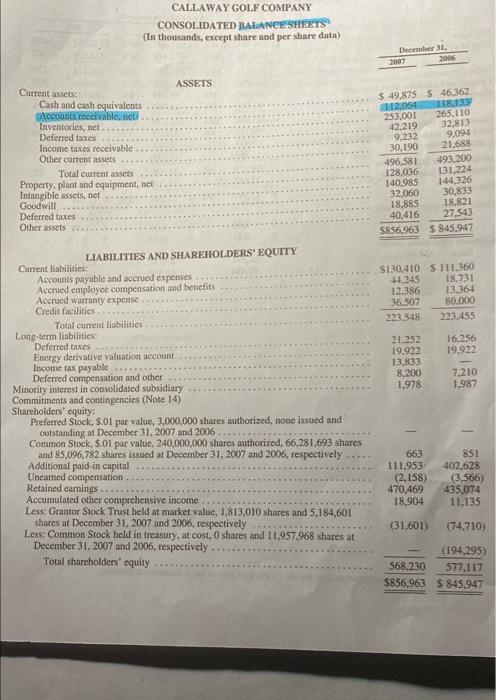

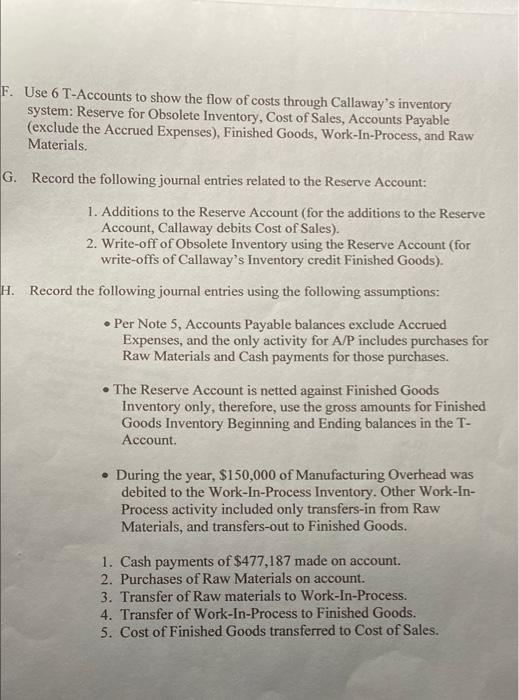

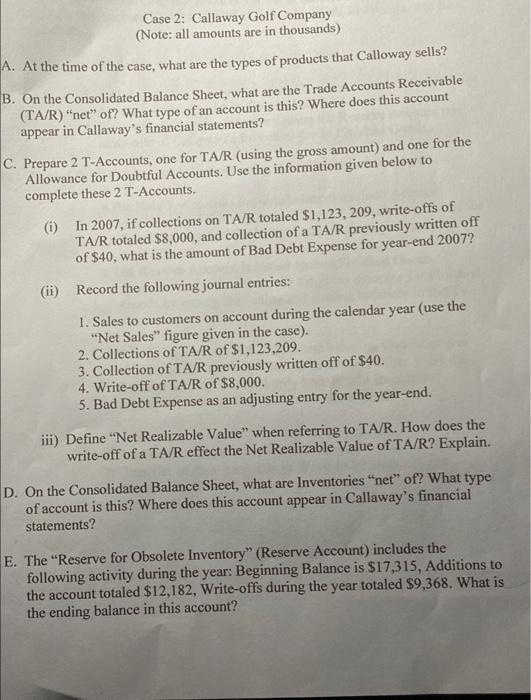

Dont have to answer A CALLAWAY GOLF COMPANY CONSOLIDATED BALANCE SHEETS (In thousands, except share and per share data) December 31 2007 2006 ASSETS Current

Dont have to answer A

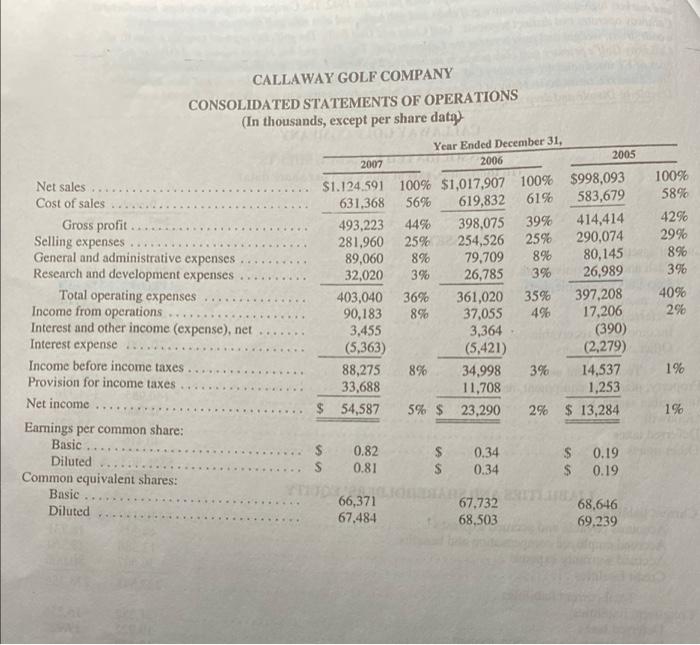

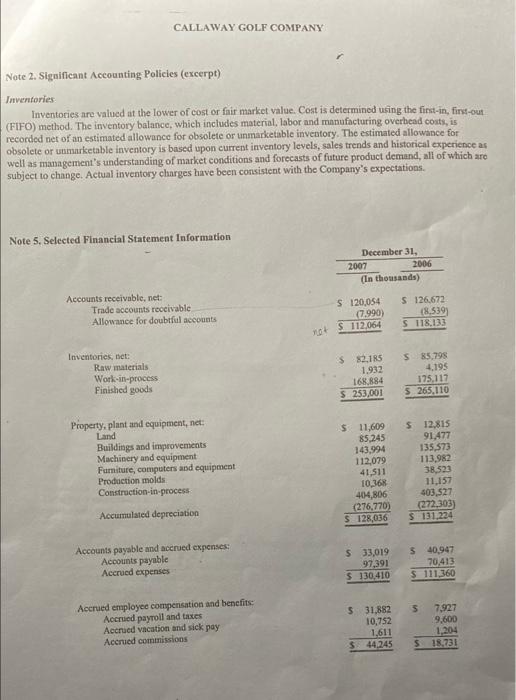

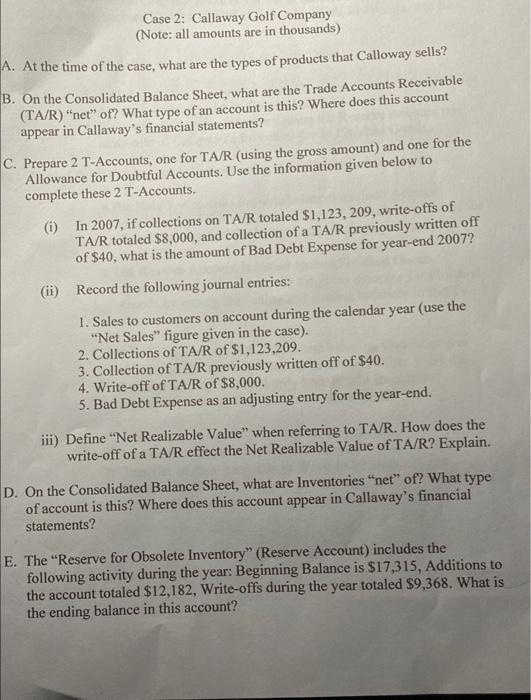

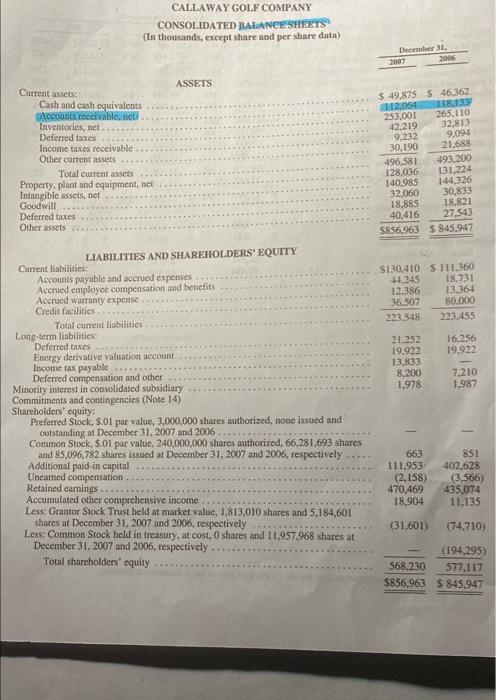

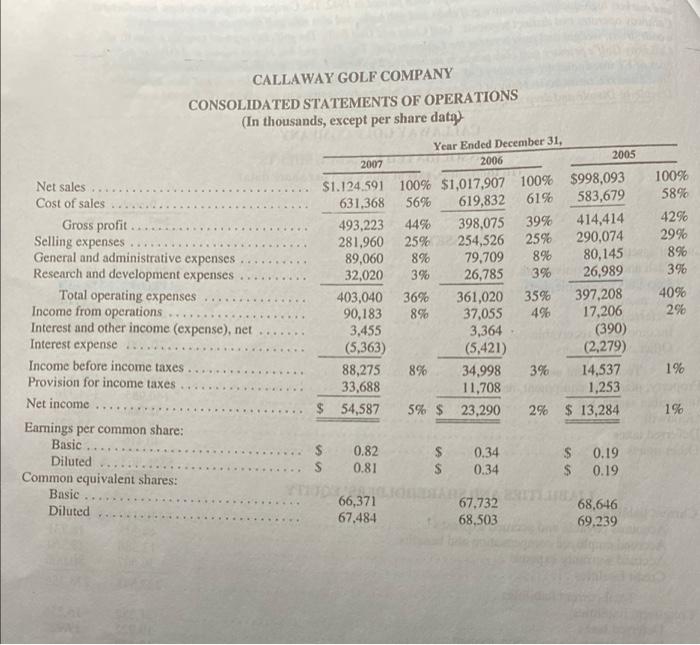

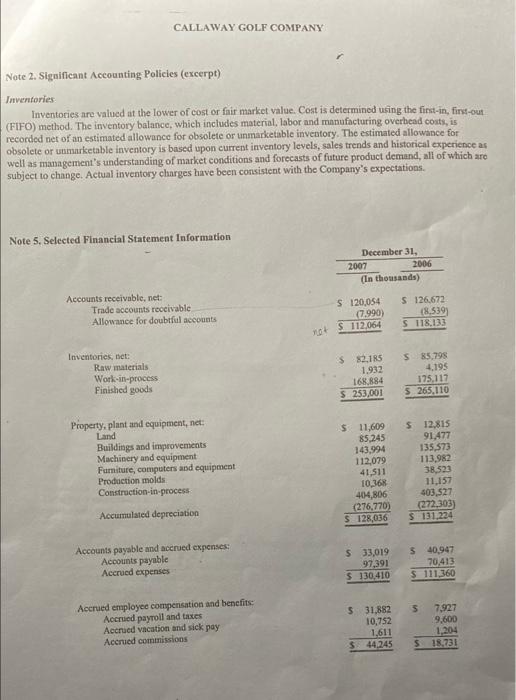

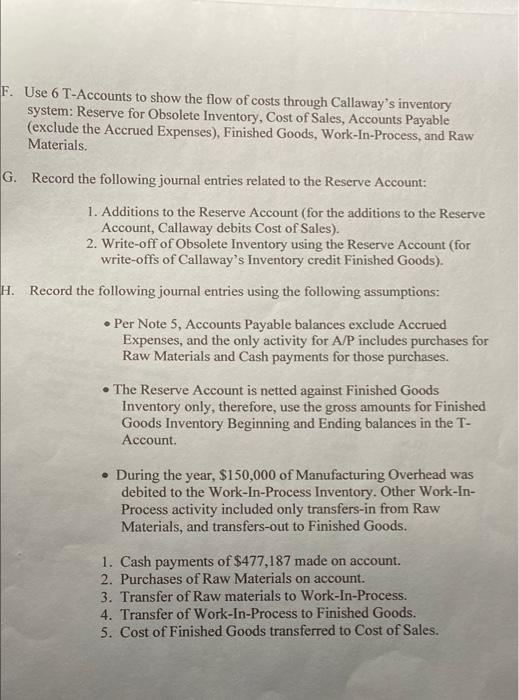

CALLAWAY GOLF COMPANY CONSOLIDATED BALANCE SHEETS (In thousands, except share and per share data) December 31 2007 2006 ASSETS Current assets Cash and cash equivalents Accounts receivable et Inventories, net Deferred taxes Income taxes receivable Other current assets Total current assets Property, plant and equipment, net Intangible assets, net Goodwill Deferred taxes Other assets $ 49,875 $ 46,362 112.064 18.13 253,001 265.110 42.219 32.813 9.232 9.094 30,190 21.688 496.581 493,200 128.036 131.224 140.985 144.326 32,060 30.833 18.885 18.821 40,416 27,543 5856,963 $ 845.947 $130,410 S 111.360 44.245 18.731 12.386 13.364 36.507 80.000 223,5-18 223.455 16.256 19.922 21.252 19.922 13,833 8.200 1.978 -7.210 1.987 LIABILITIES AND SHAREHOLDERS' EQUITY Current liabilities: Accounts payable and accrued expenses Accrued employee compensation and benefits Accrued warranty expense Credit facilities Total current liabilities Long-term liabilities Deferred taxes Energy derivative valuation account Income tax payable Deferred compensation and other Minority interest in consolidated subsidiary Commitments and contingencies (Note 14) Shareholders' equity: Preferred Stock, S.Ol par value, 3,000,000 shares authorized, none issued and outstanding at December 31, 2007 and 2006... Common Stock, S.Ol par value, 240,000,000 shares authorized, 66,281,693 shares and 85,096,782 shares issued at December 31, 2007 and 2006, respectively Additional paid-in capital Uneamed compensation Retained carings Accumulated other comprehensive income Less: Grantor Stock Trust held at market value, 1,813,010 shares and 5.184,601 shares at December 31, 2007 and 2006, respectively Less: Common Stock held in treasury, at cost. O shares and 11,957.968 shares at December 31, 2007 and 2006, respectively Total shareholders' equity 663 111.953 (2.158) 470.469 18,904 851 402,628 (3.566) 435,074 11.135 (31,601) (74.710) (194,295) 568,230 577.117 $856,963 5 845,947 CALLAWAY GOLF COMPANY CONSOLIDATED STATEMENTS OF OPERATIONS (In thousands, except per share data) Year Ended December 31, 2005 2007 2006 Net sales $1.124.591 100% $1,017,907 100% $998,093 Cost of sales 631,368 56% 619,832 61% 583,679 Gross profit 493,223 44% 398,075 39% 414,414 Selling expenses 281,960 25% 254,526 25% 290,074 General and administrative expenses 89,060 8% 79,709 8% 80,145 Research and development expenses 32,020 39 26,785 3% 26,989 Total operating expenses 403,040 36% 361,020 35% 397,208 Income from operations 90,183 8% 37,055 4% 17,206 Interest and other income (expense), net 3,455 3,364 (390) Interest expense (5,363) (5,421) (2,279) Income before income taxes 88,275 8% 34.998 3% 14,537 Provision for income taxes 33,688 11,708 1,253 Net income $ 54,587 5% $ 23,290 2% $ 13,284 Earnings per common share: Basic $ 0.82 $ 0.34 $ Diluted 0.19 S 0.81 S 0.34 Common equivalent shares: $ 0.19 Basic 66,371 67.732 Diluted 68.646 67,484 68,503 69.239 100% 58% 42% 29% 8% 3% 4096 2% 1% . 1% CALLAWAY GOLF COMPANY Note 2. Significant Accounting Policies (excerpt) Inventories Inventories are valued at the lower of cost or fair market value. Cost is determined using the firs-in, first-out (FIFO) method. The inventory balance, which includes material, labor and manufacturing overhead costs, is recorded net of an estimated allowance for obsolete or unmarketable inventory. The estimated allowance for obsolete or unmarketable inventory is based upon current inventory levels, sales trends and historical experience as well as management's understanding of market conditions and forecasts of future product demand, all of which aro subject to change. Actual inventory charges have been consistent with the Company's expectations. Note 5, Selected Financial Statement Information December 31, 2007 2006 (In thousands) Accounts receivable, net: Trade accounts recivable Allowance for doubtful accounts S 120,054 7.990) not $ 112,064 $ 126,672 18.539) S 118,133 Inventories, net Raw materials Work-in-process Finished goods 5 $2.1RS 1.932 16R884 $ 253,001 5 85.795 4,195 175,112 5 265.110 Property, plant and equipment, net: Land Buildings and improvements Machinery and equipment Furniture, computers and equipment Production molds Construction-in-process $ 11,609 85.245 143.994 112,079 41,511 10,368 404,806 (276,770) $ 128,036 5 12,815 91.477 135,573 113.982 38,523 11.157 403,527 (272,303 $ 131,224 Accumulated depreciation Accounts payable and accrued expenses Accounts payable Accrued expenses $ 33,019 97,391 $ 130,410 $ 40,947 70,413 $ 111,360 Accrued employee compensation and benefits: Accrued payroll and taxes Accrued vacation and sick pay Accrued commissions $ 31,882 10,752 1,611 $ 44,245 5 7,927 9,600 1,204 $ 18,731 Case 2: Callaway Golf Company (Note: all amounts are in thousands) A. At the time of the case, what are the types of products that Calloway sells? B. On the Consolidated Balance Sheet, what are the Trade Accounts Receivable (TA/R) "net" of? What type of an account is this? Where does this account appear in Callaway's financial statements? C. Prepare 2 T-Accounts, one for TA/R (using the gross amount) and one for the Allowance for Doubtful Accounts. Use the information given below to complete these 2 T-Accounts. (i) In 2007, if collections on TA/R totaled $1,123, 209, write-offs of TA/R totaled $8,000, and collection of a TA/R previously written off of $40, what is the amount of Bad Debt Expense for year-end 2007? (ii) Record the following journal entries: 1. Sales to customers on account during the calendar year (use the "Net Sales" figure given in the case). 2. Collections of TA/R of $1,123,209. 3. Collection of TA/R previously written off of $40. 4. Write-off of TA/R of $8,000. 5. Bad Debt Expense as an adjusting entry for the year-end. iii) Define "Net Realizable Value" when referring to TA/R. How does the write-off of a TA/R effect the Net Realizable Value of TA/R? Explain. D. On the Consolidated Balance Sheet, what are Inventories "net" of? What type of account is this? Where does this account appear in Callaway's financial statements? E. The "Reserve for Obsolete Inventory" (Reserve Account) includes the following activity during the year: Beginning Balance is $17,315, Additions to the account totaled $12,182, Write-offs during the year totaled $9,368. What is the ending balance in this account? F. Use 6 T-Accounts to show the flow of costs through Callaway's inventory system: Reserve for Obsolete Inventory, Cost of Sales, Accounts Payable (exclude the Accrued Expenses), Finished Goods, Work-In-Process, and Raw Materials G. Record the following journal entries related to the Reserve Account: 1. Additions to the Reserve Account (for the additions to the Reserve Account, Callaway debits Cost of Sales). 2. Write-off of Obsolete Inventory using the Reserve Account (for write-offs of Callaway's Inventory credit Finished Goods). H. Record the following journal entries using the following assumptions: Per Note 5, Accounts Payable balances exclude Accrued Expenses, and the only activity for A/P includes purchases for Raw Materials and Cash payments for those purchases. The Reserve Account is netted against Finished Goods Inventory only, therefore, use the gross amounts for Finished Goods Inventory Beginning and Ending balances in the T- Account . During the year, $150,000 of Manufacturing Overhead was debited to the Work-In-Process Inventory. Other Work-in- Process activity included only transfers-in from Raw Materials, and transfers-out to Finished Goods. 1. Cash payments of $477,187 made on account. 2. Purchases of Raw Materials on account. 3. Transfer of Raw materials to Work-In-Process. 4. Transfer of Work-In-Process to Finished Goods. 5. Cost of Finished Goods transferred to Cost of Sales

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started