Answered step by step

Verified Expert Solution

Question

1 Approved Answer

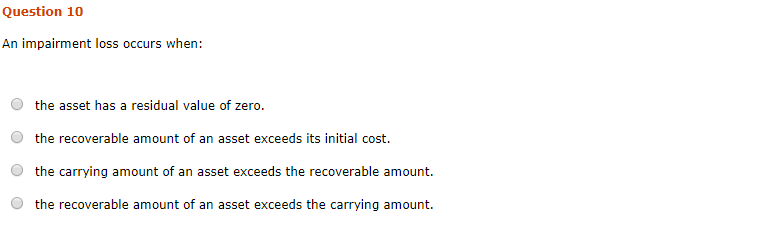

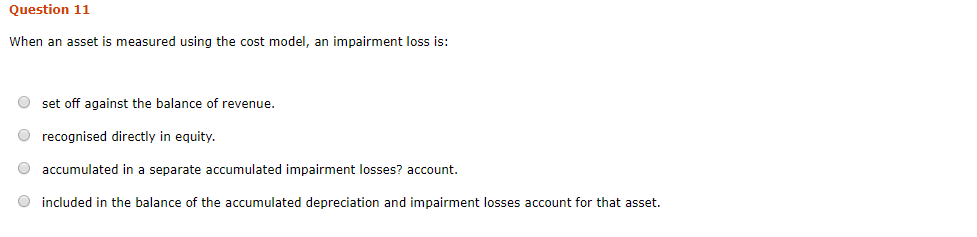

Dont need explanation only answer hurry plz Question 10 An impairment loss occurs when: O the asset has a residual value of zero. o the

Dont need explanation only answer hurry plz

Question 10 An impairment loss occurs when: O the asset has a residual value of zero. o the recoverable amount of an asset exceeds its initial cost. the carrying amount of an asset exceeds the recoverable amount. the recoverable amount of an asset exceeds the carrying amount. Question 11 When an asset is measured using the cost model, an impairment loss is: set off against the balance of revenue. recognised directly in equity. O accumulated in a separate accumulated impairment losses? account. included in the balance of the accumulated depreciation and impairment losses account for that asset. Question 12 Parkes Limited recognised an impairment loss of $20 000 against a cash-generating unit containing the following assets: buildings $50 000; roads $110 000; equipment $40 000. The net carrying amount of the roads after allocation of the impairment loss is: $ 90 000 $ 45 000 $ 99 000 $ 36 000 O Question 15 AASB 138 Intangibles, requires goodwill to only be recognised as an asset if it: O is internally generated. O arises as a result of creating new assets within the normal business operations. O does not exceed its internally recorded cost. O is acquired as part of a business combinationStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started