Question

DONT SOLVE THIS IF YOU'RE NOT SURE ABOUT THE ANSWER - The final answer (Pre-Tax Income for Windows should be $5,005,000) T he Company is

DONT SOLVE THIS IF YOU'RE NOT SURE ABOUT THE ANSWER - The final answer (Pre-Tax Income for Windows should be $5,005,000)

The Company is working on budgets for next year and plans a 10% increase in Target Pretax Income; a 10% increase in both Selling Price and Variable Cost; and a 20% increase in Fixed Costs, keeping the Current Sales Mix in Dollars constant.

Show the Contribution Margin Income Statement at the Target Pretax Income Level. HINT--you need to start at the bottom of the Contribution Margin Income Statement and work your way up to the top to figure this out.

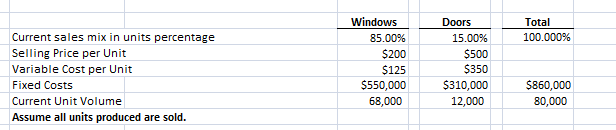

Current sales mix in units percentage Selling Price per Unit Variable Cost per unit Fixed Costs Current Unit Volume Assume all units produced are sold. Doors Windows 15.00% 85.00% $200 $500 $350 $125 $550,000 $310,000 68,000 12,000 Total 100.000% $860,000 80,000Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started