Question

Donut Corporation, has 25% equity investment in Spag Company based in France. On December 31, 2020, year-end exchange rate was one peso to PO.015 to

- Donut Corporation, has 25% equity investment in Spag Company based in France. On December 31, 2020, year-end exchange rate was one peso to PO.015 to a Euro. On this date, Donut has no translation adjustment balance pertaining to its investment. To hedge its net investment in Spag, Donut borrows 4,000 Euros for one year at 10% interest on January ,1 2021 at a spot rate of 0.017 Euro to a peso.

Assume that on November 5, 2021, Spag declares and pays a 1,000 dividend in Euros, when the spot rate is P52.50 per Euro. On December 31, Spag reports net income of 30,000 EU. The and the closing exchange rate on December 31 is P53.

a. Dividends received from Spag will be recorded as

b. What are the accounts affected by the above transactions and by how much?

2. On November 1 , 2021, KK purchased inventory at 400,000FCU from a foreign supplier to be settled on March 1. On the same date, it entered into a forward contract to hedge the exposed liability. The forward rate is PO 90 per unit of foreign currency. Spot rates on November 1is at PO.93, December 31 at PO.91 and March 1at P0.94.

a. What will be the adjusted balance in the Acceptance Payable account on December 31?

b. How much gain or loss was recorded as a result of the adjustment on December 31?

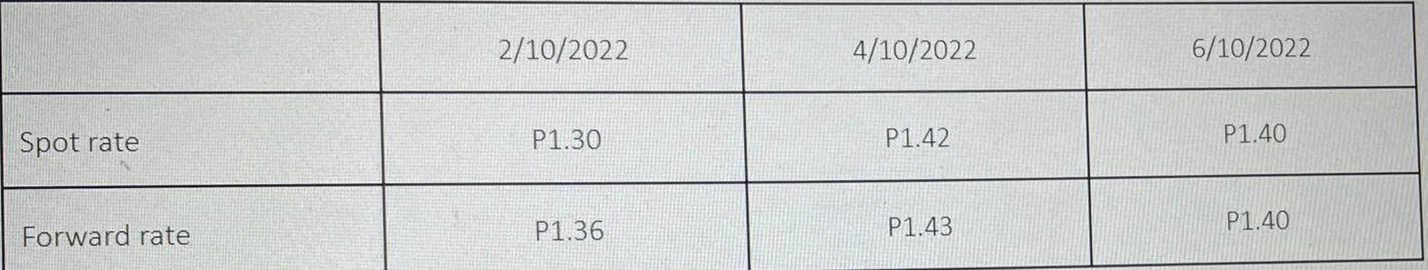

3. On April 10, 2022 Cooky entered into a foreign exchange forward contract to purchase 200,000 FCU on June 10, 2022 to hedge a purchase of inventory last February 10, 2022.

What amount of forex gain (loss) from this forward contract should be recognized on June 10, 2022?

a. 4,000 gain

b. 2,000 loss

c. no gain or loss

d. 6,000 loss

\begin{tabular}{|l|c|c|c|} \hline & 2/10/2022 & 4/10/2022 & 6/10/2022 \\ \hline Spot rate & P1.30 & P1.42 & P1.40 \\ \hline Forward rate & P1.36 & P1.43 & P1.40 \\ \hline \end{tabular}Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started