Question

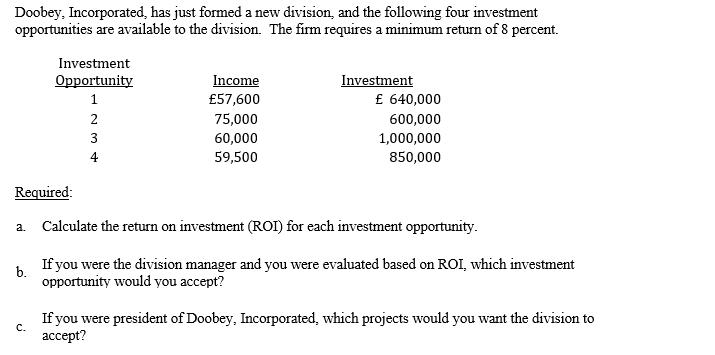

Doobey, Incorporated, has just formed a new division, and the following four investment opportunities are available to the division. The firm requires a minimum

Doobey, Incorporated, has just formed a new division, and the following four investment opportunities are available to the division. The firm requires a minimum return of 8 percent. Investment Opportunity Income Investment 1 57,600 640,000 2 75,000 600,000 3 60,000 1,000,000 4 59,500 850,000 Required: a. Calculate the return on investment (ROI) for each investment opportunity. b. C. If you were the division manager and you were evaluated based on ROI, which investment opportunity would you accept? If you were president of Doobey, Incorporated, which projects would you want the division to accept?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Business Mathematics In Canada

Authors: Ernest Jerome

7th edition

978-0071091411, 71091416, 978-0070009899

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App