Answered step by step

Verified Expert Solution

Question

1 Approved Answer

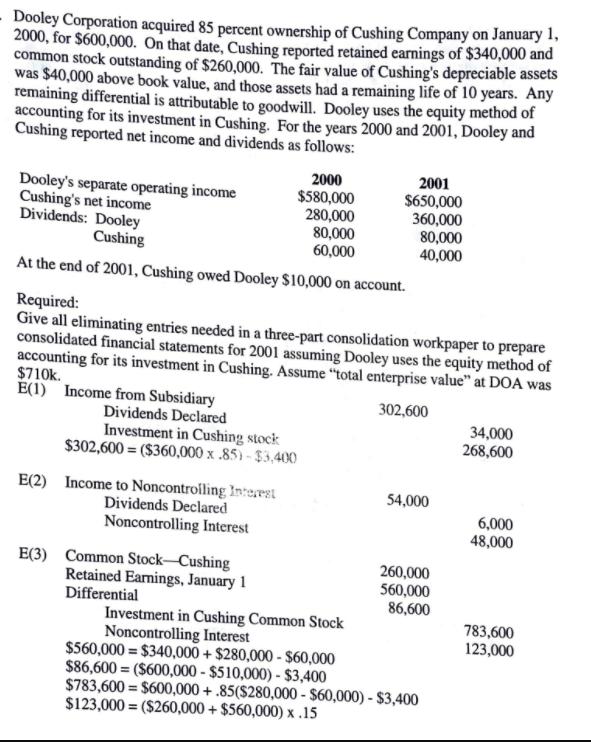

Dooley Corporation acquired 85 percent ownership of Cushing Company on January 1, 2000, for $600,000. On that date, Cushing reported retained earnings of $340,000

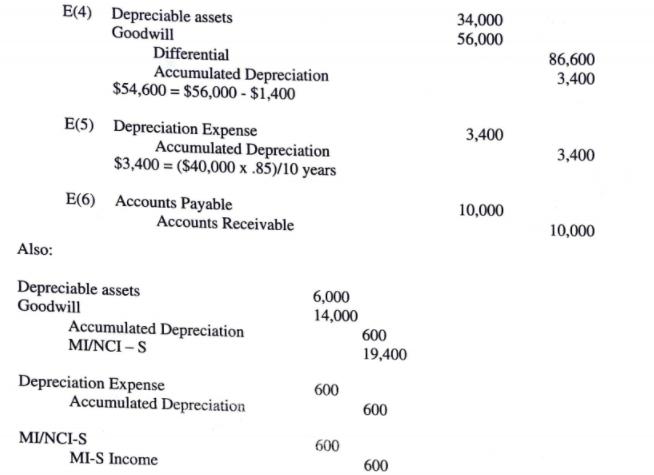

Dooley Corporation acquired 85 percent ownership of Cushing Company on January 1, 2000, for $600,000. On that date, Cushing reported retained earnings of $340,000 and common stock outstanding of $260,000. The fair value of Cushing's depreciable assets was $40,000 above book value, and those assets had a remaining life of 10 years. Any remaining differential is attributable to goodwill. Dooley uses the equity method of accounting for its investment in Cushing. For the years 2000 and 2001, Dooley and Cushing reported net income and dividends as follows: Dooley's separate operating income Cushing's net income 2000 $580,000 280,000 Dividends: Dooley Cushing At the end of 2001, Cushing owed Dooley $10,000 on account. Investment in Cushing stock $302,600=($360,000 x .85)-$3,400 E(2) Income to Noncontrolling Interest Dividends Declared Noncontrolling Interest Required: Give all eliminating entries needed in a three-part consolidation workpaper to prepare consolidated financial statements for 2001 assuming Dooley uses the equity method of accounting for its investment in Cushing. Assume "total enterprise value" at DOA was $710k. E(1) Income from Subsidiary 302,600 Dividends Declared E(3) Common Stock-Cushing Retained Earnings, January 1 Differential 80,000 60,000 2001 $650,000 360,000 80,000 40,000 Investment in Cushing Common Stock Noncontrolling Interest 54,000 260,000 560,000 86,600 $560,000 $340,000+ $280,000 - $60,000 $86,600=($600,000 - $510,000)- $3,400 $783,600 = $600,000+.85($280,000 - $60,000) - $3,400 $123,000=($260,000+ $560,000) x .15 34,000 268,600 6,000 48,000 783,600 123,000 Also: E(4) Depreciable assets Goodwill Differential Accumulated Depreciation $54,600 = $56,000 - $1,400 E(5) Depreciation Expense Accumulated Depreciation $3,400 = ($40,000 x .85)/10 years E(6) Accounts Payable Depreciable assets Goodwill MI/NCI-S Accounts Receivable Accumulated Depreciation MI/NCI - S Depreciation Expense Accumulated Depreciation MI-S Income 6,000 14,000 600 600 600 19,400 600 600 34,000 56,000 3,400 10,000 86,600 3,400 3,400 10,000

Step by Step Solution

★★★★★

3.38 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

E4 Depreciation ExpenseCushing Accumulated Depreciation Jan 1 Depreciation Expense 30000 10000 40000 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started