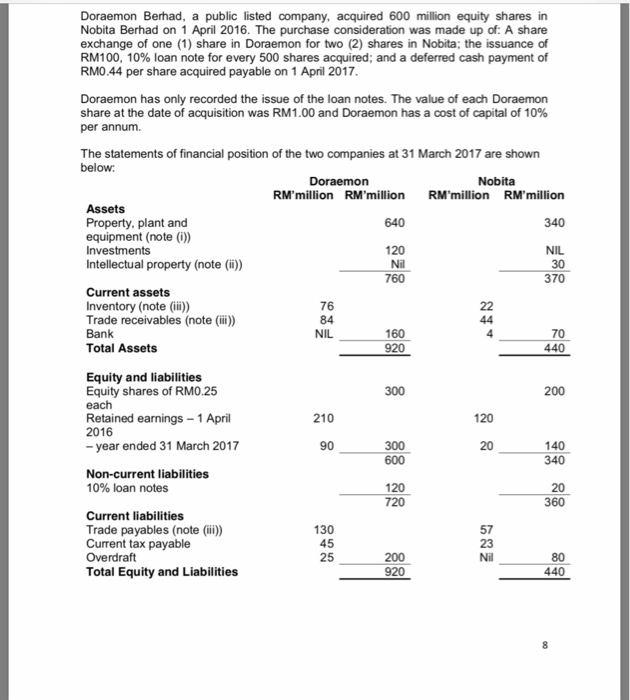

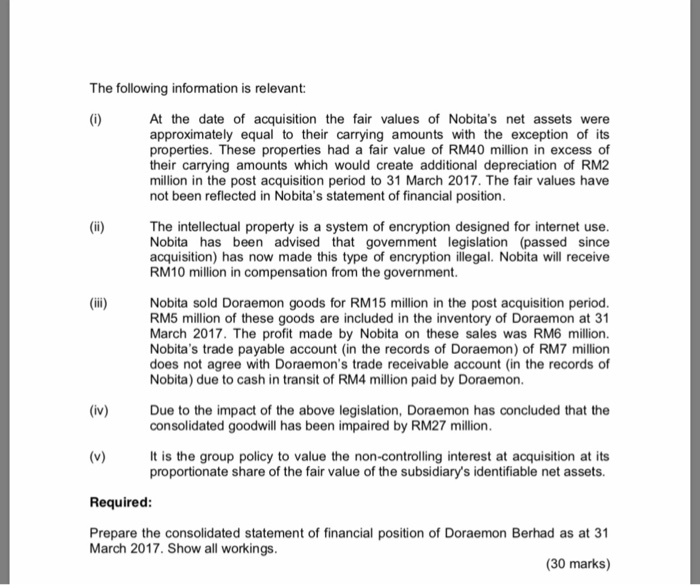

Doraemon Berhad, a public listed company, acquired 600 million equity shares in Nobita Berhad on 1 April 2016. The purchase consideration was made up of: A share exchange of one (1) share in Doraemon for two (2) shares in Nobita; the issuance of RM100, 10% loan note for every 500 shares acquired; and a deferred cash payment of RM0.44 per share acquired payable on 1 April 2017 Doraemon has only recorded the issue of the loan notes. The value of each Doraemon share at the date of acquisition was RM1.00 and Doraemon has a cost of capital of 10% per annum. The statements of financial position of the two companies at 31 March 2017 are shown below Doraemon Nobita Assets Property, plant and equipment (note (i) Investments Intellectual property (note (i)) RM'million RM'million RM'million RM'million 340 NIL 370 640 120 760 Current assets Inventory (note (ii) Trade receivables (note (ii) Bank Total Assets 76 84 NIL 160 70 Equity and liabilities Equity shares of RM0.25 300 210 Retained earnings1 April 2016 120 - year ended 31 March 2017 300 20 140 Non-current liabilities 10% loan notes 120 360 Current liabilities Trade payables (note (ii) Current tax payable 130 45 25 23 Total Equity and Liabilities 440 The following information is relevant: At the date of acquisition the fair values of Nobita's net assets were approximately equal to their carrying amounts with the exception of its properties. These properties had a fair value of RM40 million in excess of their carrying amounts which would create additional depreciation of RM2 million in the post acquisition period to 31 March 2017. The fair values have not been reflected in Nobita's statement of financial position The intellectual property is a system of encryption designed for internet use Nobita has been advised that government legislation (passed since acquisition) has now made this type of encryption illegal. Nobita will receive RM10 million in compensation from the government Nobita sold Doraemon goods for RM15 million in the post acquisition period RM5 million of these goods are included in the inventory of Doraemon at 31 March 2017. The profit made by Nobita on these sales was RM6 million. Nobita's trade payable account (in the records of Doraemon) of RM7 million does not agree with Doraemon's trade receivable account (in the records of Nobita) due to cash in transit of RM4 million paid by Doraemon (iv) Due to the impact of the above legislation, Doraemon has concluded that the consolidated goodwill has been impaired by RM27 million It is the group policy to value the non-controlling interest at acquisition at its proportionate share of the fair value of the subsidiary's identifiable net assets Required Prepare the consolidated statement of financial position of Doraemon Berhad as at 31 March 2017. Show all workings (30 marks) Doraemon Berhad, a public listed company, acquired 600 million equity shares in Nobita Berhad on 1 April 2016. The purchase consideration was made up of: A share exchange of one (1) share in Doraemon for two (2) shares in Nobita; the issuance of RM100, 10% loan note for every 500 shares acquired; and a deferred cash payment of RM0.44 per share acquired payable on 1 April 2017 Doraemon has only recorded the issue of the loan notes. The value of each Doraemon share at the date of acquisition was RM1.00 and Doraemon has a cost of capital of 10% per annum. The statements of financial position of the two companies at 31 March 2017 are shown below Doraemon Nobita Assets Property, plant and equipment (note (i) Investments Intellectual property (note (i)) RM'million RM'million RM'million RM'million 340 NIL 370 640 120 760 Current assets Inventory (note (ii) Trade receivables (note (ii) Bank Total Assets 76 84 NIL 160 70 Equity and liabilities Equity shares of RM0.25 300 210 Retained earnings1 April 2016 120 - year ended 31 March 2017 300 20 140 Non-current liabilities 10% loan notes 120 360 Current liabilities Trade payables (note (ii) Current tax payable 130 45 25 23 Total Equity and Liabilities 440 The following information is relevant: At the date of acquisition the fair values of Nobita's net assets were approximately equal to their carrying amounts with the exception of its properties. These properties had a fair value of RM40 million in excess of their carrying amounts which would create additional depreciation of RM2 million in the post acquisition period to 31 March 2017. The fair values have not been reflected in Nobita's statement of financial position The intellectual property is a system of encryption designed for internet use Nobita has been advised that government legislation (passed since acquisition) has now made this type of encryption illegal. Nobita will receive RM10 million in compensation from the government Nobita sold Doraemon goods for RM15 million in the post acquisition period RM5 million of these goods are included in the inventory of Doraemon at 31 March 2017. The profit made by Nobita on these sales was RM6 million. Nobita's trade payable account (in the records of Doraemon) of RM7 million does not agree with Doraemon's trade receivable account (in the records of Nobita) due to cash in transit of RM4 million paid by Doraemon (iv) Due to the impact of the above legislation, Doraemon has concluded that the consolidated goodwill has been impaired by RM27 million It is the group policy to value the non-controlling interest at acquisition at its proportionate share of the fair value of the subsidiary's identifiable net assets Required Prepare the consolidated statement of financial position of Doraemon Berhad as at 31 March 2017. Show all workings (30 marks)