Question

Dorion Fresh Water (DFW) sells bottled water that comes from a freshwater spring in the town of Dorion, Ontario. DFW owns the land, and much

Dorion Fresh Water (DFW) sells bottled water that comes from a freshwater spring in the town of Dorion, Ontario. DFW owns the land, and much of the surrounding area, where the freshwater spring is located. In addition, DFW has all of the equipment needed to extract the water from the spring and place it into bottles.

As a young, newly qualified professional accountant, you are looking to get out of public practice and become an active owner/manager of a small business. An opportunity has arisen to purchase all of the common shares of DFW, and you are contemplating this acquisition.

The significant competition in the bottled water market, combined with the relatively small operation of DFW and lack of brand equity, suggest that there is currently no significant goodwill associated with DFW's earnings. Accordingly, the purchase price will be based on DFW's net book value, calculated in accordance with ASPE, with an adjustment for only the fair value of capital assets. Your intention is to use your business network, and social media marketing skills, to expand DFW's operations and increase profitability.

As part of your due diligence, you discovered the following information:

1. The long-term debt is payable to a local credit union. No payments must be made until the end of 10 years, at wilich point the principal and all accrued interest are due in full. DFW received S250,000 four years ago to this day, and interest accrues at 6% annually.

2. DFW implemented a new rewards program at the beginning of this year. DFW included a liner under the bottom of each cap. The liner includes the text: (l) free bottle of water or (2) please try again. One in 10 bottles includes a free bottle of water. The promotion was a success. A total of 105,455 bottles w7ere sold during the year, and 4,556 free bottle liners were redeemed. The cost of a bottle of wrater is S0.75 and the retail value is $1.50.

3. Capital assets are appraised at $485,000 by an independent, qualified third party.

4. The capital stock includes common shares and preferred shares. There are 500 preferred shares with a cost and redemption value of S10 and $12 per share, respectively, and a 6% mandatory, cumulative dividend yield. These shares will be retained by the current owners of DFW.

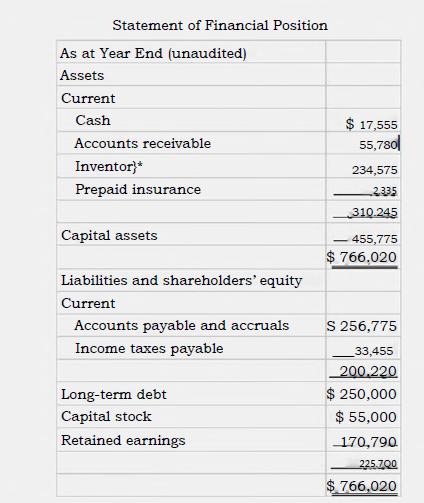

A copy of DFW's most recent internal statement of financial position is presented in Exhibit I. DFW has never had an audit or review7.

Notes to Internal Statement of Financial Position

Inventory

Inventory is carried at the lower of cost and net realizable value.

Guarantee/Commitment

DFW has provided a guarantee on $50,000 of debt for a related company, Thunder Bay Springs (TBS). TBS has been experiencing financial difficulties, and there is a 10% chance that it may be insolvent within the next slx months. TBS is currently working with its bank to refinance its debt and avoid bankruptcy.

Contingencies

1. DFW is being sued by a former employee for WTongful dismissal. The employee is suing DFW for $40,000, and the case is currently in mediation. Legal counsel suggests that it is unlikely that $40,000 will be paid out, but there is a 5096 chance of paying $20,000 and a 5096 chance of paving $10,000. The case will likely settle at the end of next year.

2. DFW is suing a competitor for infringement regarding the use of its trademarked logo. Legal counsel suggests that it is very likely that DFW will be awarded a settlement of $25,000.

List and analyzing the Issues..

Based on the review of the financial statements and the information obtained during due diligence, estimate of the purchase price. Be sure to fully discuss any proposed changes to the financial statements required to comply with ASPE.

ISSUE ….. • State the accounting issue and how it is currently being accounted for.

• What is the effect of this? For example, is income incorrectly over/understated? Are expenses not being matched to revenues?

• Identify any possible alternative ways to account for the issue such as to capitalize or expense.

• Discuss the appropriate GAAP criteria that should be applied such as the definition of a capital asset. Try to provide a balanced analysis if alternatives do exist. For example, do not only provide facts to support capitalization, try to also discuss points that support the expensing option.

• Apply case facts to the noted GAAP criteria. This will support the criteria and ultimately provide the support needed for a recommendation. • Recommend how the issue should be accounted for.

• Quantify the financial statement impact of each adjustment to correct or account for the issue. If numbers are not provided simply discuss the general financial statement impact.

Statement of Financial Position As at Year End (unaudited) Assets Current Cash Accounts receivable Inventor}* Prepaid insurance Capital assets Liabilities and shareholders' equity Current Accounts payable and accruals Income taxes payable Long-term debt Capital stock Retained earnings 17,555 55,780 234,575 2.335 310.245 455,775 $ 766,020 S 256,775 33,455 200.220 $ 250,000 $ 55,000 -170,790. 225.700 $ 766,020

Step by Step Solution

3.35 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

include include struct element row col value struct sparseMatr...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started