Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Doris, Edie & Frank agree to the formation of a general partnership (DEF) in which each will have the same one-third interest in the

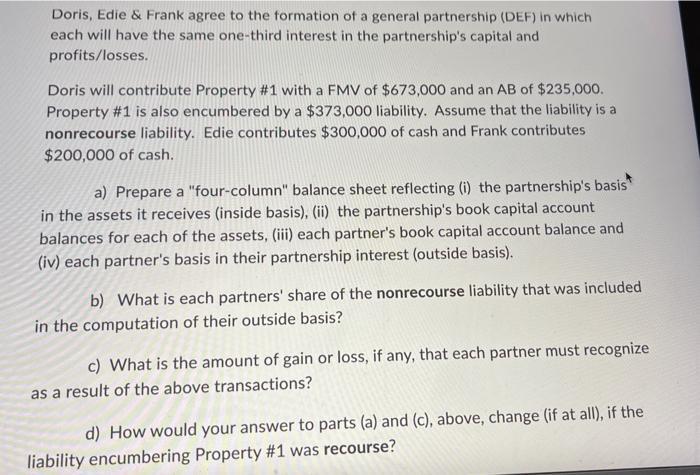

Doris, Edie & Frank agree to the formation of a general partnership (DEF) in which each will have the same one-third interest in the partnership's capital and profits/losses. Doris will contribute Property #1 with a FMV of $673,000 and an AB of $235,000. Property #1 is also encumbered by a $373,000 liability. Assume that the liability is a nonrecourse liability. Edie contributes $300,000 of cash and Frank contributes $200,000 of cash. a) Prepare a "four-column" balance sheet reflecting (i) the partnership's basis in the assets it receives (inside basis), (ii) the partnership's book capital account balances for each of the assets, (iii) each partner's book capital account balance and (iv) each partner's basis in their partnership interest (outside basis). b) What is each partners' share of the nonrecourse liability that was included in the computation of their outside basis? c) What is the amount of gain or loss, if any, that each partner must recognize as a result of the above transactions? d) How would your answer to parts (a) and (c), above, change (if at all), if the liability encumbering Property #1 was recourse?

Step by Step Solution

★★★★★

3.40 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started