Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Dot.com is considering replacing its existing machine. You are given the following facts: The firm has spent $5,000 studying the compatibility of the new

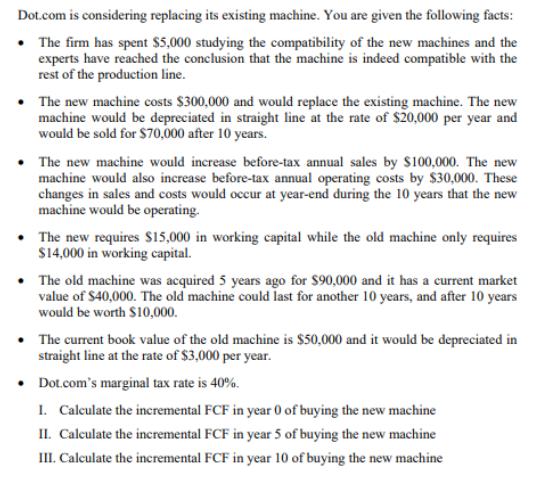

Dot.com is considering replacing its existing machine. You are given the following facts: The firm has spent $5,000 studying the compatibility of the new machines and the experts have reached the conclusion that the machine is indeed compatible with the rest of the production line. The new machine costs $300,000 and would replace the existing machine. The new machine would be depreciated in straight line at the rate of $20,000 per year and would be sold for $70,000 after 10 years. The new machine would increase before-tax annual sales by $100,000. The new machine would also increase before-tax annual operating costs by $30,000. These changes in sales and costs would occur at year-end during the 10 years that the new machine would be operating. The new requires $15,000 in working capital while the old machine only requires $14,000 in working capital. The old machine was acquired 5 years ago for $90,000 and it has a current market value of $40,000. The old machine could last for another 10 years, and after 10 years would be worth $10,000. The current book value of the old machine is $50,000 and it would be depreciated in straight line at the rate of $3,000 per year. Dot.com's marginal tax rate is 40%. I. Calculate the incremental FCF in year 0 of buying the new machine II. Calculate the incremental FCF in year 5 of buying the new machine III. Calculate the incremental FCF in year 10 of buying the new machine

Step by Step Solution

★★★★★

3.44 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

I To calculate the incremental FCF in year 0 of buying the new machine we need to consider the initial investment changes in sales and costs and changes in working capital The initial investment inclu...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started