Answered step by step

Verified Expert Solution

Question

1 Approved Answer

double checking making sure my answer is right the first picture was blurry Comore Jom the Computer equipment (office equipment) purchased 6Vyears ago for $170,000,

double checking

making sure my answer is right the first picture was blurry

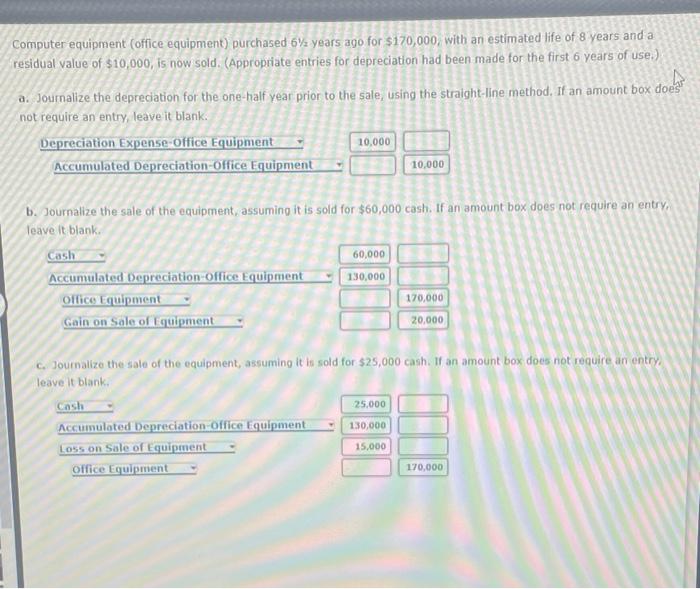

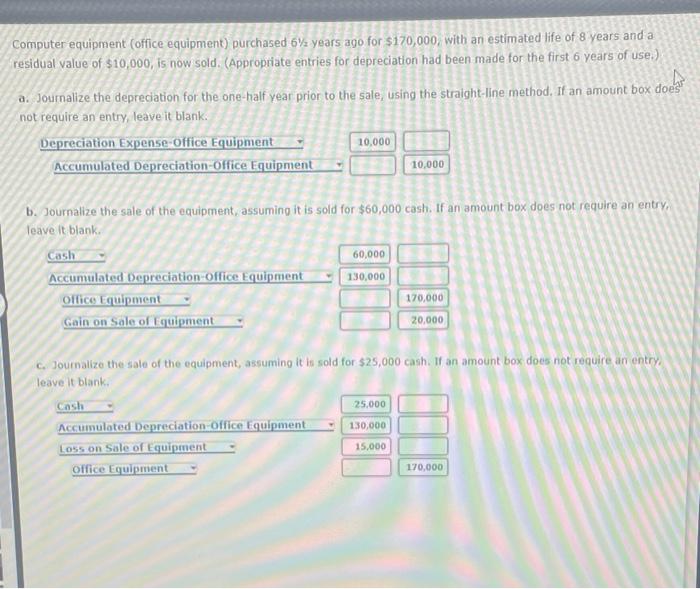

Comore Jom the Computer equipment (office equipment) purchased 6Vyears ago for $170,000, with an estimated life of 8 years and a residual value of $10,000, is now sold. (Appropriate entries for depreciation had been made for the first 6 years of use.) a. Journalize the depreciation for the one-half year prior to the sale, using the straight-line method. If an amount box does not require an entry, leave it blank. Depreciation Expense Office Equipment Accumulated Depreciation Office Equipment 10,000 10,000 b. Journalize the sale of the equipment, assuming it is sold for $60,000 cash. If an amount box does not require an entry, leave it blank. Cash 60,000 Accumulated Depreciation Office Equipment Office Equipment 170,000 Gain on Sale of Equipment 130,000 20,000 c. Journalize the sale of the equipment, assuming it is sold for $25,000 cash. If an amount box does not require an entry leave it blank cash 25,000 Accumulated Depreciation Office Equipment 130,000 Loss on Sale of Equipment Office Equipment 15.000 170,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started