Answered step by step

Verified Expert Solution

Question

1 Approved Answer

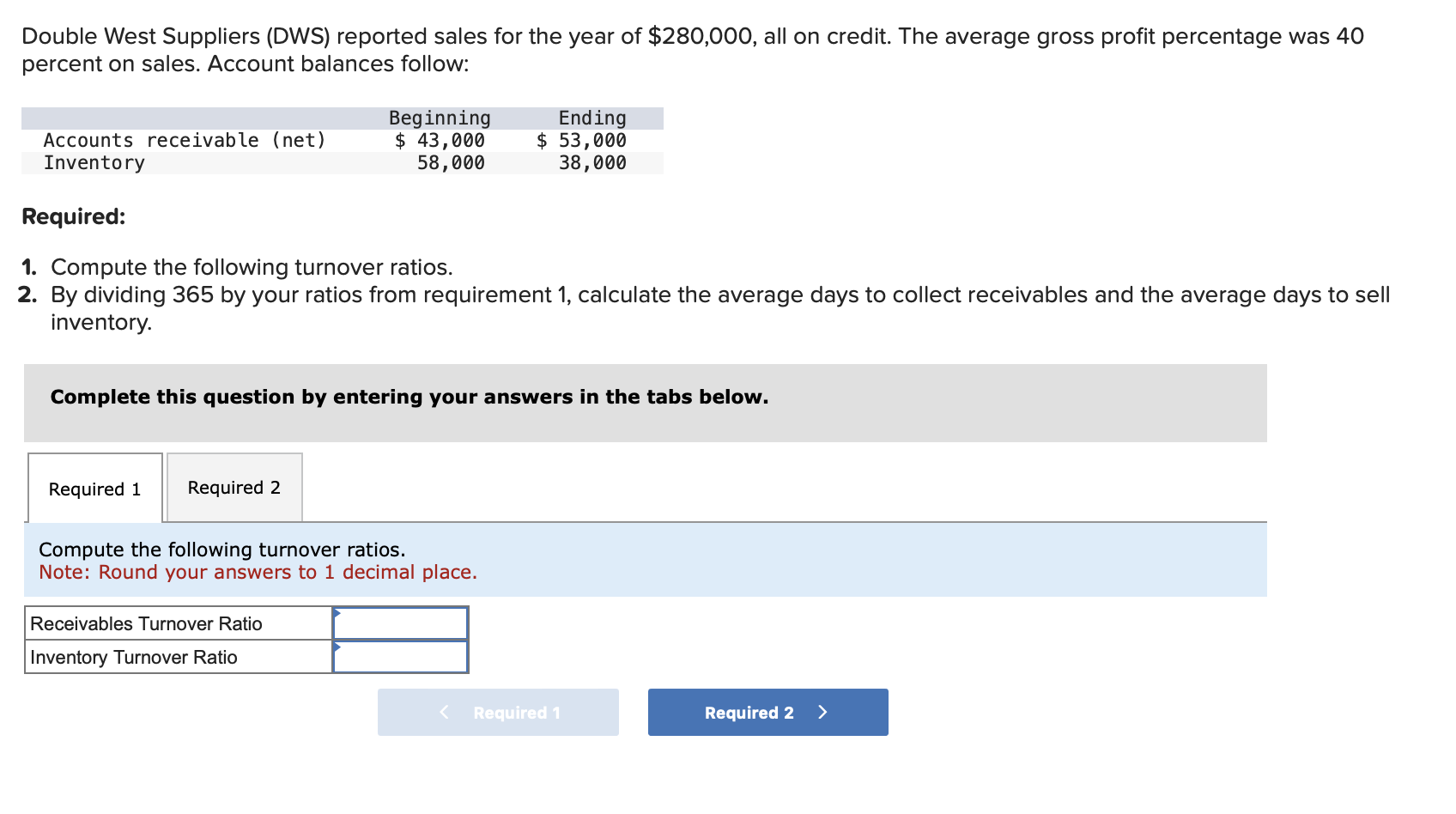

Double West Suppliers (DWS) reported sales for the year of $280,000, all on credit. The average gross profit percentage was 40 percent on sales.

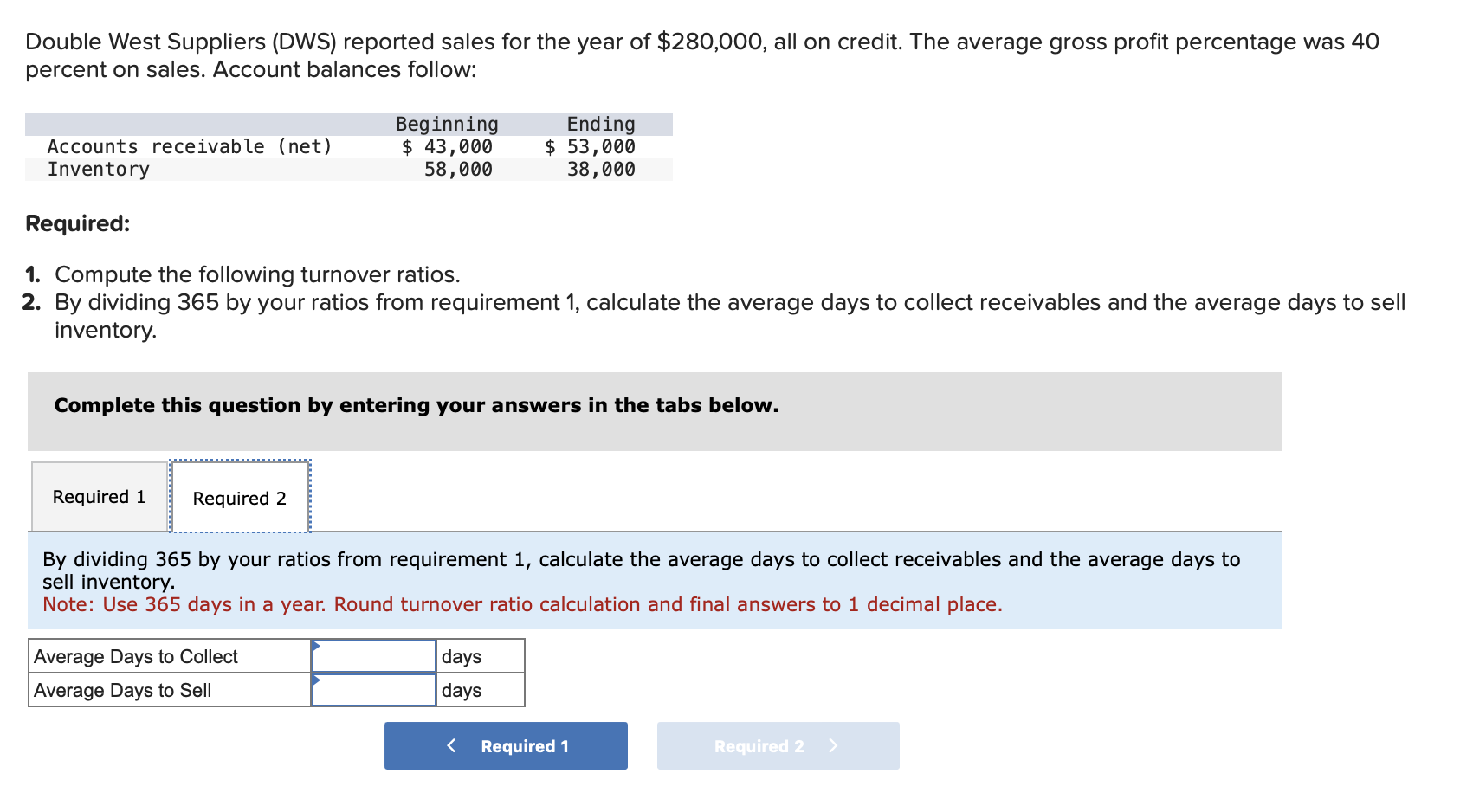

Double West Suppliers (DWS) reported sales for the year of $280,000, all on credit. The average gross profit percentage was 40 percent on sales. Account balances follow: Accounts receivable (net) Inventory Beginning $ 43,000 58,000 Ending $ 53,000 38,000 Required: 1. Compute the following turnover ratios. 2. By dividing 365 by your ratios from requirement 1, calculate the average days to collect receivables and the average days to sell inventory. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Compute the following turnover ratios. Note: Round your answers to 1 decimal place. Receivables Turnover Ratio Inventory Turnover Ratio > Required 1 Required 2 > Double West Suppliers (DWS) reported sales for the year of $280,000, all on credit. The average gross profit percentage was 40 percent on sales. Account balances follow: Accounts receivable (net) Inventory Beginning $ 43,000 58,000 Ending $ 53,000 38,000 Required: 1. Compute the following turnover ratios. 2. By dividing 365 by your ratios from requirement 1, calculate the average days to collect receivables and the average days to sell inventory. Complete this question by entering your answers in the tabs below. Required 1 Required 2 By dividing 365 by your ratios from requirement 1, calculate the average days to collect receivables and the average days to sell inventory. Note: Use 365 days in a year. Round turnover ratio calculation and final answers to 1 decimal place. Average Days to Collect Average Days to Sell days days < Required 1 Required 2 >

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Answer Required 1 Compute the following turnover ratios Receivables Turnover Ratio The receivables turnover ratio measures how efficiently a company c...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started