Doug Robinson and Dante are considering the possibility of opening their own manufacturing facility. They expect first-year sales to be $800,000, and they feel

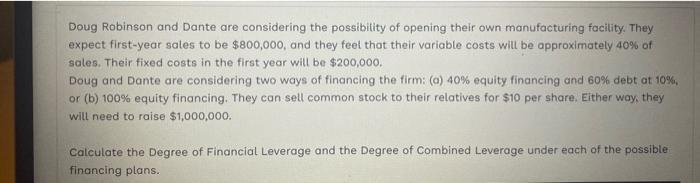

Doug Robinson and Dante are considering the possibility of opening their own manufacturing facility. They expect first-year sales to be $800,000, and they feel that their variable costs will be approximately 40% of sales. Their fixed costs in the first year will be $200,000. Doug and Dante are considering two ways of financing the firm: (a) 40% equity financing and 60% debt at 10%, or (b) 100% equity financing. They can sell common stock to their relatives for $10 per share. Either way, they will need to raise $1,000,000. Calculate the Degree of Financial Leverage and the Degree of Combined Leverage under each of the possible financing plans.

Step by Step Solution

3.35 Rating (164 Votes )

There are 3 Steps involved in it

Step: 1

Variable cost ratio 40 Contribution margin ratio sales varia...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started