Answered step by step

Verified Expert Solution

Question

1 Approved Answer

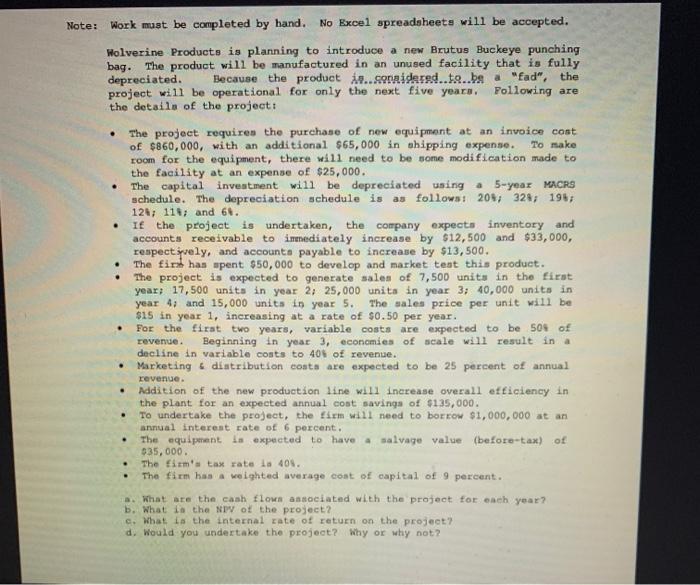

Note: Work must be completed by hand. No Excel spreadsheets will be accepted. Wolverine Products is planning to introduce a new Brutus Buckeye punching

Note: Work must be completed by hand. No Excel spreadsheets will be accepted. Wolverine Products is planning to introduce a new Brutus Buckeye punching bag. The product will be manufactured in an unused facility that is fully depreciated. Because the product is..considered..ta..ba a "fad", the project will be operational for only the next five years. Following are the details of the project: . . . . . . . . The project requires the purchase of new equipment at an invoice cost. of $860,000, with an additional $65,000 in shipping expense. To make room for the equipment, there will need to be some modification made to the facility at an expense of $25,000. The capital investment will be depreciated using a 5-year MACRS schedule. The depreciation schedule is as follows: 20%, 32%; 19%; 12%; 11; and 6%. . . If the project is undertaken, the company expects inventory and accounts receivable to immediately increase by $12,500 and $33,000, respectively, and accounts payable to increase by $13,500. The firs has spent $50,000 to develop and market test this product. The project is expected to generate sales of 7,500 units in the first year; 17,500 units in year 2; 25,000 units in year 3; 40,000 units in year 4 and 15,000 units in year 5. The sales price per unit will be $15 in year 1, increasing at a rate of $0.50 per year. For the first two years, variable costs are expected to be 50% of Beginning in year 3, economies of scale will result in a decline in variable costs to 40% of revenue. revenue. Marketing & distribution costs are expected to be 25 percent of annual revenue. Addition of the new production line will increase overall efficiency in the plant for an expected annual cost savings of $135,000. To undertake the project, the firm will need to borrow $1,000,000 at an annual interest rate of 6 percent. The equipment is expected to have a salvage value (before-tax) of $35,000. The firm's tax rate is 40%. The firm has a weighted average cost of capital of 9 percent. a. What are the cash flows associated with the project for each year? b. What is the NPV of the project? c. What is the internal rate of return on the project? d. Would you undertake the project? Why or why not?

Step by Step Solution

★★★★★

3.54 Rating (147 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the cash flows associated with the project for each year we need to consider the following components Sales Revenue Variable Costs Marketing Distribution Costs Cost Savings from Efficienc...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started