Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Dover purchased a new storage facility on December 1, 2020. The new building cost $1,910,000. A new member of the accounting team recorded depreciation

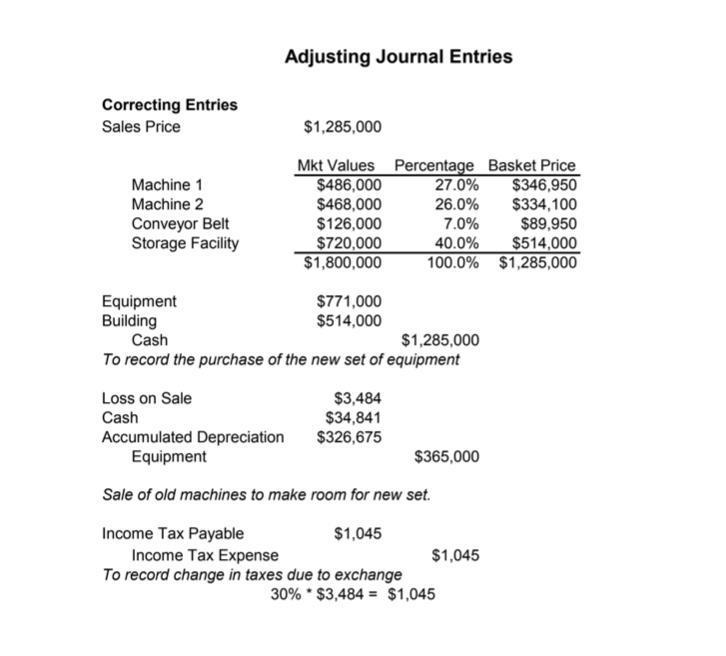

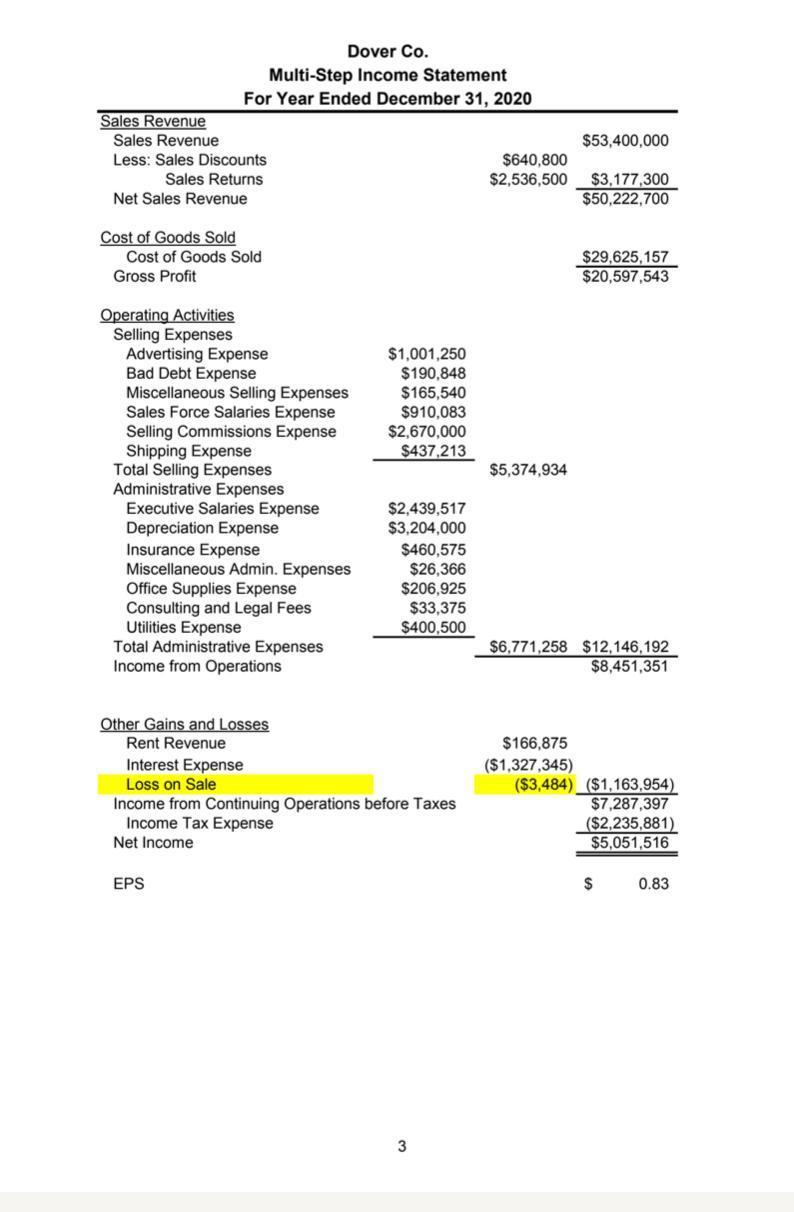

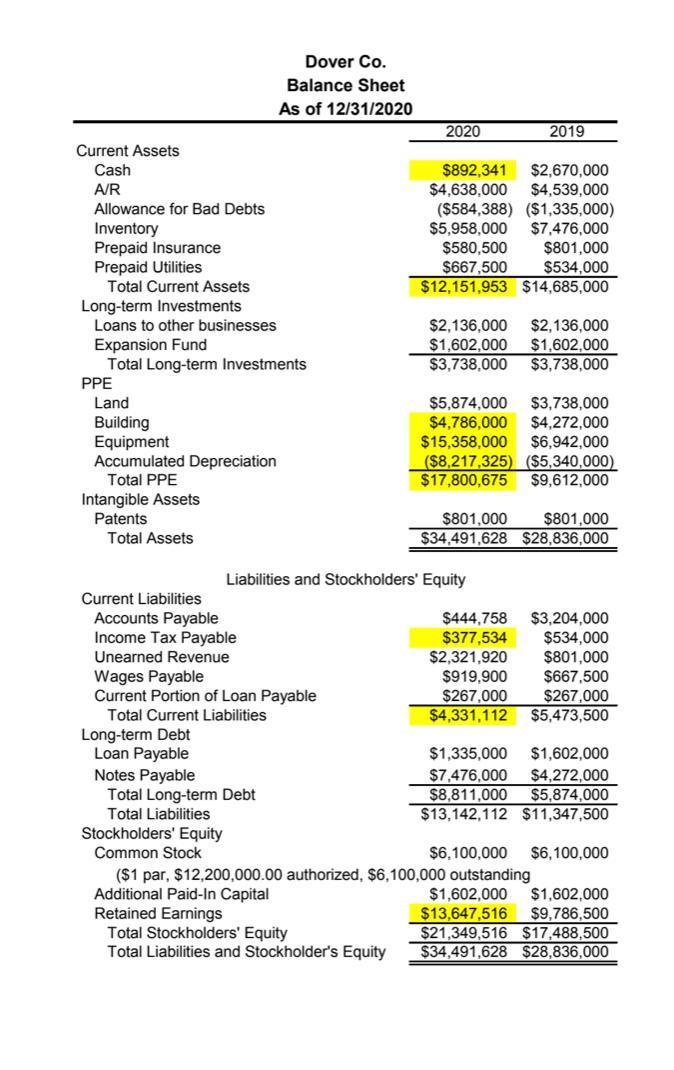

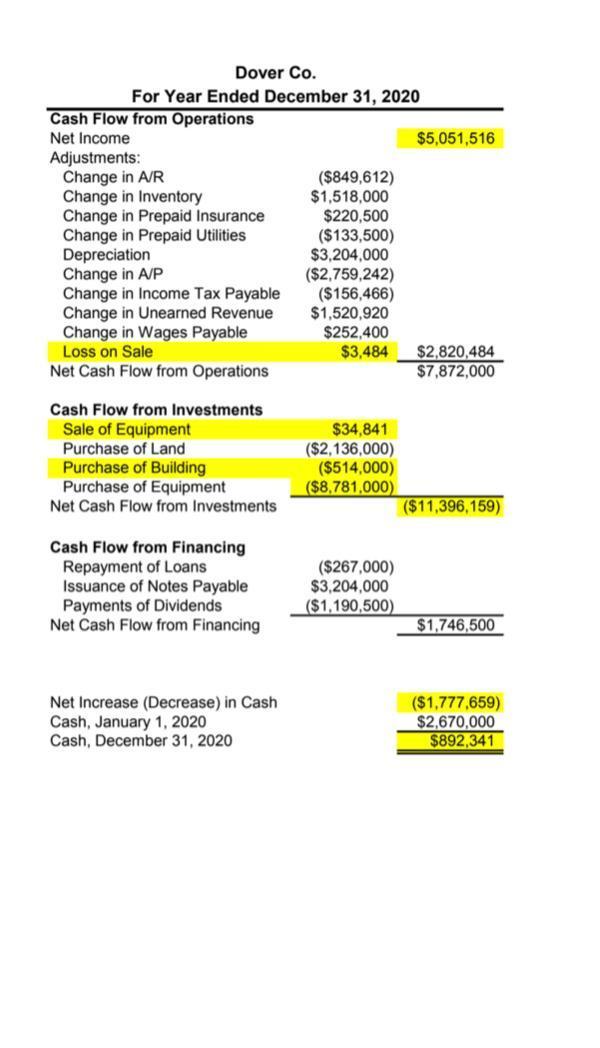

Dover purchased a new storage facility on December 1, 2020. The new building cost $1,910,000. A new member of the accounting team recorded depreciation on the new facility using the straight line method. The manager was impressed with his hard work, since he appropriately used partial year depreciation and used the method correctly. However, she had to remind him Dover uses the sum-of- the-years (SYD) method for buildings. Unfortunately, the mistake in method wasn't corrected before the financial statements were created. At the time of the purchase, the operations manager estimated that the new facility would be used for 10 years and would have a $80,200 salvage value. Dover's management would like to know the effect of your adjustment on the following ratios: Asset Turnover (Net Sales / average total assets) . Current Ratio ROA Assignment: Calculations 1. Make the appropriate journal entries, if any, to account for the change in depreciation method (including any necessary changes to income tax expense) on the new facility ONLY (the rest of the depreciation was appropriately recorded). 2. Make any necessary changes to the financial statements. Critical Thinking 3. Calculate each of the required ratios using the original values (before any changes) and the updated values (after your changes). 4. In practice, most companies use the straight-line depreciation method, typically without any salvage value. How do you think companies justify this decision to their owners and creditors? Do you agree with using only this one method? Defend your answer. 5. After looking over the numbers, you believe that would be better off following the more conservative option of reporting a full year of depreciation. Provide two (2) arguments that you could use to convince the management team that your plan is the most appropriate. Correcting Entries Sales Price Machine 1 Machine 2 Conveyor Belt Storage Facility Equipment Building Adjusting Journal Entries Loss on Sale Cash $1,285,000 Mkt Values Percentage Basket Price $486,000 $468,000 $126,000 $720,000 $1,800,000 $771,000 $514,000 Cash $1,285,000 To record the purchase of the new set of equipment $3,484 $34,841 $326,675 27.0% $346,950 26.0% $334,100 7.0% $89,950 40.0% $514,000 100.0% $1,285,000 Accumulated Depreciation Equipment Sale of old machines to make room for new set. Income Tax Payable $1,045 Income Tax Expense To record change in taxes due to exchange $365,000 $1,045 30% $3,484 = $1,045 Sales Revenue Sales Revenue Less: Sales Discounts Sales Returns Dover Co. Multi-Step Income Statement For Year Ended December 31, 2020 Net Sales Revenue Cost of Goods Sold Cost of Goods Sold Gross Profit Operating Activities Selling Expenses Advertising Expense Bad Debt Expense Miscellaneous Selling Expenses Sales Force Salaries Expense Selling Commissions Expense Shipping Expense Total Selling Expenses Administrative Expenses Executive Salaries Expense Depreciation Expense Insurance Expense Miscellaneous Admin. Expenses Office Supplies Expense Consulting and Legal Fees Utilities Expense Total Administrative Expenses Income from Operations Other Gains and Losses Rent Revenue EPS $1,001,250 $190,848 $165,540 $910,083 $2,670,000 $437,213 $2,439,517 $3,204,000 $460,575 $26,366 $206,925 $33,375 $400,500 Interest Expense Loss on Sale Income from Continuing Operations before Taxes Income Tax Expense Net Income 3 $640,800 $2,536,500 $5,374,934 $53,400,000 $166,875 ($1,327,345) $3,177,300 $50,222,700 $29,625,157 $20,597,543 $6,771,258 $12,146,192 $8,451,351 ($3,484) ($1,163,954) $7,287,397 ($2,235,881) $5,051,516 $ 0.83 Current Assets Cash A/R Allowance for Bad Debts Inventory Prepaid Insurance Prepaid Utilities Total Current Assets Long-term Investments Loans to other businesses Expansion Fund Total Long-term Investments PPE Land Building Equipment Accumulated Depreciati Total PPE Intangible Assets Patents Total Assets Dover Co. Balance Sheet As of 12/31/2020 Current Liabilities Accounts Payable Income Tax Payable Unearned Revenue Wages Payable Current Portion of Loan Payable Total Current Liabilities Long-term Debt Loan Payable Notes Payable Total Long-term Debt Total Liabilities Stockholders' Equity Common Stock 2020 Retained Earnings Total Stockholders' Equity Total Liabilities and Stockholder's Equity $892,341 $2,670,000 $4,638,000 $4,539,000 ($584,388) ($1,335,000) $5,958,000 $7,476,000 Liabilities and Stockholders' Equity 2019 $580,500 $667,500 $12,151,953 $14,685,000 $2,136,000 $2,136,000 $1,602,000 $1,602,000 $3,738,000 $3,738,000 $801,000 $534,000 $5,874,000 $3,738,000 $4,786,000 $4,272,000 $15,358,000 $6,942,000 ($8,217,325) ($5,340,000) $17,800,675 $9,612,000 $801,000 $801,000 $34,491,628 $28,836,000 $444,758 $377,534 $3,204,000 $534,000 $2,321,920 $801,000 $919,900 $667,500 $267,000 $267,000 $4,331,112 $5,473,500 ($1 par, $12,200,000.00 authorized, $6,100,000 outstanding Additional Paid-In Capital $1,335,000 $1,602,000 $7,476,000 $4,272,000 $8,811,000 $5,874,000 $13,142,112 $11,347,500 $6,100,000 $6,100,000 $1,602,000 $1,602,000 $13,647,516 $9,786,500 $21,349,516 $17,488,500 $34,491,628 $28,836,000 Dover Co. For Year Ended December 31, 2020 Cash Flow from Operations Net Income Adjustments: Change in A/R Change in Inventory Change in Prepaid Insurance Change in Prepaid Utilities Depreciation Change in A/P Change in Income Tax Payable Change in Unearned Revenue Change in Wages Payable Loss on Sale Net Cash Flow from Operations Cash Flow from Investments Sale of Equipment Purchase of Land Purchase of Building Purchase of Equipment Net Cash Flow from Investments Cash Flow from Financing Repayment of Loans Issuance of Notes Payable Payments of Dividends Net Cash Flow from Financing Net Increase (Decrease) in Cash Cash, January 1, 2020 Cash, December 31, 2020 ($849,612) $1,518,000 $220,500 ($133,500) $3,204,000 ($2,759,242) ($156,466) $1,520,920 $252,400 $3,484 $34,841 ($2,136,000) ($514,000) ($8,781,000) ($267,000) $3,204,000 ($1,190,500) $5,051,516 $2,820,484 $7,872,000 ($11,396,159) $1,746,500 ($1,777,659) $2,670,000 $892,341 Dover purchased a new storage facility on December 1, 2020. The new building cost $1,910,000. A new member of the accounting team recorded depreciation on the new facility using the straight line method. The manager was impressed with his hard work, since he appropriately used partial year depreciation and used the method correctly. However, she had to remind him Dover uses the sum-of- the-years (SYD) method for buildings. Unfortunately, the mistake in method wasn't corrected before the financial statements were created. At the time of the purchase, the operations manager estimated that the new facility would be used for 10 years and would have a $80,200 salvage value. Dover's management would like to know the effect of your adjustment on the following ratios: Asset Turnover (Net Sales / average total assets) . Current Ratio ROA Assignment: Calculations 1. Make the appropriate journal entries, if any, to account for the change in depreciation method (including any necessary changes to income tax expense) on the new facility ONLY (the rest of the depreciation was appropriately recorded). 2. Make any necessary changes to the financial statements. Critical Thinking 3. Calculate each of the required ratios using the original values (before any changes) and the updated values (after your changes). 4. In practice, most companies use the straight-line depreciation method, typically without any salvage value. How do you think companies justify this decision to their owners and creditors? Do you agree with using only this one method? Defend your answer. 5. After looking over the numbers, you believe that would be better off following the more conservative option of reporting a full year of depreciation. Provide two (2) arguments that you could use to convince the management team that your plan is the most appropriate. Correcting Entries Sales Price Machine 1 Machine 2 Conveyor Belt Storage Facility Equipment Building Adjusting Journal Entries Loss on Sale Cash $1,285,000 Mkt Values Percentage Basket Price $486,000 $468,000 $126,000 $720,000 $1,800,000 $771,000 $514,000 Cash $1,285,000 To record the purchase of the new set of equipment $3,484 $34,841 $326,675 27.0% $346,950 26.0% $334,100 7.0% $89,950 40.0% $514,000 100.0% $1,285,000 Accumulated Depreciation Equipment Sale of old machines to make room for new set. Income Tax Payable $1,045 Income Tax Expense To record change in taxes due to exchange $365,000 $1,045 30% $3,484 = $1,045 Sales Revenue Sales Revenue Less: Sales Discounts Sales Returns Dover Co. Multi-Step Income Statement For Year Ended December 31, 2020 Net Sales Revenue Cost of Goods Sold Cost of Goods Sold Gross Profit Operating Activities Selling Expenses Advertising Expense Bad Debt Expense Miscellaneous Selling Expenses Sales Force Salaries Expense Selling Commissions Expense Shipping Expense Total Selling Expenses Administrative Expenses Executive Salaries Expense Depreciation Expense Insurance Expense Miscellaneous Admin. Expenses Office Supplies Expense Consulting and Legal Fees Utilities Expense Total Administrative Expenses Income from Operations Other Gains and Losses Rent Revenue EPS $1,001,250 $190,848 $165,540 $910,083 $2,670,000 $437,213 $2,439,517 $3,204,000 $460,575 $26,366 $206,925 $33,375 $400,500 Interest Expense Loss on Sale Income from Continuing Operations before Taxes Income Tax Expense Net Income 3 $640,800 $2,536,500 $5,374,934 $53,400,000 $166,875 ($1,327,345) $3,177,300 $50,222,700 $29,625,157 $20,597,543 $6,771,258 $12,146,192 $8,451,351 ($3,484) ($1,163,954) $7,287,397 ($2,235,881) $5,051,516 $ 0.83 Current Assets Cash A/R Allowance for Bad Debts Inventory Prepaid Insurance Prepaid Utilities Total Current Assets Long-term Investments Loans to other businesses Expansion Fund Total Long-term Investments PPE Land Building Equipment Accumulated Depreciati Total PPE Intangible Assets Patents Total Assets Dover Co. Balance Sheet As of 12/31/2020 Current Liabilities Accounts Payable Income Tax Payable Unearned Revenue Wages Payable Current Portion of Loan Payable Total Current Liabilities Long-term Debt Loan Payable Notes Payable Total Long-term Debt Total Liabilities Stockholders' Equity Common Stock 2020 Retained Earnings Total Stockholders' Equity Total Liabilities and Stockholder's Equity $892,341 $2,670,000 $4,638,000 $4,539,000 ($584,388) ($1,335,000) $5,958,000 $7,476,000 Liabilities and Stockholders' Equity 2019 $580,500 $667,500 $12,151,953 $14,685,000 $2,136,000 $2,136,000 $1,602,000 $1,602,000 $3,738,000 $3,738,000 $801,000 $534,000 $5,874,000 $3,738,000 $4,786,000 $4,272,000 $15,358,000 $6,942,000 ($8,217,325) ($5,340,000) $17,800,675 $9,612,000 $801,000 $801,000 $34,491,628 $28,836,000 $444,758 $377,534 $3,204,000 $534,000 $2,321,920 $801,000 $919,900 $667,500 $267,000 $267,000 $4,331,112 $5,473,500 ($1 par, $12,200,000.00 authorized, $6,100,000 outstanding Additional Paid-In Capital $1,335,000 $1,602,000 $7,476,000 $4,272,000 $8,811,000 $5,874,000 $13,142,112 $11,347,500 $6,100,000 $6,100,000 $1,602,000 $1,602,000 $13,647,516 $9,786,500 $21,349,516 $17,488,500 $34,491,628 $28,836,000 Dover Co. For Year Ended December 31, 2020 Cash Flow from Operations Net Income Adjustments: Change in A/R Change in Inventory Change in Prepaid Insurance Change in Prepaid Utilities Depreciation Change in A/P Change in Income Tax Payable Change in Unearned Revenue Change in Wages Payable Loss on Sale Net Cash Flow from Operations Cash Flow from Investments Sale of Equipment Purchase of Land Purchase of Building Purchase of Equipment Net Cash Flow from Investments Cash Flow from Financing Repayment of Loans Issuance of Notes Payable Payments of Dividends Net Cash Flow from Financing Net Increase (Decrease) in Cash Cash, January 1, 2020 Cash, December 31, 2020 ($849,612) $1,518,000 $220,500 ($133,500) $3,204,000 ($2,759,242) ($156,466) $1,520,920 $252,400 $3,484 $34,841 ($2,136,000) ($514,000) ($8,781,000) ($267,000) $3,204,000 ($1,190,500) $5,051,516 $2,820,484 $7,872,000 ($11,396,159) $1,746,500 ($1,777,659) $2,670,000 $892,341 Dover purchased a new storage facility on December 1, 2020. The new building cost $1,910,000. A new member of the accounting team recorded depreciation on the new facility using the straight line method. The manager was impressed with his hard work, since he appropriately used partial year depreciation and used the method correctly. However, she had to remind him Dover uses the sum-of- the-years (SYD) method for buildings. Unfortunately, the mistake in method wasn't corrected before the financial statements were created. At the time of the purchase, the operations manager estimated that the new facility would be used for 10 years and would have a $80,200 salvage value. Dover's management would like to know the effect of your adjustment on the following ratios: Asset Turnover (Net Sales / average total assets) . Current Ratio ROA Assignment: Calculations 1. Make the appropriate journal entries, if any, to account for the change in depreciation method (including any necessary changes to income tax expense) on the new facility ONLY (the rest of the depreciation was appropriately recorded). 2. Make any necessary changes to the financial statements. Critical Thinking 3. Calculate each of the required ratios using the original values (before any changes) and the updated values (after your changes). 4. In practice, most companies use the straight-line depreciation method, typically without any salvage value. How do you think companies justify this decision to their owners and creditors? Do you agree with using only this one method? Defend your answer. 5. After looking over the numbers, you believe that would be better off following the more conservative option of reporting a full year of depreciation. Provide two (2) arguments that you could use to convince the management team that your plan is the most appropriate. Correcting Entries Sales Price Machine 1 Machine 2 Conveyor Belt Storage Facility Equipment Building Adjusting Journal Entries Loss on Sale Cash $1,285,000 Mkt Values Percentage Basket Price $486,000 $468,000 $126,000 $720,000 $1,800,000 $771,000 $514,000 Cash $1,285,000 To record the purchase of the new set of equipment $3,484 $34,841 $326,675 27.0% $346,950 26.0% $334,100 7.0% $89,950 40.0% $514,000 100.0% $1,285,000 Accumulated Depreciation Equipment Sale of old machines to make room for new set. Income Tax Payable $1,045 Income Tax Expense To record change in taxes due to exchange $365,000 $1,045 30% $3,484 = $1,045 Sales Revenue Sales Revenue Less: Sales Discounts Sales Returns Dover Co. Multi-Step Income Statement For Year Ended December 31, 2020 Net Sales Revenue Cost of Goods Sold Cost of Goods Sold Gross Profit Operating Activities Selling Expenses Advertising Expense Bad Debt Expense Miscellaneous Selling Expenses Sales Force Salaries Expense Selling Commissions Expense Shipping Expense Total Selling Expenses Administrative Expenses Executive Salaries Expense Depreciation Expense Insurance Expense Miscellaneous Admin. Expenses Office Supplies Expense Consulting and Legal Fees Utilities Expense Total Administrative Expenses Income from Operations Other Gains and Losses Rent Revenue EPS $1,001,250 $190,848 $165,540 $910,083 $2,670,000 $437,213 $2,439,517 $3,204,000 $460,575 $26,366 $206,925 $33,375 $400,500 Interest Expense Loss on Sale Income from Continuing Operations before Taxes Income Tax Expense Net Income 3 $640,800 $2,536,500 $5,374,934 $53,400,000 $166,875 ($1,327,345) $3,177,300 $50,222,700 $29,625,157 $20,597,543 $6,771,258 $12,146,192 $8,451,351 ($3,484) ($1,163,954) $7,287,397 ($2,235,881) $5,051,516 $ 0.83 Current Assets Cash A/R Allowance for Bad Debts Inventory Prepaid Insurance Prepaid Utilities Total Current Assets Long-term Investments Loans to other businesses Expansion Fund Total Long-term Investments PPE Land Building Equipment Accumulated Depreciati Total PPE Intangible Assets Patents Total Assets Dover Co. Balance Sheet As of 12/31/2020 Current Liabilities Accounts Payable Income Tax Payable Unearned Revenue Wages Payable Current Portion of Loan Payable Total Current Liabilities Long-term Debt Loan Payable Notes Payable Total Long-term Debt Total Liabilities Stockholders' Equity Common Stock 2020 Retained Earnings Total Stockholders' Equity Total Liabilities and Stockholder's Equity $892,341 $2,670,000 $4,638,000 $4,539,000 ($584,388) ($1,335,000) $5,958,000 $7,476,000 Liabilities and Stockholders' Equity 2019 $580,500 $667,500 $12,151,953 $14,685,000 $2,136,000 $2,136,000 $1,602,000 $1,602,000 $3,738,000 $3,738,000 $801,000 $534,000 $5,874,000 $3,738,000 $4,786,000 $4,272,000 $15,358,000 $6,942,000 ($8,217,325) ($5,340,000) $17,800,675 $9,612,000 $801,000 $801,000 $34,491,628 $28,836,000 $444,758 $377,534 $3,204,000 $534,000 $2,321,920 $801,000 $919,900 $667,500 $267,000 $267,000 $4,331,112 $5,473,500 ($1 par, $12,200,000.00 authorized, $6,100,000 outstanding Additional Paid-In Capital $1,335,000 $1,602,000 $7,476,000 $4,272,000 $8,811,000 $5,874,000 $13,142,112 $11,347,500 $6,100,000 $6,100,000 $1,602,000 $1,602,000 $13,647,516 $9,786,500 $21,349,516 $17,488,500 $34,491,628 $28,836,000 Dover Co. For Year Ended December 31, 2020 Cash Flow from Operations Net Income Adjustments: Change in A/R Change in Inventory Change in Prepaid Insurance Change in Prepaid Utilities Depreciation Change in A/P Change in Income Tax Payable Change in Unearned Revenue Change in Wages Payable Loss on Sale Net Cash Flow from Operations Cash Flow from Investments Sale of Equipment Purchase of Land Purchase of Building Purchase of Equipment Net Cash Flow from Investments Cash Flow from Financing Repayment of Loans Issuance of Notes Payable Payments of Dividends Net Cash Flow from Financing Net Increase (Decrease) in Cash Cash, January 1, 2020 Cash, December 31, 2020 ($849,612) $1,518,000 $220,500 ($133,500) $3,204,000 ($2,759,242) ($156,466) $1,520,920 $252,400 $3,484 $34,841 ($2,136,000) ($514,000) ($8,781,000) ($267,000) $3,204,000 ($1,190,500) $5,051,516 $2,820,484 $7,872,000 ($11,396,159) $1,746,500 ($1,777,659) $2,670,000 $892,341 Dover purchased a new storage facility on December 1, 2020. The new building cost $1,910,000. A new member of the accounting team recorded depreciation on the new facility using the straight line method. The manager was impressed with his hard work, since he appropriately used partial year depreciation and used the method correctly. However, she had to remind him Dover uses the sum-of- the-years (SYD) method for buildings. Unfortunately, the mistake in method wasn't corrected before the financial statements were created. At the time of the purchase, the operations manager estimated that the new facility would be used for 10 years and would have a $80,200 salvage value. Dover's management would like to know the effect of your adjustment on the following ratios: Asset Turnover (Net Sales / average total assets) . Current Ratio ROA Assignment: Calculations 1. Make the appropriate journal entries, if any, to account for the change in depreciation method (including any necessary changes to income tax expense) on the new facility ONLY (the rest of the depreciation was appropriately recorded). 2. Make any necessary changes to the financial statements. Critical Thinking 3. Calculate each of the required ratios using the original values (before any changes) and the updated values (after your changes). 4. In practice, most companies use the straight-line depreciation method, typically without any salvage value. How do you think companies justify this decision to their owners and creditors? Do you agree with using only this one method? Defend your answer. 5. After looking over the numbers, you believe that would be better off following the more conservative option of reporting a full year of depreciation. Provide two (2) arguments that you could use to convince the management team that your plan is the most appropriate. Correcting Entries Sales Price Machine 1 Machine 2 Conveyor Belt Storage Facility Equipment Building Adjusting Journal Entries Loss on Sale Cash $1,285,000 Mkt Values Percentage Basket Price $486,000 $468,000 $126,000 $720,000 $1,800,000 $771,000 $514,000 Cash $1,285,000 To record the purchase of the new set of equipment $3,484 $34,841 $326,675 27.0% $346,950 26.0% $334,100 7.0% $89,950 40.0% $514,000 100.0% $1,285,000 Accumulated Depreciation Equipment Sale of old machines to make room for new set. Income Tax Payable $1,045 Income Tax Expense To record change in taxes due to exchange $365,000 $1,045 30% $3,484 = $1,045 Sales Revenue Sales Revenue Less: Sales Discounts Sales Returns Dover Co. Multi-Step Income Statement For Year Ended December 31, 2020 Net Sales Revenue Cost of Goods Sold Cost of Goods Sold Gross Profit Operating Activities Selling Expenses Advertising Expense Bad Debt Expense Miscellaneous Selling Expenses Sales Force Salaries Expense Selling Commissions Expense Shipping Expense Total Selling Expenses Administrative Expenses Executive Salaries Expense Depreciation Expense Insurance Expense Miscellaneous Admin. Expenses Office Supplies Expense Consulting and Legal Fees Utilities Expense Total Administrative Expenses Income from Operations Other Gains and Losses Rent Revenue EPS $1,001,250 $190,848 $165,540 $910,083 $2,670,000 $437,213 $2,439,517 $3,204,000 $460,575 $26,366 $206,925 $33,375 $400,500 Interest Expense Loss on Sale Income from Continuing Operations before Taxes Income Tax Expense Net Income 3 $640,800 $2,536,500 $5,374,934 $53,400,000 $166,875 ($1,327,345) $3,177,300 $50,222,700 $29,625,157 $20,597,543 $6,771,258 $12,146,192 $8,451,351 ($3,484) ($1,163,954) $7,287,397 ($2,235,881) $5,051,516 $ 0.83 Current Assets Cash A/R Allowance for Bad Debts Inventory Prepaid Insurance Prepaid Utilities Total Current Assets Long-term Investments Loans to other businesses Expansion Fund Total Long-term Investments PPE Land Building Equipment Accumulated Depreciati Total PPE Intangible Assets Patents Total Assets Dover Co. Balance Sheet As of 12/31/2020 Current Liabilities Accounts Payable Income Tax Payable Unearned Revenue Wages Payable Current Portion of Loan Payable Total Current Liabilities Long-term Debt Loan Payable Notes Payable Total Long-term Debt Total Liabilities Stockholders' Equity Common Stock 2020 Retained Earnings Total Stockholders' Equity Total Liabilities and Stockholder's Equity $892,341 $2,670,000 $4,638,000 $4,539,000 ($584,388) ($1,335,000) $5,958,000 $7,476,000 Liabilities and Stockholders' Equity 2019 $580,500 $667,500 $12,151,953 $14,685,000 $2,136,000 $2,136,000 $1,602,000 $1,602,000 $3,738,000 $3,738,000 $801,000 $534,000 $5,874,000 $3,738,000 $4,786,000 $4,272,000 $15,358,000 $6,942,000 ($8,217,325) ($5,340,000) $17,800,675 $9,612,000 $801,000 $801,000 $34,491,628 $28,836,000 $444,758 $377,534 $3,204,000 $534,000 $2,321,920 $801,000 $919,900 $667,500 $267,000 $267,000 $4,331,112 $5,473,500 ($1 par, $12,200,000.00 authorized, $6,100,000 outstanding Additional Paid-In Capital $1,335,000 $1,602,000 $7,476,000 $4,272,000 $8,811,000 $5,874,000 $13,142,112 $11,347,500 $6,100,000 $6,100,000 $1,602,000 $1,602,000 $13,647,516 $9,786,500 $21,349,516 $17,488,500 $34,491,628 $28,836,000 Dover Co. For Year Ended December 31, 2020 Cash Flow from Operations Net Income Adjustments: Change in A/R Change in Inventory Change in Prepaid Insurance Change in Prepaid Utilities Depreciation Change in A/P Change in Income Tax Payable Change in Unearned Revenue Change in Wages Payable Loss on Sale Net Cash Flow from Operations Cash Flow from Investments Sale of Equipment Purchase of Land Purchase of Building Purchase of Equipment Net Cash Flow from Investments Cash Flow from Financing Repayment of Loans Issuance of Notes Payable Payments of Dividends Net Cash Flow from Financing Net Increase (Decrease) in Cash Cash, January 1, 2020 Cash, December 31, 2020 ($849,612) $1,518,000 $220,500 ($133,500) $3,204,000 ($2,759,242) ($156,466) $1,520,920 $252,400 $3,484 $34,841 ($2,136,000) ($514,000) ($8,781,000) ($267,000) $3,204,000 ($1,190,500) $5,051,516 $2,820,484 $7,872,000 ($11,396,159) $1,746,500 ($1,777,659) $2,670,000 $892,341

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Dec 1 2020 Building ac To Bank Being asset purchase Dec 31 2020 Depreciation on Building ac To Build...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started