Answered step by step

Verified Expert Solution

Question

1 Approved Answer

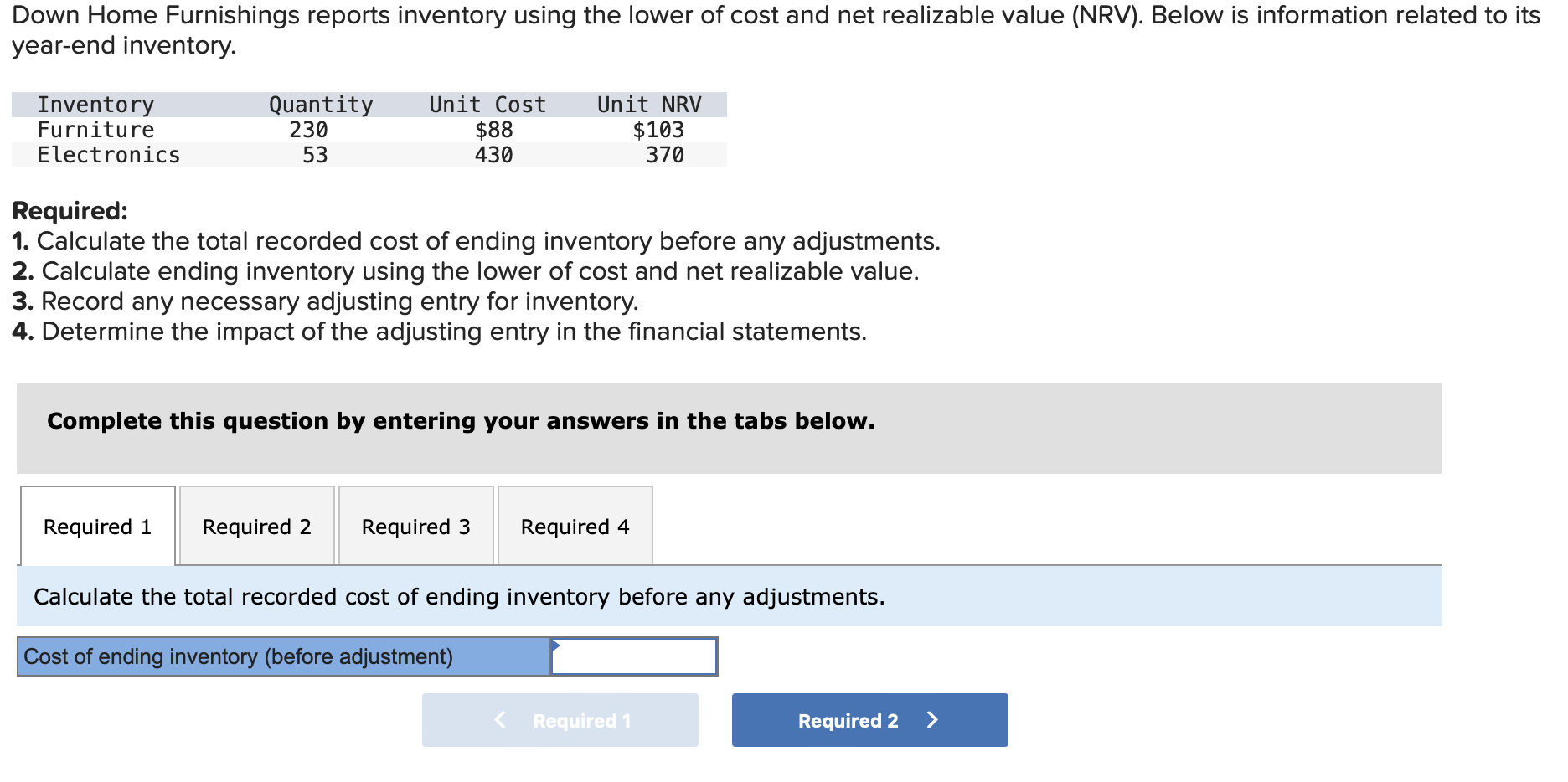

Down Home Furnishings reports inventory using the lower of cost and net realizable value (NRV). Below is information related to its year-end inventory. Inventory

Down Home Furnishings reports inventory using the lower of cost and net realizable value (NRV). Below is information related to its year-end inventory. Inventory Furniture Electronics Required: Quantity Unit Cost Unit NRV 230 53 $88 430 $103 370 1. Calculate the total recorded cost of ending inventory before any adjustments. 2. Calculate ending inventory using the lower of cost and net realizable value. 3. Record any necessary adjusting entry for inventory. 4. Determine the impact of the adjusting entry in the financial statements. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Required 4 Calculate the total recorded cost of ending inventory before any adjustments. Cost of ending inventory (before adjustment) < Required 1 Required 2 >

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To calculate the total recorded cost of ending inventory before a...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

6641e3caad84b_987668.pdf

180 KBs PDF File

6641e3caad84b_987668.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started