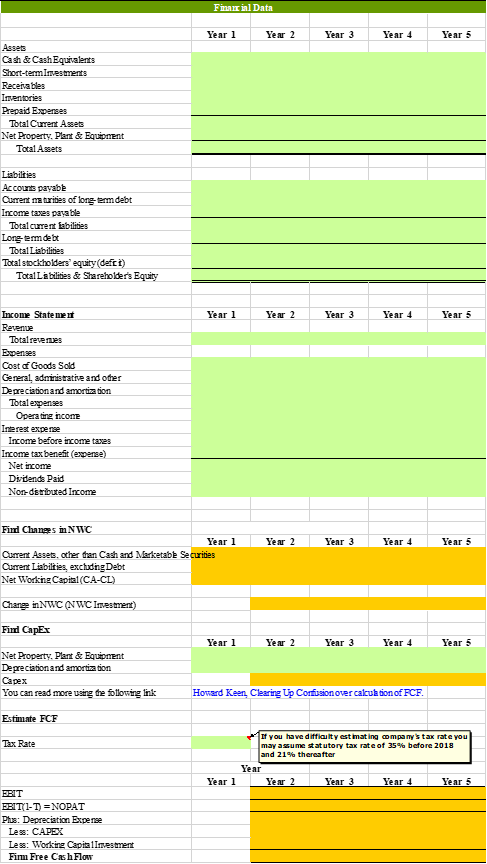

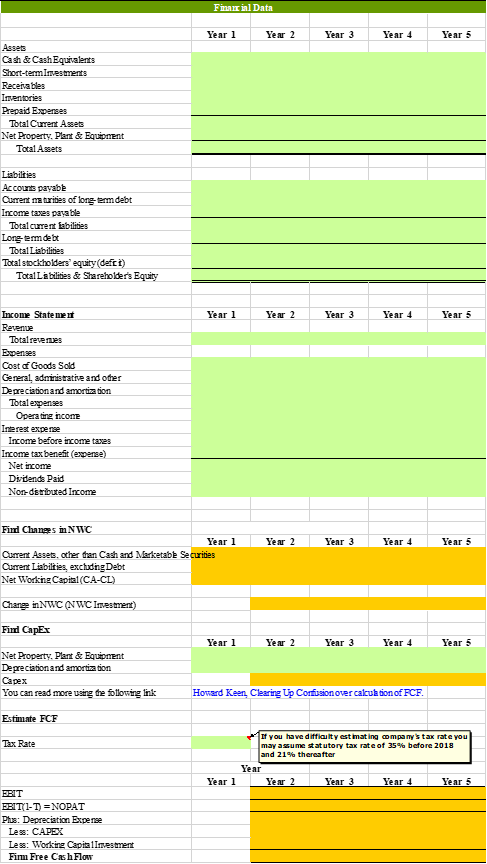

Download annual financial data for the last 5 years from Edgar Website (forms 10-K). Attention: if your company became public less than 5 years ago, you will also have to download data from its IPO filing prospectus (form 424B4). Template below is approximate, you may modify it (change, delete, or add rows), to suit your company .Using approach similar to the one described in this module's Excel file you will have to calculate the FCF for the company of your choice. If you have difficulty estimating company's tax rate you may assume statutory tax rate of 35% for years before 2018. My company is Walt Disney. Please show calculations.

Finare inl Data Year 1 Year 2 Year 3 3 Year 4 Year 5 Assets Cash & Cash Equivalents Short-term Investments Receivables Inventories Prepaid Expenses Total Current Asses Net Property. Plant & Equipment Total Assets Liabilties Accounts payable Current na trities of long-ermdebt Income tases payable Total current abilities Long-term debt Total Liabilities Total stockholders' equity (defct) Total Labilities & Shareholders Equity Income Statement Year 1 Year 2 Year 3 Year 4 Year 5 Revenue Total revenues Expenses Cost of Goods Sold General, administrative and other Depreciation and amortization Total expenses Operating income Interest expense Income before income taxes Income tax benefit (expense) Net income Dividends Paid Non-distributed Income Year 2 Year 3 Year 4 Year 5 Find Changes in NWC Year 1 Current Assets. Other than Cash and Marketable Securities Current Liabilties, excluding Debt Net Working Capial (CA-CL) Change in NWC (NWC Inesment) Find CapEx Year 1 Year 2 Year 3 Year 4 Year 5 Net Property. Plant & Equipment Depreciation and amortization Capex You can read more using the following link Howard Keen Clearing Up Corfusion over calculation of FCF. Estimate FCF Tax Rate If you have difficulty estimating company's tax rate you may assume statutory tax rate of 35% before 2018 and 21% thereafter Year Yen 2 Year 3 Year 4 Year 5 Year 1 ERIT ERITY1-T) = NOPAT Plus: Depreciation Expense Less: CAPEX Less: Working Capital Investment Fimm Free Cash Flow Finare inl Data Year 1 Year 2 Year 3 3 Year 4 Year 5 Assets Cash & Cash Equivalents Short-term Investments Receivables Inventories Prepaid Expenses Total Current Asses Net Property. Plant & Equipment Total Assets Liabilties Accounts payable Current na trities of long-ermdebt Income tases payable Total current abilities Long-term debt Total Liabilities Total stockholders' equity (defct) Total Labilities & Shareholders Equity Income Statement Year 1 Year 2 Year 3 Year 4 Year 5 Revenue Total revenues Expenses Cost of Goods Sold General, administrative and other Depreciation and amortization Total expenses Operating income Interest expense Income before income taxes Income tax benefit (expense) Net income Dividends Paid Non-distributed Income Year 2 Year 3 Year 4 Year 5 Find Changes in NWC Year 1 Current Assets. Other than Cash and Marketable Securities Current Liabilties, excluding Debt Net Working Capial (CA-CL) Change in NWC (NWC Inesment) Find CapEx Year 1 Year 2 Year 3 Year 4 Year 5 Net Property. Plant & Equipment Depreciation and amortization Capex You can read more using the following link Howard Keen Clearing Up Corfusion over calculation of FCF. Estimate FCF Tax Rate If you have difficulty estimating company's tax rate you may assume statutory tax rate of 35% before 2018 and 21% thereafter Year Yen 2 Year 3 Year 4 Year 5 Year 1 ERIT ERITY1-T) = NOPAT Plus: Depreciation Expense Less: CAPEX Less: Working Capital Investment Fimm Free Cash Flow