Question: Download the Applying Excel form below. Follow the tutorial on the first tab using basic Excel functions. After following the tutorial on the first tab,

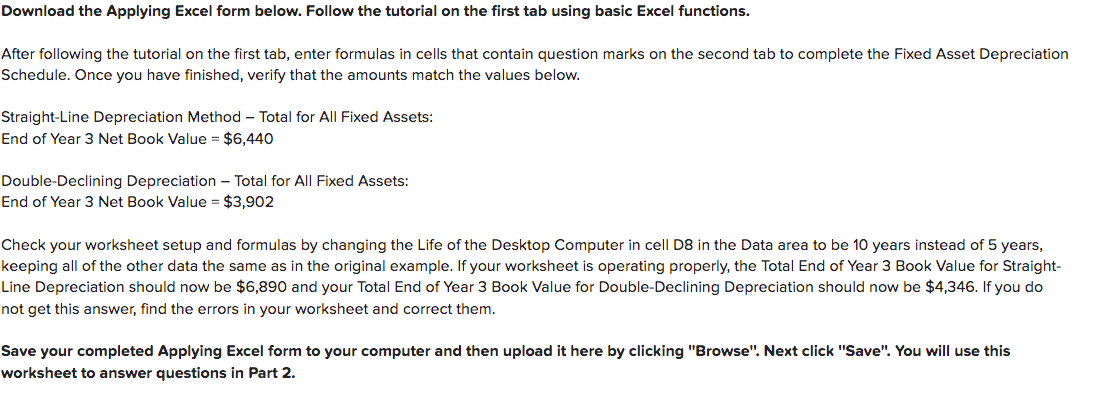

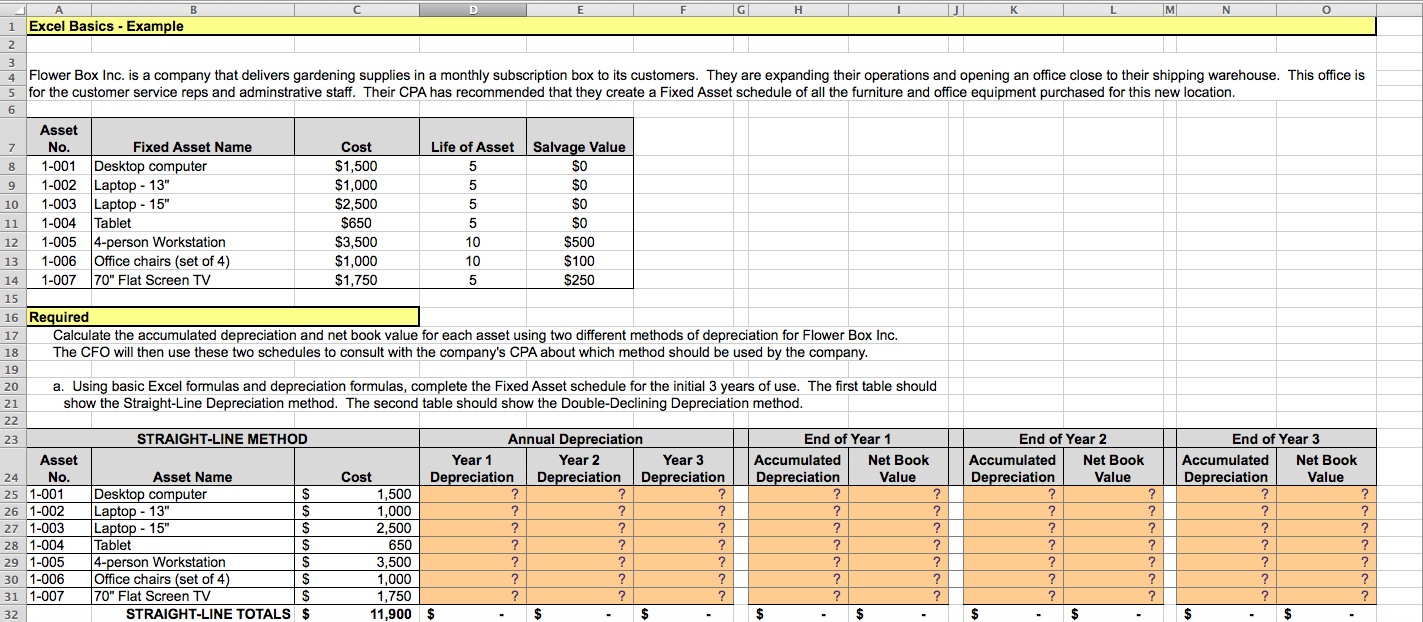

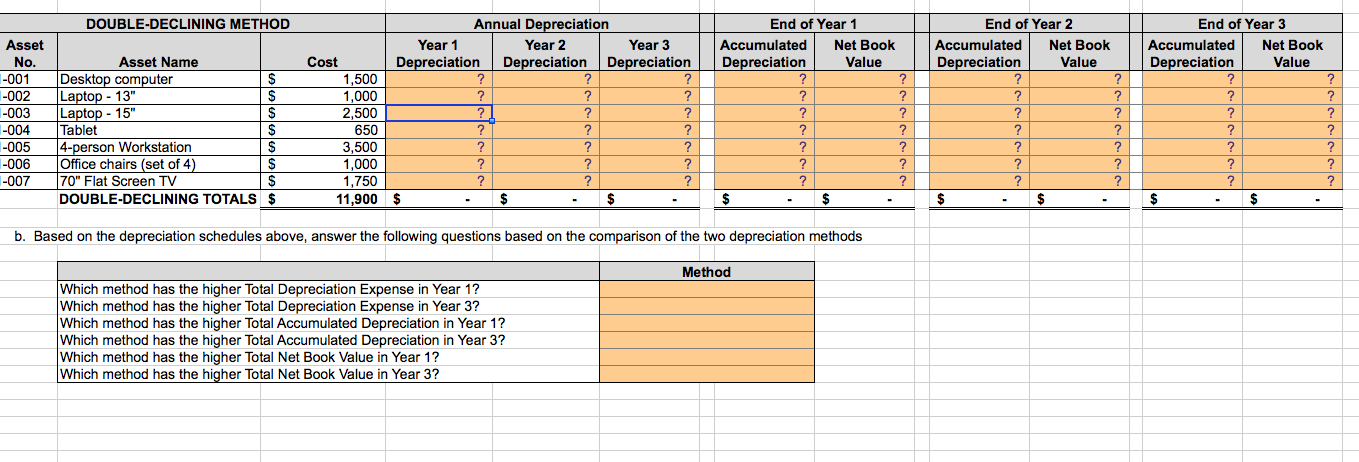

Download the Applying Excel form below. Follow the tutorial on the first tab using basic Excel functions. After following the tutorial on the first tab, enter formulas in cells that contain question marks on the second tab to complete the Fixed Asset Depreciation Schedule. Once you have finished, verify that the amounts match the values below. Straight-Line Depreciation Method - Total for All Fixed Assets: End of Year 3 Net Book Value = $6,440 Double-Declining Depreciation - Total for All Fixed Assets: End of Year 3 Net Book Value = $3,902 Check your worksheet setup and formulas by changing the Life of the Desktop Computer in cell D8 in the Data area to be 10 years instead of 5 years, keeping all of the other data the same as in the original example. If your worksheet is operating properly, the Total End of Year 3 Book Value for Straight- Line Depreciation should now be $6,890 and your Total End of Year 3 Book Value for Double-Declining Depreciation should now be $4,346. If you do not get this answer, find the errors in your worksheet and correct them. Save your completed Applying Excel form to your computer and then upload it here by clicking "Browse". Next click "Save". You will use this worksheet to answer questions in Part 2. A B F H K || 6 13 G 1 Excel Basics - Example 2 3 4 Flower Box Inc. is a company that delivers gardening supplies in a monthly subscription box to its customers. They are expanding their operations and opening an office close to their shipping warehouse. This office is 5 for the customer service reps and adminstrative staff. Their CPA has recommended that they create a Fixed Asset schedule of all the furniture and office equipment purchased for this new location. 6 Asset 7 No. Fixed Asset Name Cost Life of Asset Salvage Value 8 8 1-001 Desktop computer $1,500 5 5 $0 9 1-002 Laptop - 13" $1,000 5 $0 10 1-003 Laptop - 15" $2,500 5 SO 11 1-004 Tablet $650 5 SO 12 1-005 4-person Workstation $3,500 10 $500 1-006 Office chairs (set of 4) $1,000 10 $100 14 1-007 70" Flat Screen TV $1,750 5 $250 15 16 Required 17 Calculate the accumulated depreciation and net book value for each asset using two different methods of depreciation for Flower Box Inc. 18 The CFO will then use these two schedules to consult with the company's CPA about which method should be used by the company. 19 20 a. Using basic Excel formulas and depreciation formulas, complete the Fixed Asset schedule for the initial 3 years of use. The first table should 21 show the Straight-Line Depreciation method. The second table should show the Double-Declining Depreciation method. 22 23 STRAIGHT-LINE METHOD Annual Depreciation End of Year 1 End of Year 2 End of Year 3 Asset Year 1 Year 2 Year 3 Accumulated Net Book Accumulated Net Book Accumulated Net Book 24 No. Asset Name Cost Depreciation Depreciation Depreciation Depreciation Value Depreciation Value Depreciation Value 25 1-001 Desktop computer $ 1,500 ? ? ? ? ? ? ? ? ? 26 1-002 Laptop - 13" $ 1,000 ? ? ? ? ? ? ? ? ? ? 27 1-003 Laptop - 15" $ 2,500 ? ? ? ? ? ? ? ? ? ? 28 1-004 Tablet $ 650 ? ? ? ? ? ? ? ? ? ? 29 1-005 4-person Workstation $ 3,500 ? ? ? ? ? ? ? ? ? 30 1-006 Office chairs (set of 4) $ 1,000 ? ? ? ? ? ? ? ? ? ? 31 1-007 70" Flat Screen TV | $ 1,750 ? ? ? ? ? ? ? ? ? 32 STRAIGHT-LINE TOTALS $ 11,900 $ $ - $ $ $ $ - $ $ $ num DOUBLE-DECLINING METHOD Asset No. .-001 -002 .-003 .-004 .-005 .-006 -007 Asset Name Desktop computer $ Laptop - 13" S Laptop - 15" $ Tablet $ 4-person Workstation S Office chairs (set of 4) S 70" Flat Screen TV $ DOUBLE-DECLINING TOTALS $ Annual Depreciation Year 1 Year 2 Year 3 Cost Depreciation Depreciation Depreciation 1,500 ? ? ? 1,000 ? ? ? ? 2,500 ? ? ? 650 ? ? ? 3,500 ? ? ? 1,000 ? ? ? ? 1,750 ? ? ? ? 11,900 $ $ $ End of Year 1 Accumulated Net Book Depreciation Value ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? $ $ End of Year 2 Accumulated Net Book Depreciation Value ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? $ $ End of Year 3 Accumulated Net Book Depreciation Value ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? $ $ b. Based on the depreciation schedules above, answer the following questions based on the comparison of the two depreciation methods Method Which method has the higher Total Depreciation Expense in Year 1? Which method has the higher Total Depreciation Expense in Year 3? Which method has the higher Total Accumulated Depreciation in Year 1? Which method has the higher Total Accumulated Depreciation in Year 3? Which method has the higher Total Net Book Value in Year 1? Which method has the higher Total Net Book Value in Year 3

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts