Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Download the Week 3 Guidance for additional help. Include the following content in this section. Formulate the expected financial returns and associated risks by completing

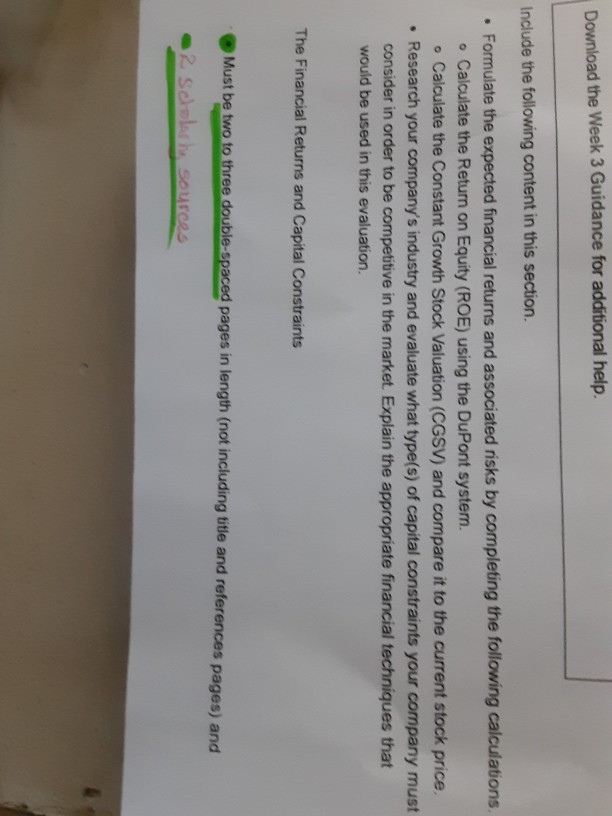

Download the Week 3 Guidance for additional help. Include the following content in this section. Formulate the expected financial returns and associated risks by completing the following calculations Calculate the Return on Equity (ROE) using the DuPont system. Calculate the Constant Growth Stock Valuation (CGSV) and compare it to the current stock price, Research your company's industry and evaluate what type(s) of capital constraints your company must consider in order to be competitive in the market. Explain the appropriate financial techniques that would be used in this evaluation. The Financial Returns and Capital Constraints Must be two to three double-spaced pages in length (not including title and references pages) and 2 Scholarly sources Download the Week 3 Guidance for additional help. Include the following content in this section. Formulate the expected financial returns and associated risks by completing the following calculations Calculate the Return on Equity (ROE) using the DuPont system. Calculate the Constant Growth Stock Valuation (CGSV) and compare it to the current stock price, Research your company's industry and evaluate what type(s) of capital constraints your company must consider in order to be competitive in the market. Explain the appropriate financial techniques that would be used in this evaluation. The Financial Returns and Capital Constraints Must be two to three double-spaced pages in length (not including title and references pages) and 2 Scholarly sources

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started