Question

Doyle Company issued $386,000 of 10-year, 8 percent bonds on January 1, Year 1. The bonds were issued at face value. Interest is payable in

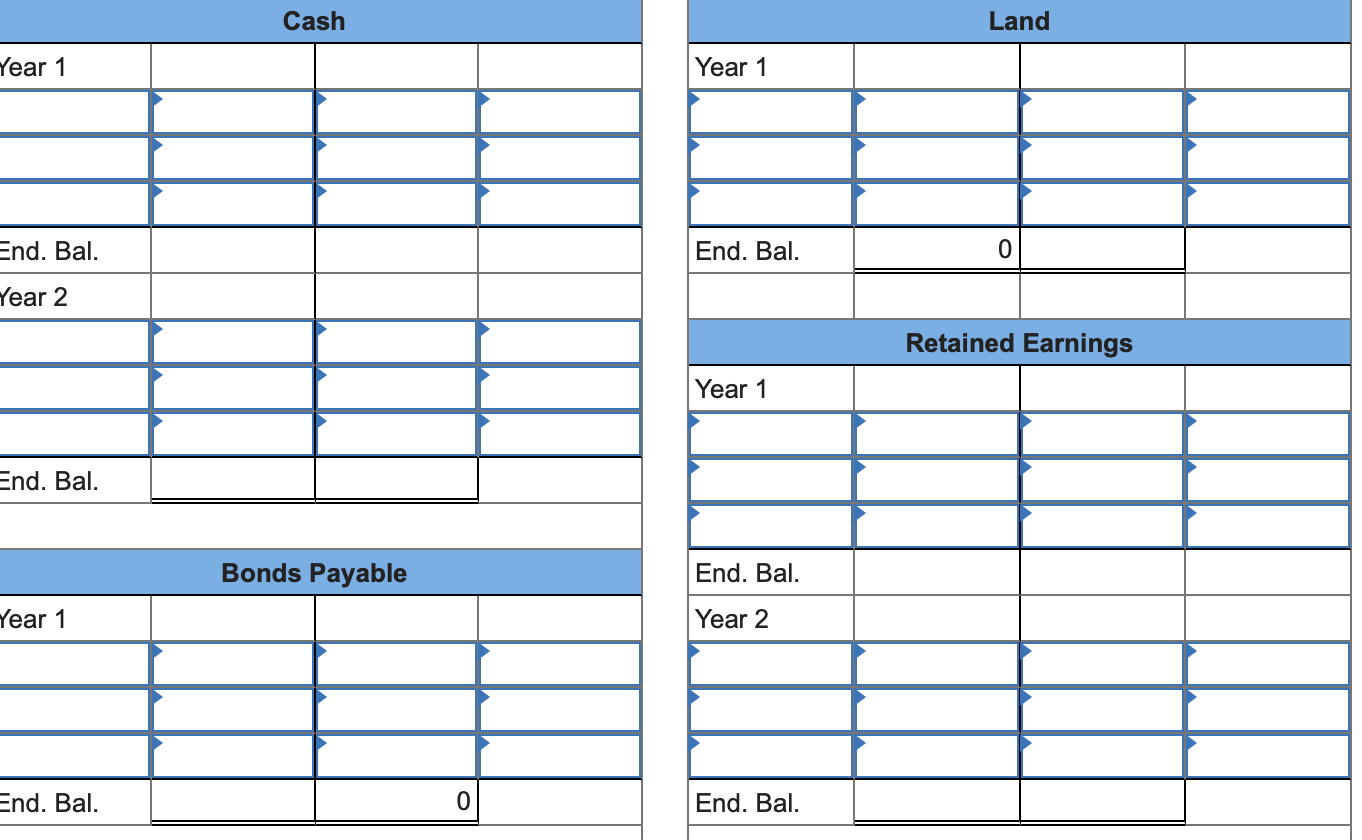

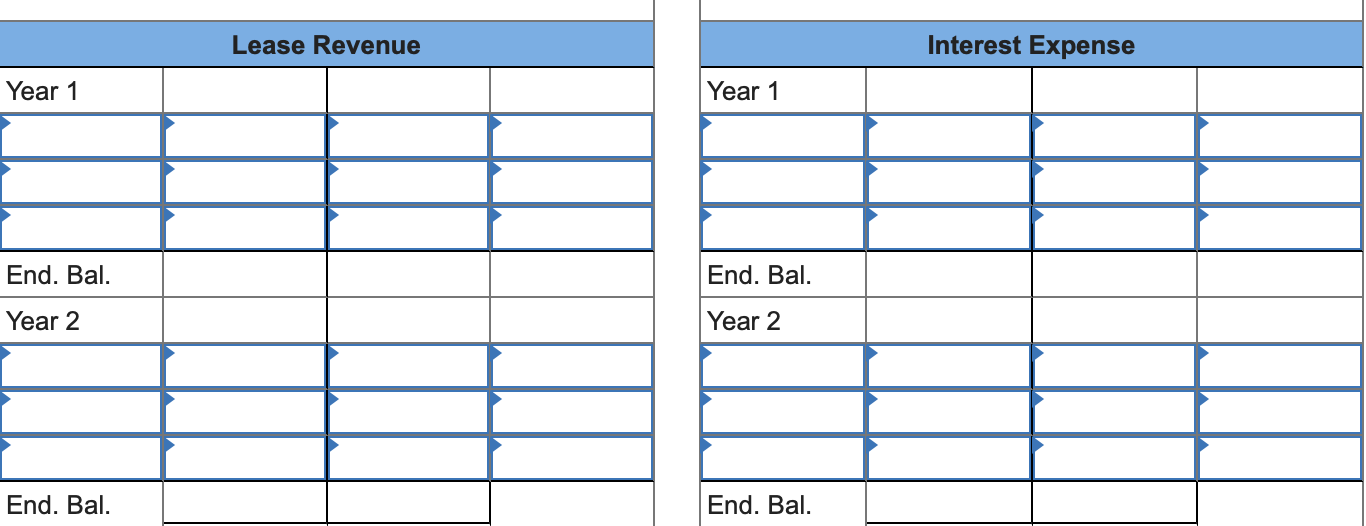

Doyle Company issued $386,000 of 10-year, 8 percent bonds on January 1, Year 1. The bonds were issued at face value. Interest is payable in cash on December 31 of each year. Doyle immediately invested the proceeds from the bond issue in land. The land was leased for an annual $51,500 of cash revenue, which was collected on December 31 of each year, beginning December 31, Year 1.

PART A. Required a. Prepare the journal entries for these events, and post them to T-accounts for Year 1 and Year 2. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.)

PART B.

(Select "cl" for all the closing entries.)

-

1

Record the issue of bonds payable.

-

2

Record the purchase of land.

-

3

Record the receipt of lease revenue.

-

4

Record the interest expenses for bonds payable.

-

5

Record the entry to close revenue and expense accounts.

-

6

Record the receipt of lease revenue.

-

7

Record the interest expenses for bonds payable.

-

8

Record the entry to close revenue and expense accounts.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started