Answered step by step

Verified Expert Solution

Question

1 Approved Answer

DPCL is a small-sized firm manufacturing hand tools. Its manufacturing plant is situated in Sohar. The company's sales in the year ending December 2014

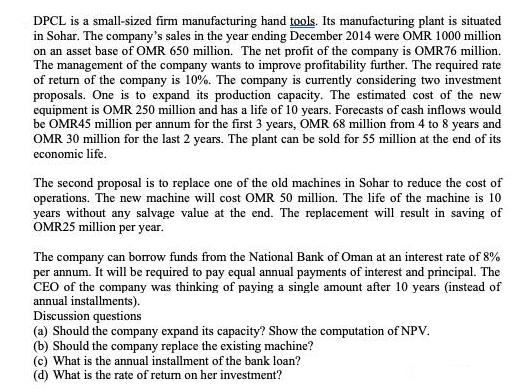

DPCL is a small-sized firm manufacturing hand tools. Its manufacturing plant is situated in Sohar. The company's sales in the year ending December 2014 were OMR 1000 million on an asset base of OMR 650 million. The net profit of the company is OMR76 million. The management of the company wants to improve profitability further. The required rate of return of the company is 10%. The company is currently considering two investment proposals. One is to expand its production capacity. The estimated cost of the new equipment is OMR 250 million and has a life of 10 years. Forecasts of cash inflows would be OMR45 million per annum for the first 3 years, OMR 68 million from 4 to 8 years and OMR 30 million for the last 2 years. The plant can be sold for 55 million at the end of its economic life. The second proposal is to replace one of the old machines in Sohar to reduce the cost of operations. The new machine will cost OMR 50 million. The life of the machine is 10 years without any salvage value at the end. The replacement will result in saving of OMR25 million per year. The company can borrow funds from the National Bank of Oman at an interest rate of 8% per annum. It will be required to pay equal annual payments of interest and principal. The CEO of the company was thinking of paying a single amount after 10 years (instead of annual installments). Discussion questions (a) Should the company expand its capacity? Show the computation of NPV. (b) Should the company replace the existing machine? (c) What is the annual installment of the bank loan? (d) What is the rate of return on her investment?

Step by Step Solution

★★★★★

3.33 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

PartA NPV of Expanding its capcity NPV means Net Present Value NPV PV of Cash Inflows PV of Cash Out...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started