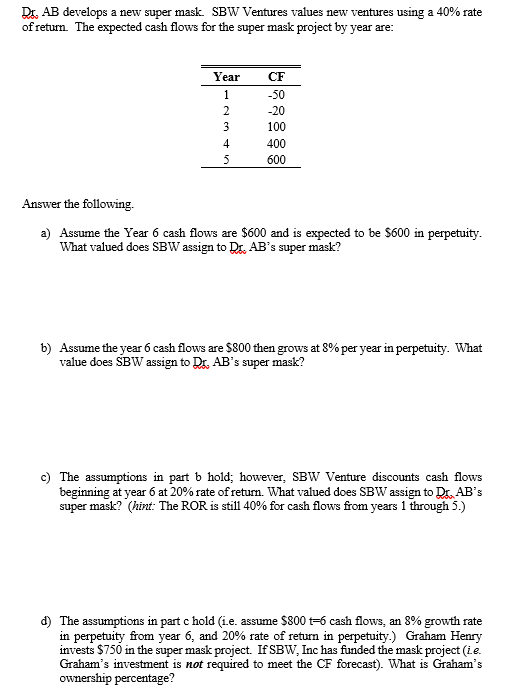

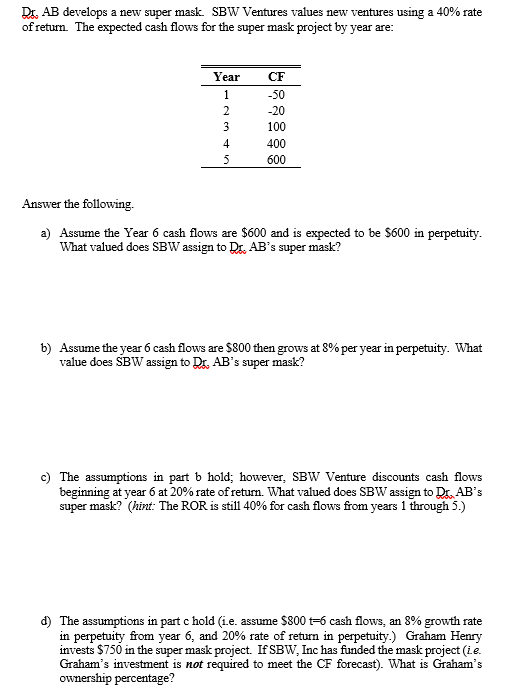

Dr. AB develops a new super mask. SBW Ventures values new ventures using a 40% rate of return. The expected cash flows for the super mask project by year are: Answer the following. a) Assume the Year 6 cash flows are $600 and is expected to be $600 in perpetuity. What valued does SBW assign to Dr. AB's super mask? b) Assume the year 6 cash flows are $800 then grows at 8% per year in perpetuity. What value does SBW assign to Dr,AB 's super mask? c) The assumptions in part b hold; however, SBW Venture discounts cash flows beginning at year 6 at 20% rate of return. What valued does SBW assign to Dr,AB 's super mask? (hint: The ROR is still 40% for cash flows from years 1 through 5 .) d) The assumptions in part c hold (i.e. assume $800t=6 cash flows, an 8% growth rate in perpetuity from year 6 , and 20% rate of return in perpetuity.) Graham Henry invests $750 in the super mask project. If SBW, Inc has funded the mask project (ie. Graham's investment is not required to meet the CF forecast). What is Graham's ownership percentage? Dr. AB develops a new super mask. SBW Ventures values new ventures using a 40% rate of return. The expected cash flows for the super mask project by year are: Answer the following. a) Assume the Year 6 cash flows are $600 and is expected to be $600 in perpetuity. What valued does SBW assign to Dr. AB's super mask? b) Assume the year 6 cash flows are $800 then grows at 8% per year in perpetuity. What value does SBW assign to Dr,AB 's super mask? c) The assumptions in part b hold; however, SBW Venture discounts cash flows beginning at year 6 at 20% rate of return. What valued does SBW assign to Dr,AB 's super mask? (hint: The ROR is still 40% for cash flows from years 1 through 5 .) d) The assumptions in part c hold (i.e. assume $800t=6 cash flows, an 8% growth rate in perpetuity from year 6 , and 20% rate of return in perpetuity.) Graham Henry invests $750 in the super mask project. If SBW, Inc has funded the mask project (ie. Graham's investment is not required to meet the CF forecast). What is Graham's ownership percentage