Answered step by step

Verified Expert Solution

Question

1 Approved Answer

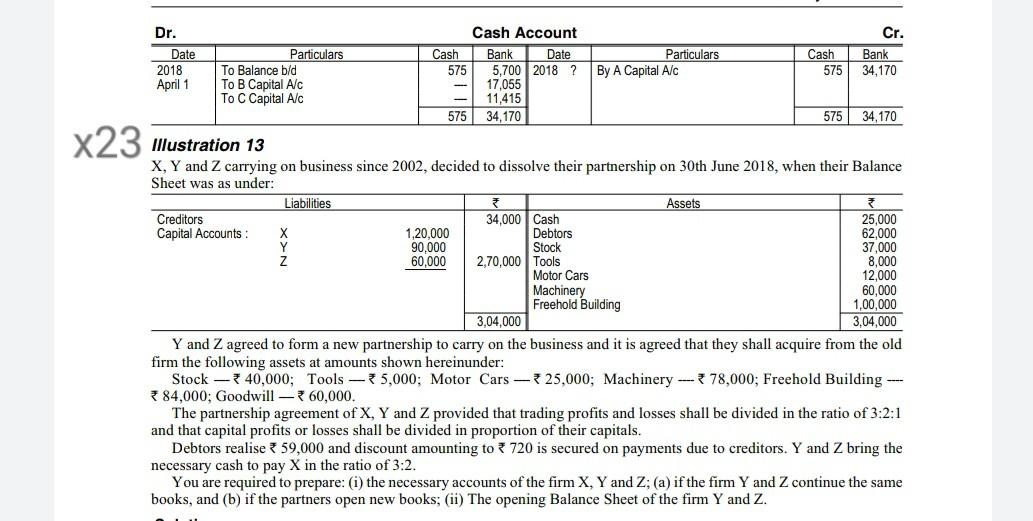

Dr. Date 2018 April 1 Particulars To Balance b/d To B Capital A/C To C Capital Alc Cash Account Cash Bank Date 575 5,700 2018

Dr. Date 2018 April 1 Particulars To Balance b/d To B Capital A/C To C Capital Alc Cash Account Cash Bank Date 575 5,700 2018 ? 17,055 11,415 575 34,170 Particulars By A Capital Alc Cash 575 Cr. Bank 34,170 575 34,170 x23 illustration 13 Y X, Y and Z carrying on business since 2002, decided to dissolve their partnership on 30th June 2018, when their Balance Sheet was as under: Liabilities Assets Creditors 34,000 Cash 25,000 Capital Accounts: X 1,20,000 Debtors 62,000 90,000 Stock 37,000 Z 60,000 2,70,000 Tools 8,000 Motor Cars 12,000 Machinery 60,000 Freehold Building 1,00,000 3,04,000 3,04,000 Y and Z agreed to form a new partnership to carry on the business and it is agreed that they shall acquire from the old firm the following assets at amounts shown hereinunder: Stock 40,000; Tools 35,000; Motor Cars 25,000; Machinery -- *78,000; Freehold Building - 84,000; Goodwill 360,000. The partnership agreement of X, Y and Z provided that trading profits and losses shall be divided in the ratio of 3:2:1 and that capital profits or losses shall be divided in proportion of their capitals. Debtors realise ? 59,000 and discount amounting to * 720 is secured on payments due to creditors. Y and Z bring the necessary cash to pay X in the ratio of 3:2. You are required to prepare: (i) the necessary accounts of the firm X, Y and Z; (a) if the firm Y and Z continue the same books, and (b) if the partners open new books; (ii) The opening Balance Sheet of the firm Y and Z

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started