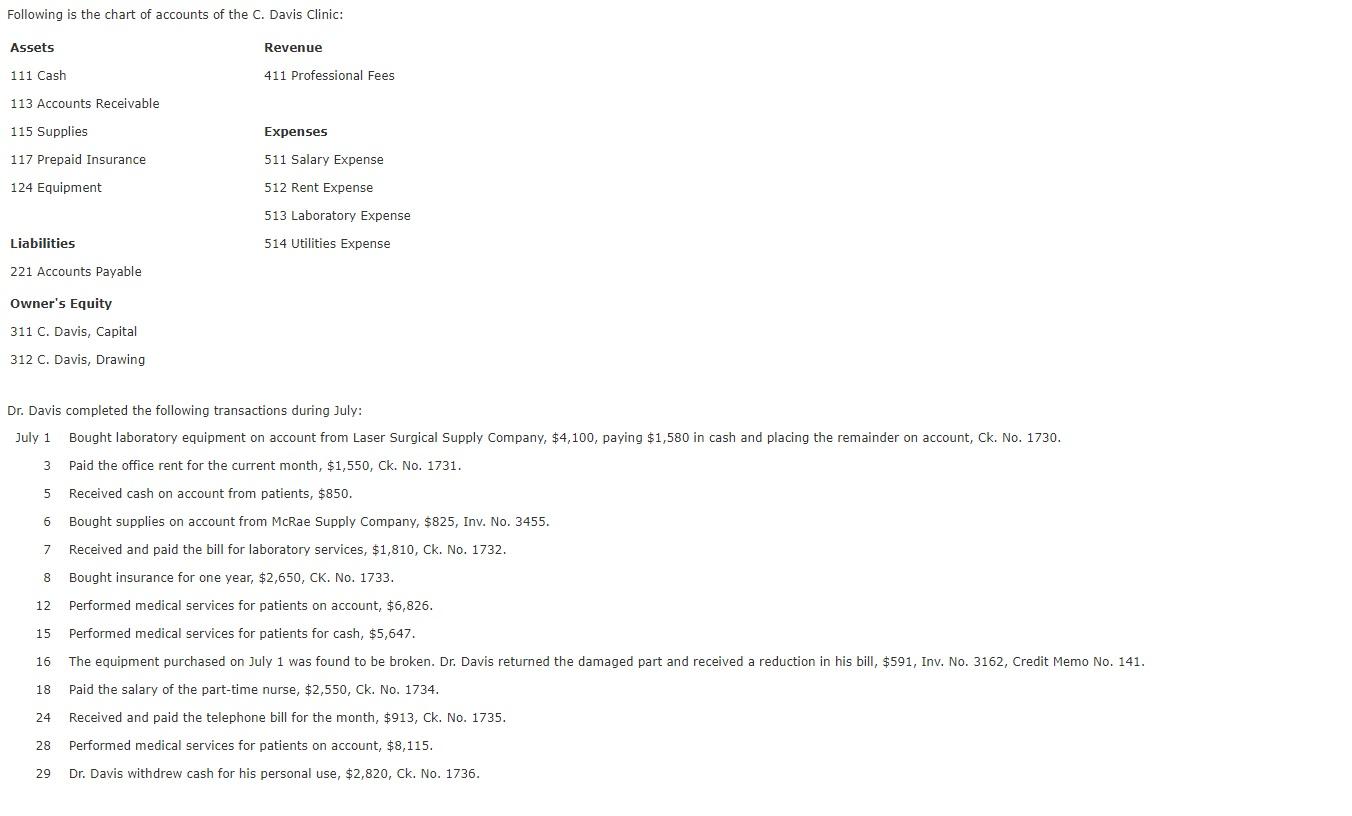

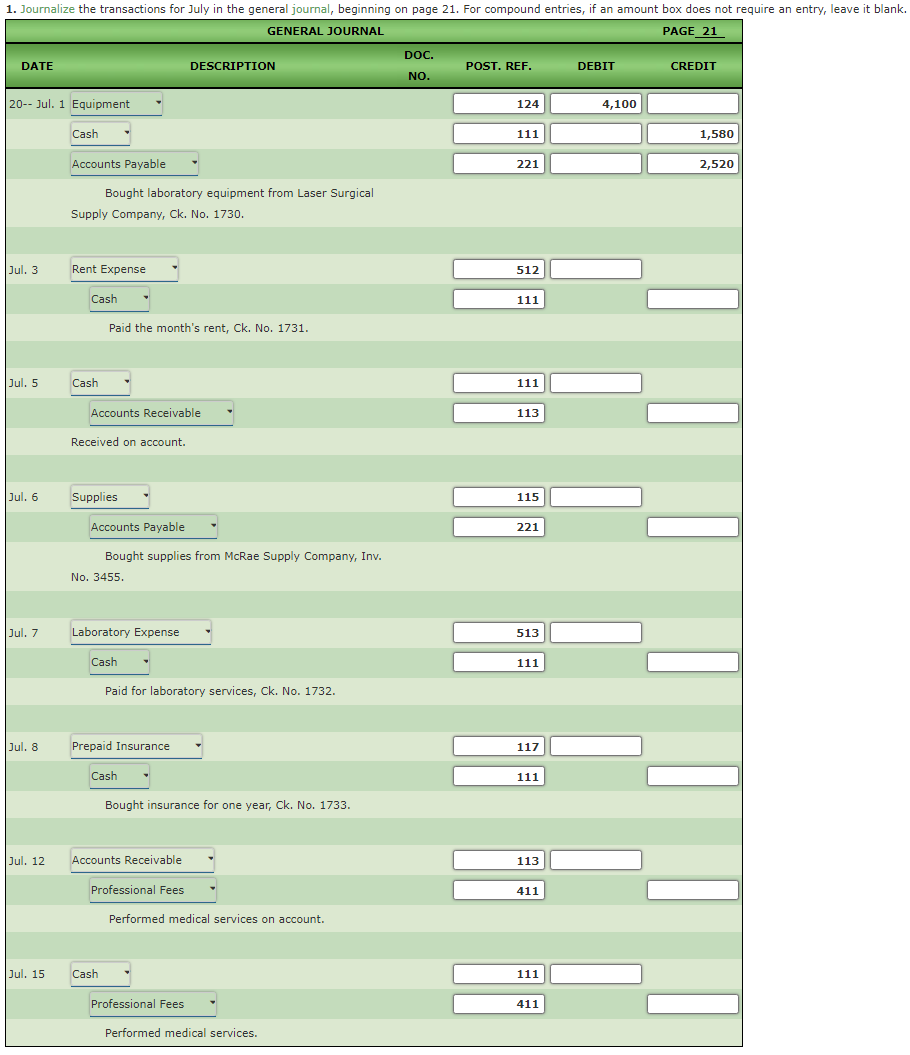

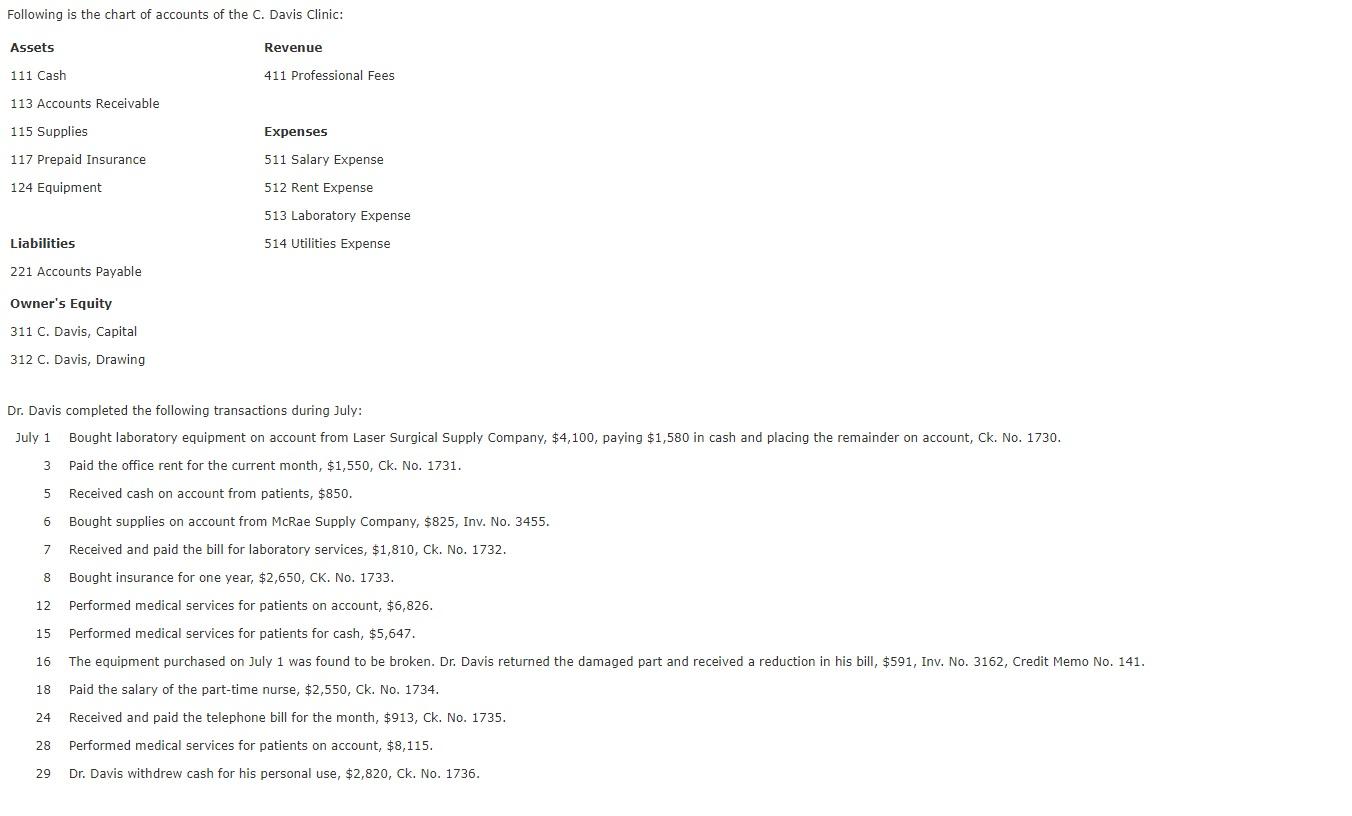

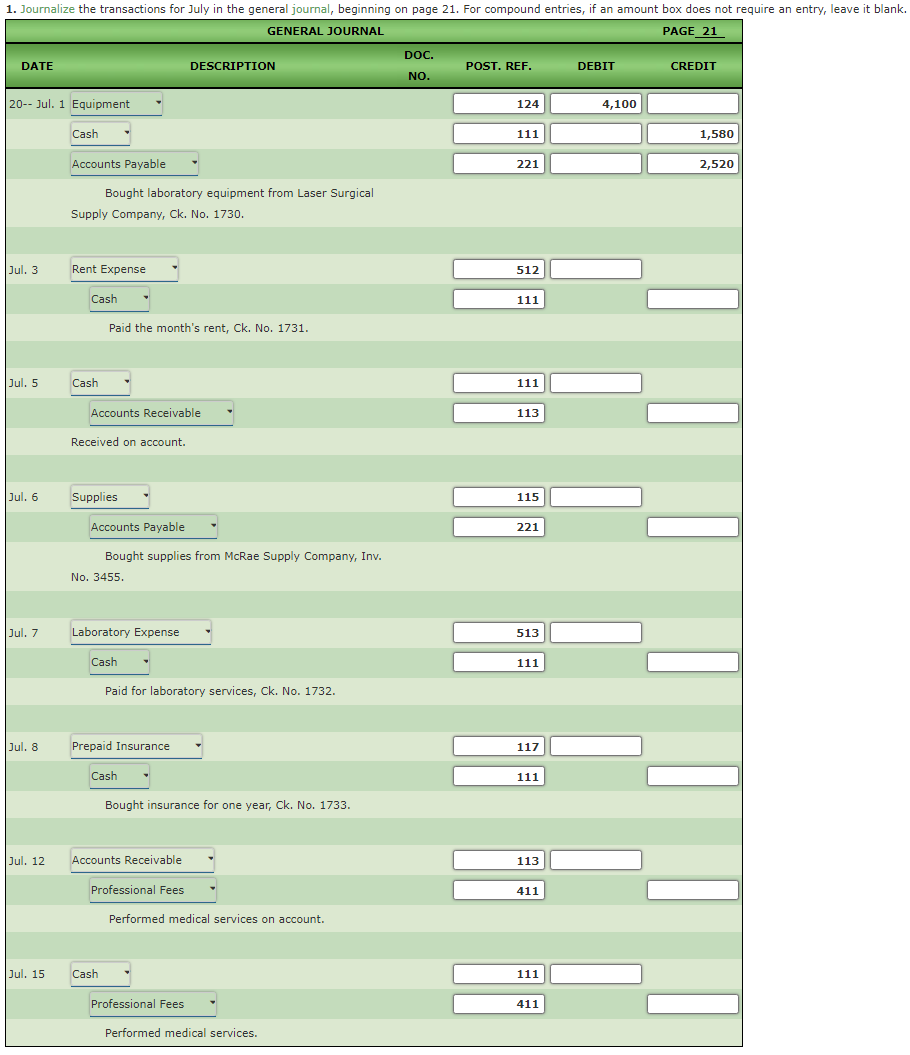

Dr. Davis completed the following transactions during July:

| July 1 | | Bought laboratory equipment on account from Laser Surgical Supply Company, $4,100, paying $1,580 in cash and placing the remainder on account, Ck. No. 1730. |

| 3 | | Paid the office rent for the current month, $1,550, Ck. No. 1731. |

| 5 | | Received cash on account from patients, $850. |

| 6 | | Bought supplies on account from McRae Supply Company, $825, Inv. No. 3455. |

| 7 | | Received and paid the bill for laboratory services, $1,810, Ck. No. 1732. |

| 8 | | Bought insurance for one year, $2,650, CK. No. 1733. |

| 12 | | Performed medical services for patients on account, $6,826. |

| 15 | | Performed medical services for patients for cash, $5,647. |

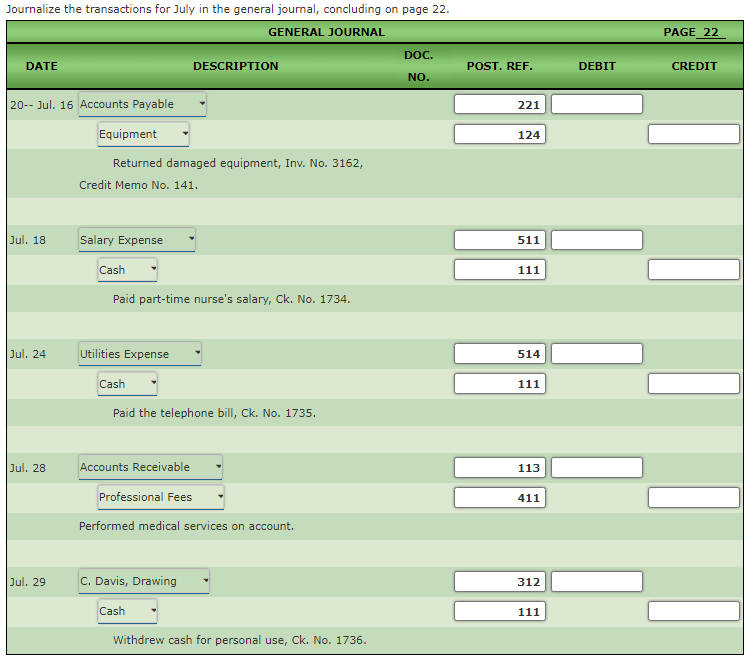

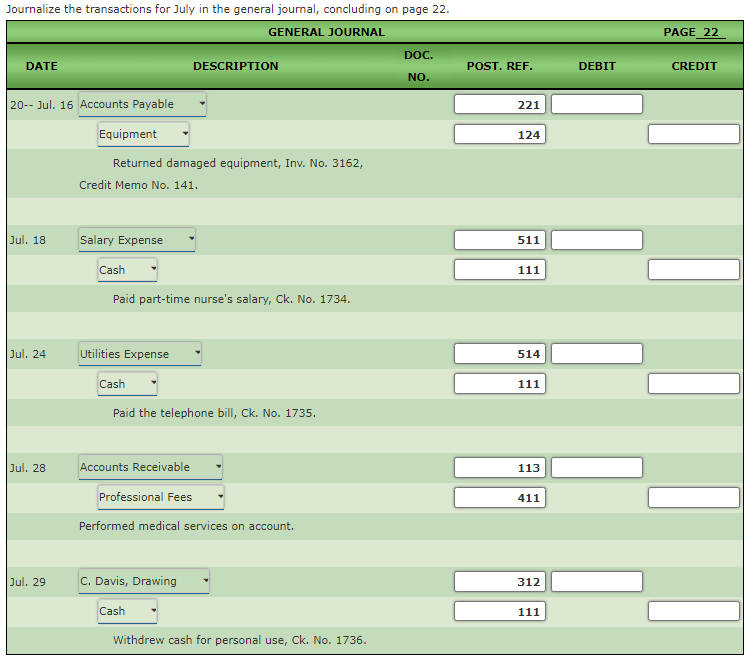

| 16 | | The equipment purchased on July 1 was found to be broken. Dr. Davis returned the damaged part and received a reduction in his bill, $591, Inv. No. 3162, Credit Memo No. 141. |

| 18 | | Paid the salary of the part-time nurse, $2,550, Ck. No. 1734. |

| 24 | | Received and paid the telephone bill for the month, $913, Ck. No. 1735. |

| 28 | | Performed medical services for patients on account, $8,115. |

| 29 | | Dr. Davis withdrew cash for his personal use, $2,820, Ck. No. 1736. |

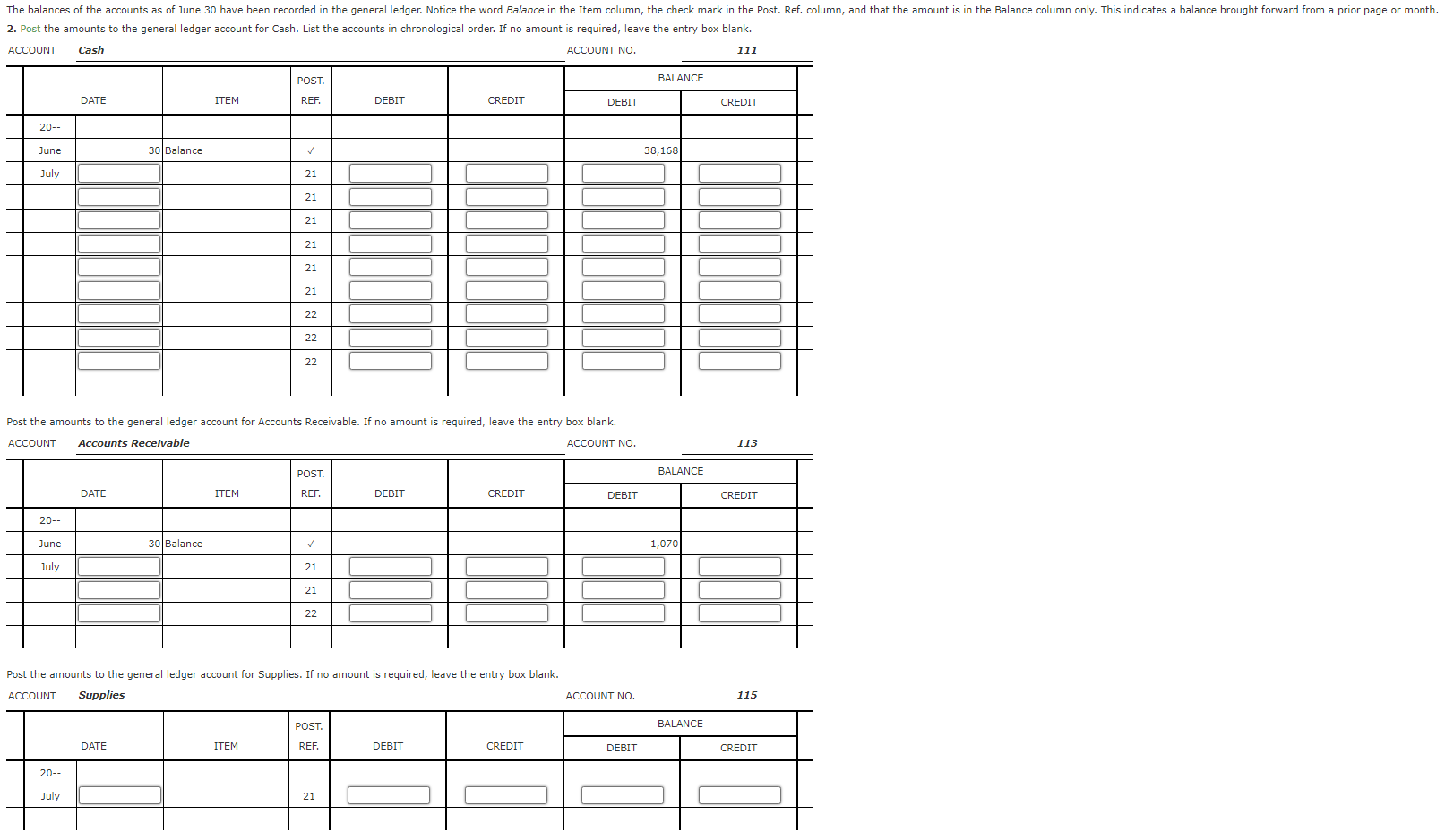

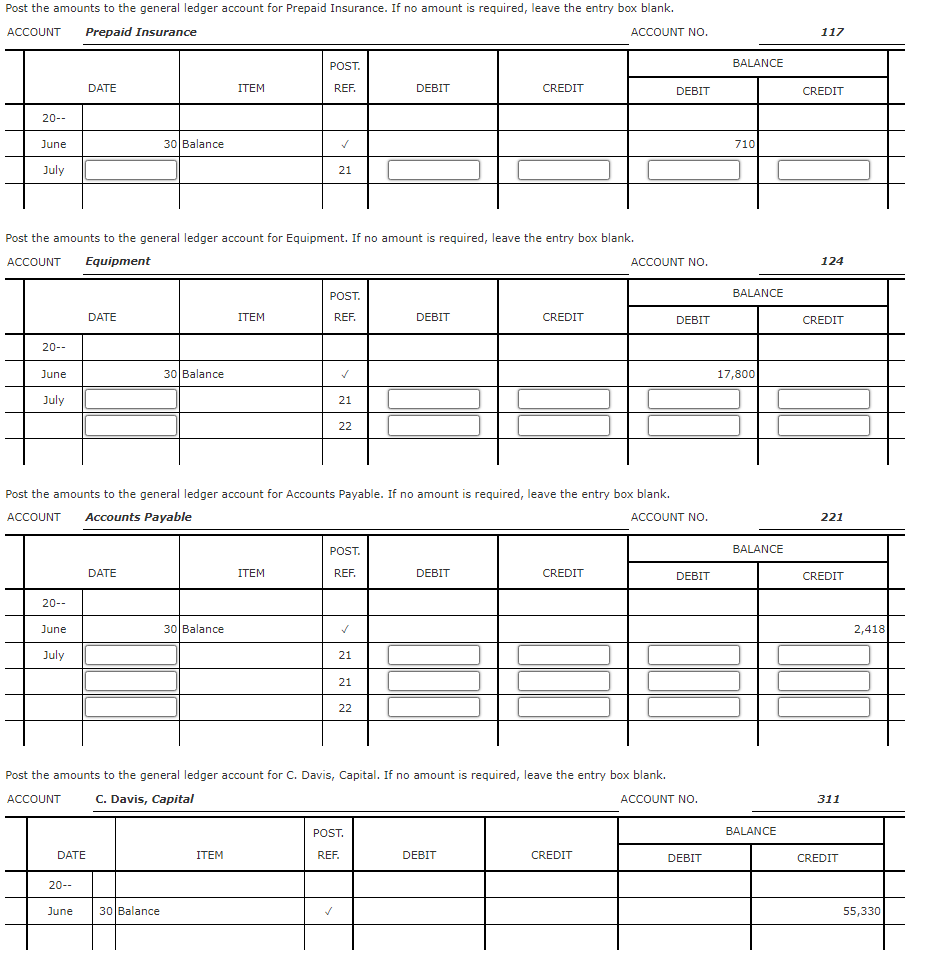

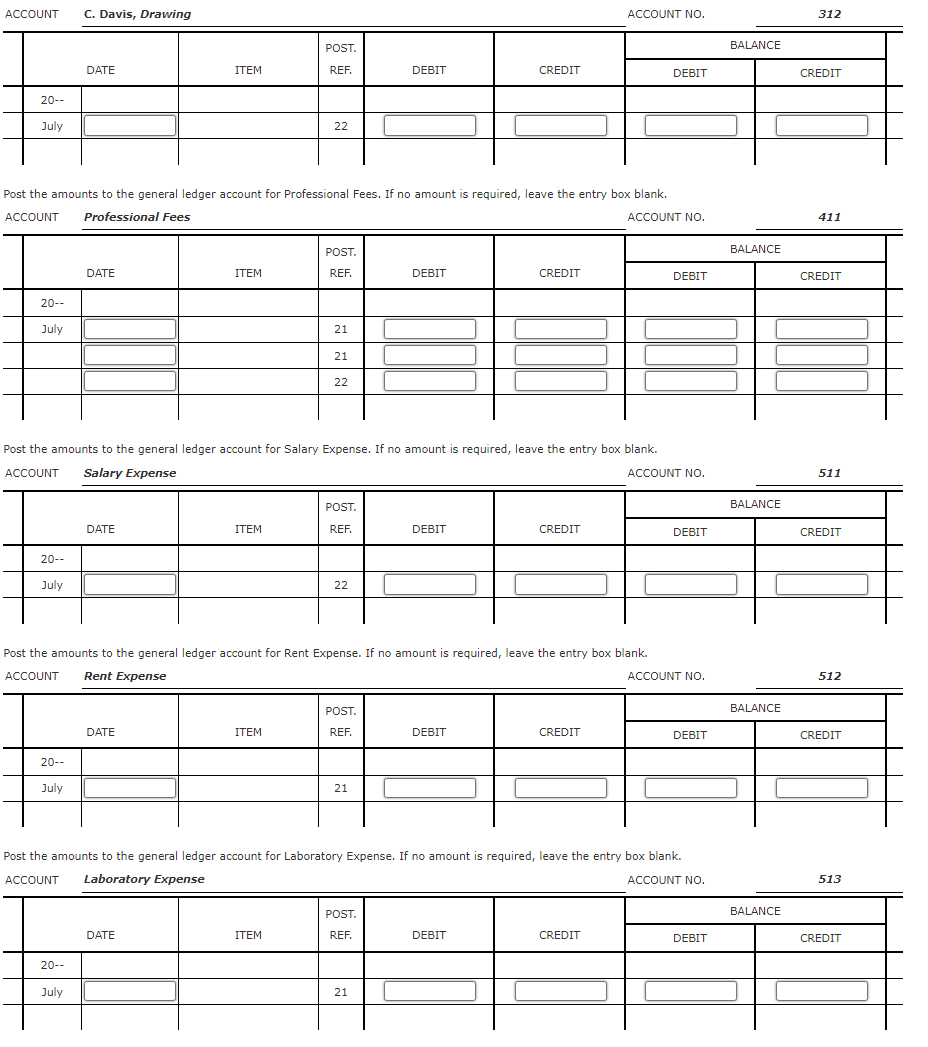

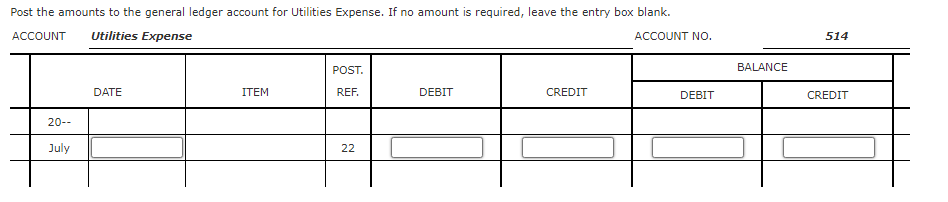

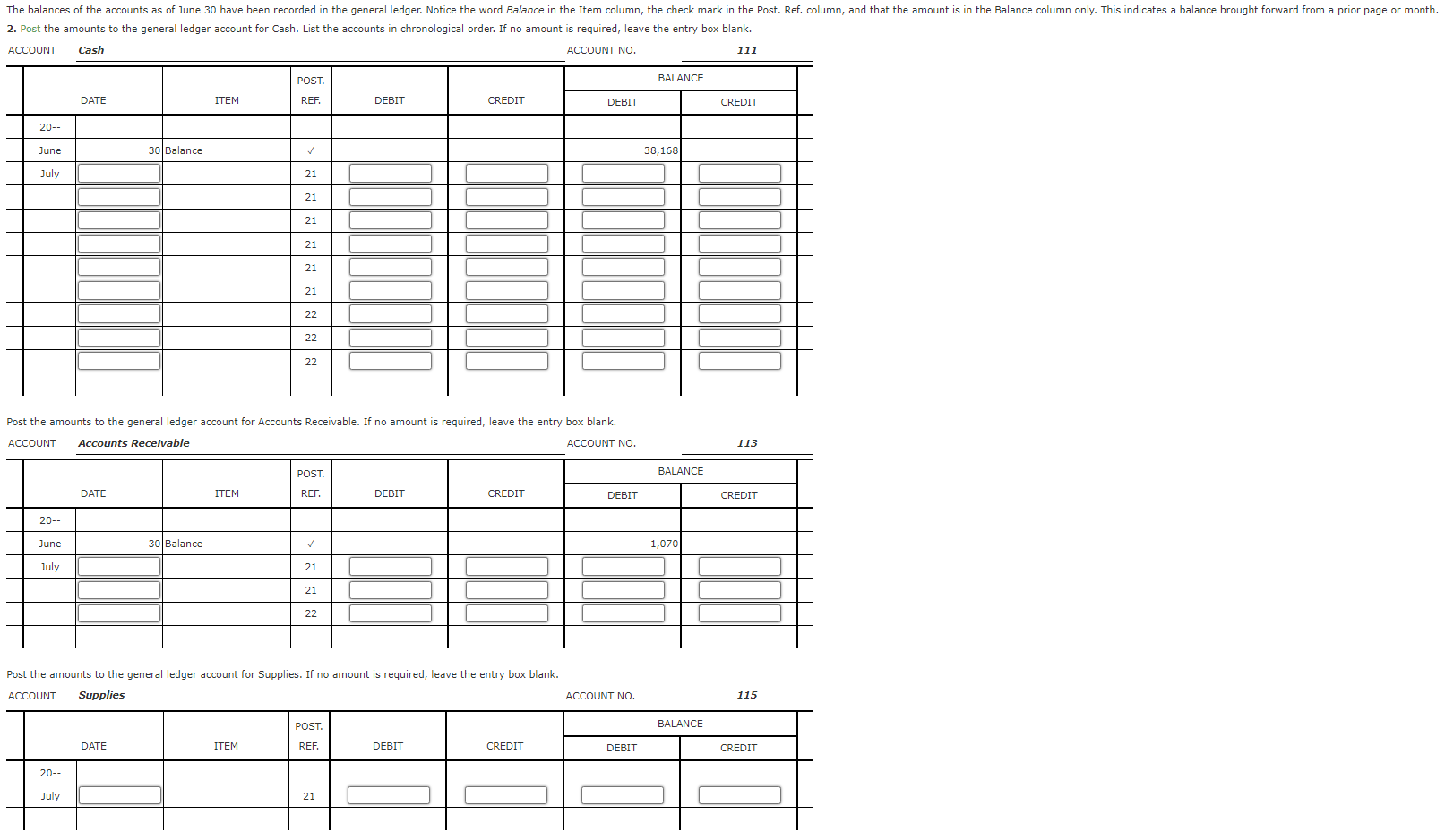

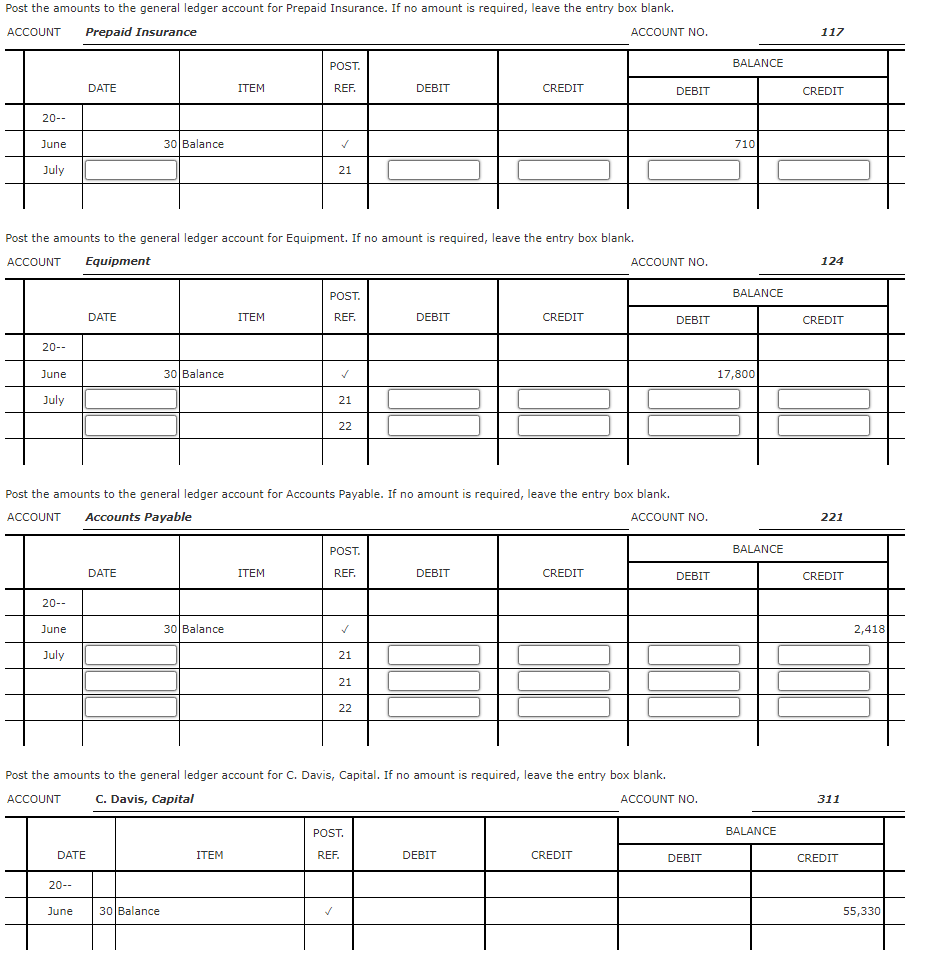

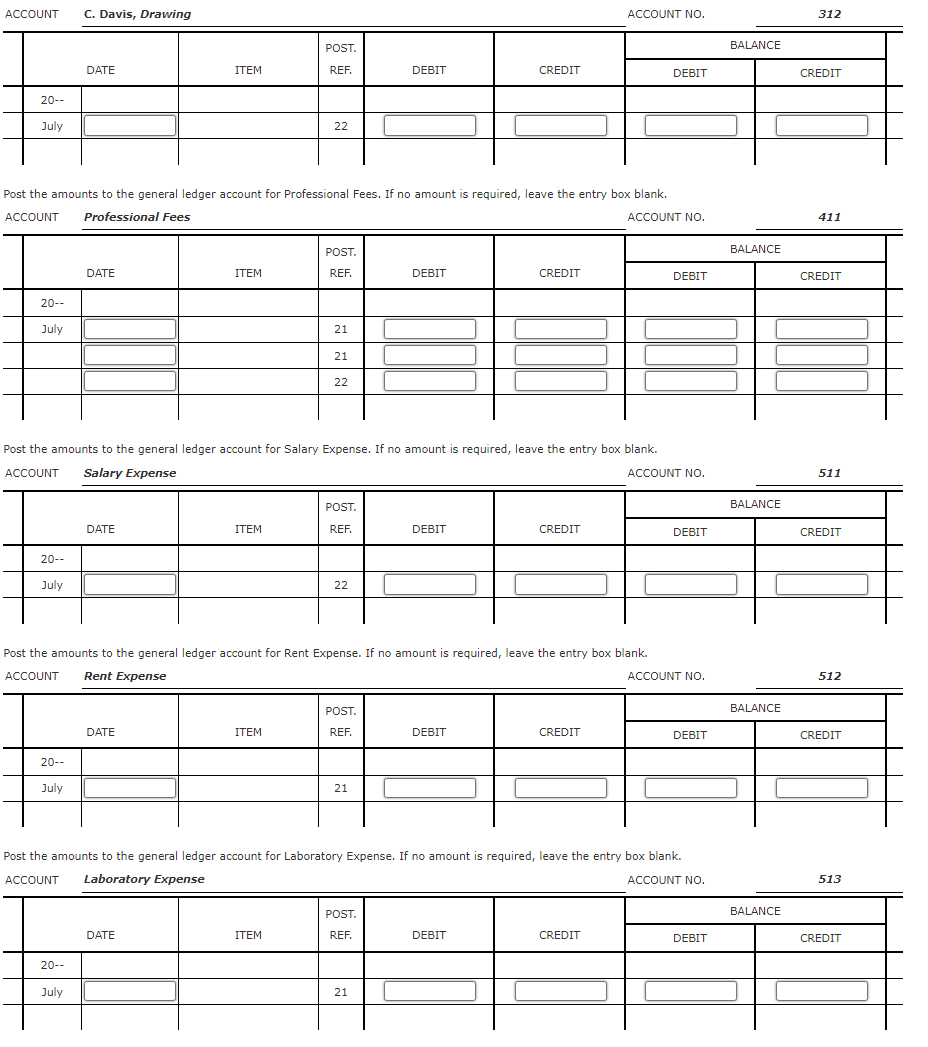

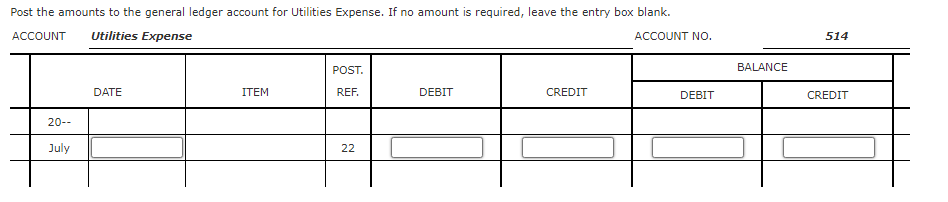

Following is the chart of accounts of the C. Davis Clinic: Dr. Davis completed the following transactions during July: July 1 Bought laboratory equipment on account from Laser Surgical Supply Company, $4,100, paying $1,580 in cash and placing the remainder on account, Ck. No. 1730. 3 Paid the office rent for the current month, $1,550, Ck. No. 1731 . 5 Received cash on account from patients, $850, 6 Bought supplies on account from McRae Supply Company, $825, Inv. No. 3455. 7 Received and paid the bill for laboratory services, $1,810, Ck. No. 1732. 8 Bought insurance for one year, $2,650, CK. No. 1733. 12 Performed medical services for patients on account, $6,826. 15 Performed medical services for patients for cash, $5,647. 16 The equipment purchased on July 1 was found to be broken. Dr. Davis returned the damaged part and received a reduction in his bill, $591, Inv. No. 3162 , Credit Memo No. 141. 18 Paid the salary of the part-time nurse, $2,550, Ck. No. 1734. 24 Received and paid the telephone bill for the month, $913, Ck. No. 1735. 28 Performed medical services for patients on account, $8,115. 29 Dr. Davis withdrew cash for his personal use, $2,820, Ck. No. 1736. Bought laboratory equipment from Laser Surgical Supply Company, Ck. No. 1730. Jul. 3 512 111 Paid the month's rent, Ck. No. 1731. Jul. 5 111 113 Received on account. Bought supplies from McRae Supply Company, Inv. No. 3455 . Jul. 7 513 111 Paid for laboratory services, Ck. No. 1732. Bought insurance for one year, Ck. No. 1733. Journalize the transactions for July in the general journal, concluding on page 22 . Paid part-time nurse's salary, Ck. No. 1734. Paid the telephone bill, Ck. No. 1735. \begin{tabular}{rlr} Jul. 28 & Accounts Receivable & 113 \\ \hline Professional Fees & & 411 \\ \hline \end{tabular} Performed medical services on account. Jul. 29 C. Davis, Drawing 312 Cash 111 Withdrew cash for personal use, Ck. No. 1736. Post the amounts to the general ledger account for Accounts Receivable. If no amount is required, leave the entry box blank. ACCOUNT Accounts Receivable ACCOUNT NO. Post the amounts to the general ledger account for Supplies. If no amount is required, leave the entry box blank. ACCOUNT Supplies Post the amounts to the general ledger account for Accounts Payable. If no amount is required, leave the entry box blank. ACCOUNT Accounts Payable ACCOUNT 1 Post the amounts to the general ledger account for C. Davis, Capital. If no amount is required, leave the entry box blank. ACCOUNT C. Davis, Capital ACCOUNT NO Post the amounts to the general ledger account for Professional Fees. If no amount is required, leave the entry box blank. ACCOUNT Professional Fees ACCOUNT NO Post the amounts to the general ledger account for Salary Expense. If no amount is required, leave the entry box blank. ACCOUNT Salary Expense ACCOUNT NO Post the amounts to the general ledger account for Rent Expense. If no amount is required, leave the entry box blank. ACCOUNT Rent Expense ACCOUNT NO Post the amounts to the general ledger account for Laboratory Expense. If no amount is required, leave the entry box blank. ACCOUNT Laboratory Expense ACCOUNT NO Post the amounts to the general ledger account for Utilities Expense. If no amount is required, leave the entry box blank