Answered step by step

Verified Expert Solution

Question

1 Approved Answer

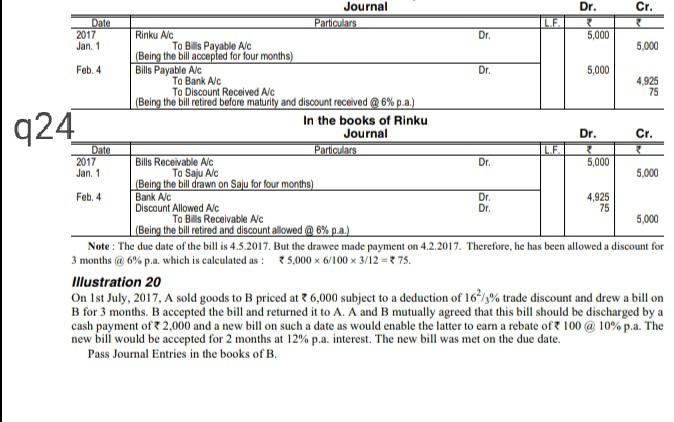

Dr. Dr. 924 LE 3 Date 2017 Dr. Journal Dr. Cr. Date Particulars LE 3 2017 Rinku Ac 5,000 Jan. 1 To Bills Payable Alc

Dr. Dr. 924 LE 3 Date 2017 Dr. Journal Dr. Cr. Date Particulars LE 3 2017 Rinku Ac 5,000 Jan. 1 To Bills Payable Alc 5,000 (Being the bill accepted for four months) Feb. 4 Bills Payable Alc 5,000 To Bank Alc 4,925 To Discount Received Alc 75 (Being the bill retired before maturity and discount received @ 6% p.a.) In the books of Rinku Journal Dr. Cr. Particulars Bills Receivable Alc 5,000 Jan. 1 To Saju Alc 5.000 (Being the bill drawn on Saju for four months) Feb. 4 Bank AC 4.925 Discount Allowed Alc Dr. 75 To Bils Receivable Alc 5,000 (Being the bill retired and discount allowed @ 6% pa) Note: The due date of the bill is 4.5.2017. But the drawee made payment on 4.2.2017. Therefore, he has been allowed a discount for 3 months @ 6% p.a. which is calculated as : 25,000 x 6/100 x 3/12 = 275. Illustration 20 On 1st July, 2017. A sold goods to B priced at 6,000 subject to a deduction of 16/%trade discount and drew a bill on B for 3 months. B accepted the bill and returned it to A. A and B mutually agreed that this bill should be discharged by a cash payment of 2,000 and a new bill on such a date as would enable the latter to earn a rebate of 100 @ 10%p.a. The new bill would be accepted for 2 months at 12% p.a. interest. The new bill was met on the due date. Pass Journal Entries in the books of B. Dr

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started