Question

Dr. John Anderson previously worked as a research scientist for Sensor Inc., a company that develops tiny sensors that detect and identify trace amounts of

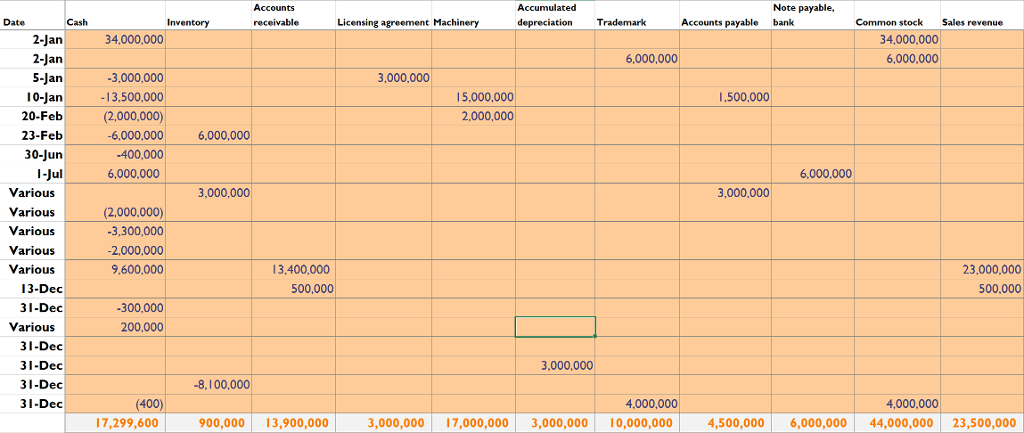

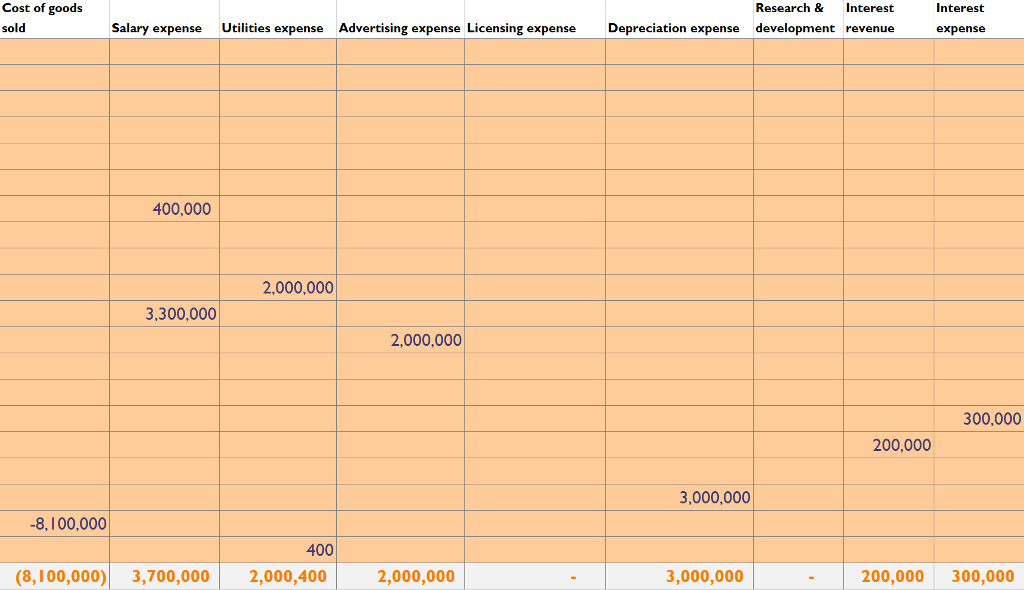

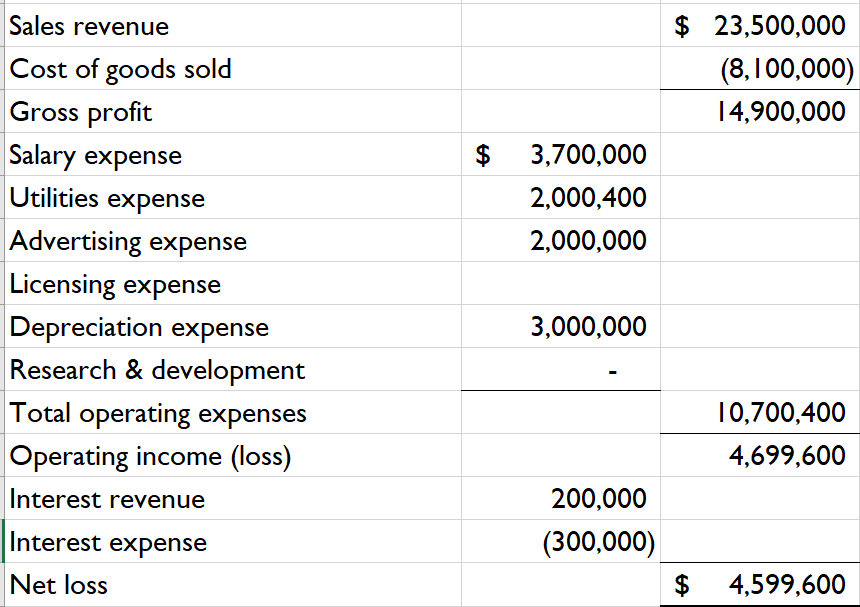

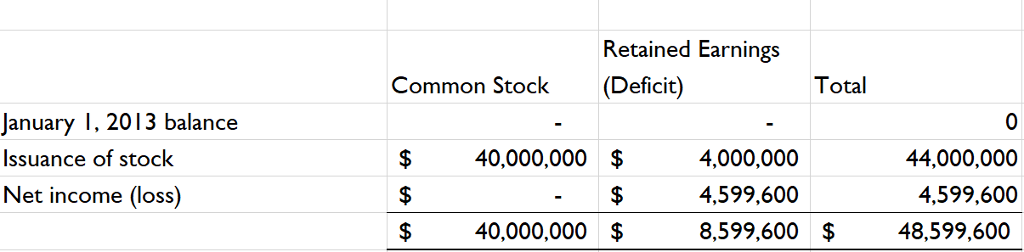

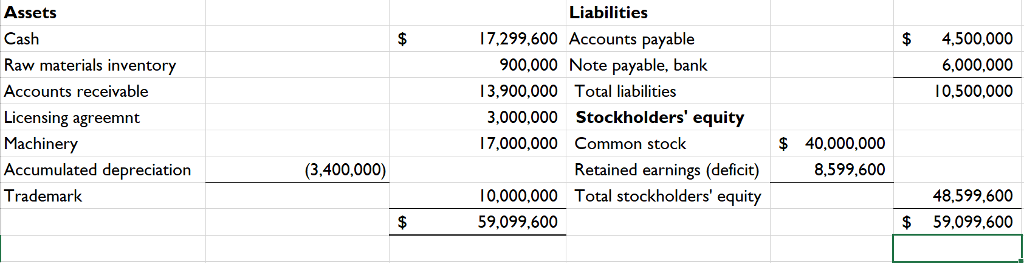

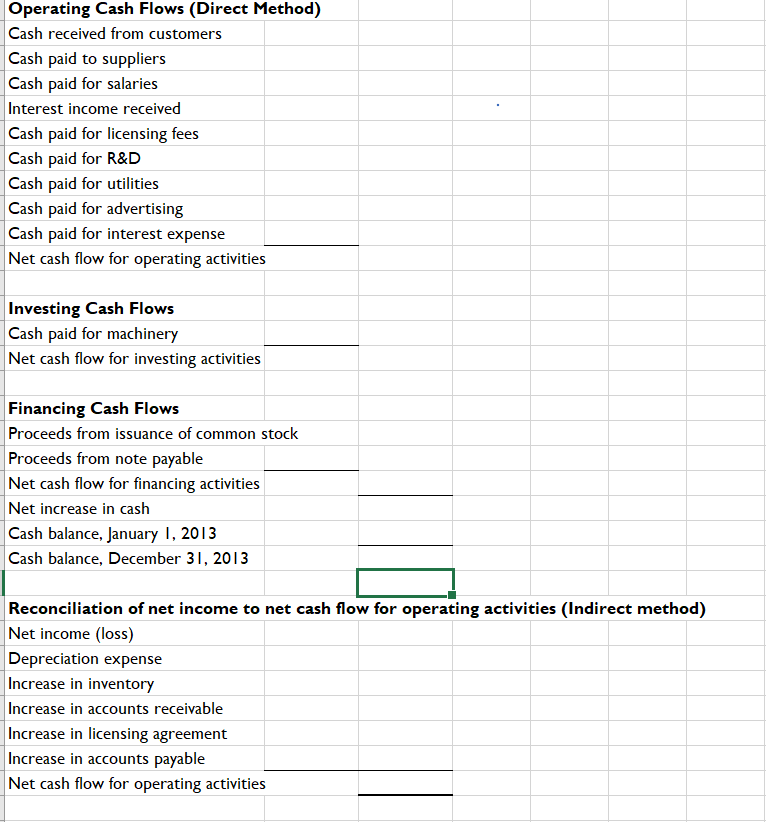

Dr. John Anderson previously worked as a research scientist for Sensor Inc., a company that develops tiny sensors that detect and identify trace amounts of chemicals in the air. Sensor Inc. markets and sells the sensors to industrial companies to assist with leak and hazardous agent detection. Anderson plans to license the technology and develop the sensor for a device that would help physicians detect early-stage cancers. Patients would breathe directly into the device, which would analyze a users breath for traces of key compounds associated with the most common cancers. In addition to eliminating the need for invasive biopsy procedures, the screening tool would also be inexpensive, easy to use and provide immediate results. In 2012, Anderson applied for the trademark for BreatheScreen with the United States Patent and Trademark Office and was granted the trademark in November 2012. In addition to the small entity electronic filing fee of $375 for the trademark, Anderson paid $2,500 to a lawyer who assisted him with the filing process. The following provides a summary of events for 2013: 1. On January 2, Anderson, together with three investors, established BreatheScreen Inc. BreatheScreen issued 17,000,000 common shares to investors for $2 per share. 2. Also on January 2, BreatheScreen issued an additional 3,000,000 shares, which were given to Anderson in exchange for the trademark BreatheScreen. The trademark is viewed as a key success factor to the business. 3. On January 5, BreatheScreen signed a one-year licensing agreement with Sensor Inc. The licensing period began on February 1, 2013, and the annual fee of $3,000,000 was paid in full. 4. On January 10, BreatheScreen purchased new machinery that will be used in the production of the BreatheScreen for $13,500,000 in cash. An additional $1,500,000 was paid for installation. 5. BreatheScreen contracted with a small health technology company to modify the original sensing chip to detect certain volatile organic compounds (VOCs) associated with cancer. Toward the end of February 2013, the health technology company delivered the required specifications and a pre-production model and was paid a total of $2,000,000. 6. On February 23, BreatheScreen paid $6,000,000 upon receiving a delivery of materials for use in the production of BreatheScreen. 7. BreatheScreen paid $400,000 for salaries to corporate officers and employees (for the January to June period). 8. On July 1, BreatheScreen borrowed $6,000,000 from a bank. The annual interest is 10 percent and is paid semi-annually. 9. Additional materials (electrical components, packaging, labels, etc.) to be used in BreatheScreen production were purchased for a total of $3,000,000. Under the favorable terms obtained from its suppliers, BreatheScreen will make no payments until February 2014. 10. During the nine months ended December 31, 2013, the company paid $2,000,000 for fire insurance for the production facility and other production-related expenses (e.g., utilities and labor). 11. An additional $3,300,000 in cash was paid for corporate salaries and other corporate expenses (for the July to December period). 12. BreatheScreen spent $2,000,000 in cash on advertising to help introduce the product. They initially started with print advertising in journals and magazines targeted to health care professionals but quickly realized the need for a social media presence. They hired an unpaid intern to help build online awareness. 13. Toward the end of 2013, sales started to accelerate. BreatheScreen sold and shipped a total of $23,000,000 of its products. At the end of the year, a total of $9,600,000 of these sales had yet to be collected. The largest single receivable was due from a reputable pharmaceutical company, which purchased a substantial number of devices as part of a promotional campaign. Most of the other receivables were on transactions that had been made close to year-end, and were expected to be collected in January 2014. 14. On December 13, BreatheScreen signed a contract with the organizer of the International Fair for Medical Devices 2014 (IFMD) for 1,000 units of BreatheScreen, with the intention of giving them away to health care professionals visiting the trade show. The selling price specified in the contract is $500 per unit. BreatheScreen This document is authorized for use only in Financial Statement Analysis - 25 July 2016 by Dr Ding Ding, SIM University from July 2016 to September 2016. BreatheScreen Inc.: Transaction Analysis and Financial Statements A-216 p. 3 promised to deliver the units on March 10, 2014. IFMD had up to 30 days after delivery to pay for the devices. 15. At the end of the year, BreatheScreen paid $300,000 in interest on their bank loan. 16. BreatheScreen received $200,000 in interest on its cash account. The following additional information was gathered in the process of preparing BreatheScreens financial reports for 2013: 17. The 12-month licensing agreement with Sensor Inc. was due to expire on January 31, 2014. As of December 31, 2013, the company was still negotiating the terms of an extension of the licensing agreement. 18. The machinery used in the production of BreatheScreen was expected to last for approximately 5 years (one year of which had already passed). BreatheScreen did not expect the machinery to have any remaining value after 5 years. 19. As of December 31, 2013, there was still $900,000 worth of materials in the warehouse. There were no finished or partially finished BreatheScreen devices. 20. The trademark for BreatheScreen is initially valid for 10 years and may be renewed indefinitely for 10-year periods. The filing fee for a trademark renewal was $400. A valuation analysis conducted at the end of the year suggested that the value of the trademark had increased to approximately $10,000,000. This document is authorized for use only in Financial Statement Analysis - 25 July 2016 by Dr Ding Ding, SIM University from July 2016 to September 2016.

Blank the last form

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started