Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Dr. Lam is 36 years old and is in the process of getting a divorce. As part of the divorce proceedings, Dr. Lam must sell

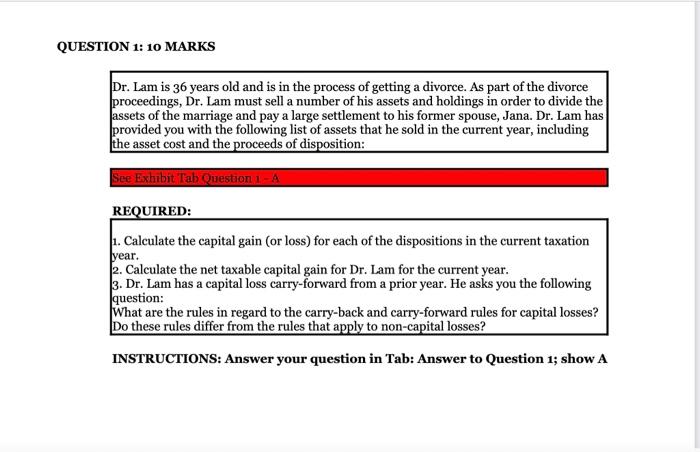

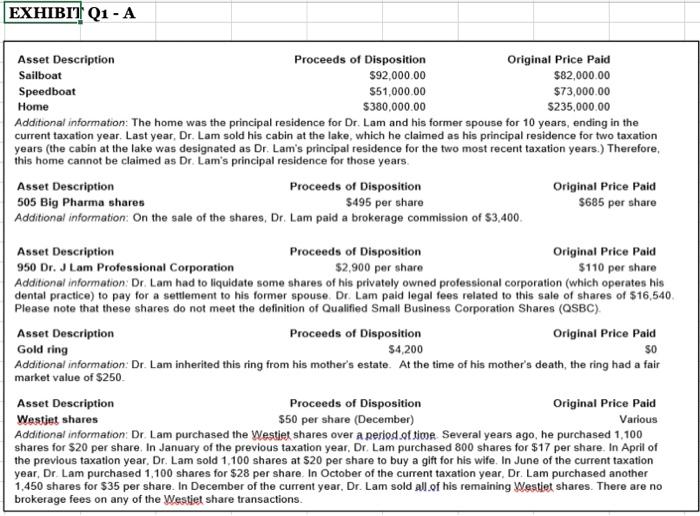

Dr. Lam is 36 years old and is in the process of getting a divorce. As part of the divorce proceedings, Dr. Lam must sell a number of his assets and holdings in order to divide the assets of the marriage and pay a large settlement to his former spouse, Jana. Dr. Lam has provided you with the following list of assets that he sold in the current year, including the asset cost and the proceeds of disposition: See Exhibit Tab Question 1 - A REQUIRED: 1. Calculate the capital gain (or loss) for each of the dispositions in the current taxation year. 2. Calculate the net taxable capital gain for Dr. Lam for the current year. 3. Dr. Lam has a capital loss carry-forward from a prior year. He asks you the following question: What are the rules in regard to the carry-back and carry-forward rules for capital losses? Do these rules differ from the rules that apply to non-capital losses? INSTRUCTIONS: Answer your question in Tab: Answer to Question 1; show A 1,450 shares for $35 per share. In December of the current year, Dr. Lam sold all of his remaining Westiet shares. There are no brokerage fees on any of the Westiet share transactions

Dr. Lam is 36 years old and is in the process of getting a divorce. As part of the divorce proceedings, Dr. Lam must sell a number of his assets and holdings in order to divide the assets of the marriage and pay a large settlement to his former spouse, Jana. Dr. Lam has provided you with the following list of assets that he sold in the current year, including the asset cost and the proceeds of disposition: See Exhibit Tab Question 1 - A REQUIRED: 1. Calculate the capital gain (or loss) for each of the dispositions in the current taxation year. 2. Calculate the net taxable capital gain for Dr. Lam for the current year. 3. Dr. Lam has a capital loss carry-forward from a prior year. He asks you the following question: What are the rules in regard to the carry-back and carry-forward rules for capital losses? Do these rules differ from the rules that apply to non-capital losses? INSTRUCTIONS: Answer your question in Tab: Answer to Question 1; show A 1,450 shares for $35 per share. In December of the current year, Dr. Lam sold all of his remaining Westiet shares. There are no brokerage fees on any of the Westiet share transactions Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started