Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Dr. Oriana Percival, who is a British national, is a pharmacologist working in a pharmaceutical firm which headquarters in Oslo, Norway. The job requires

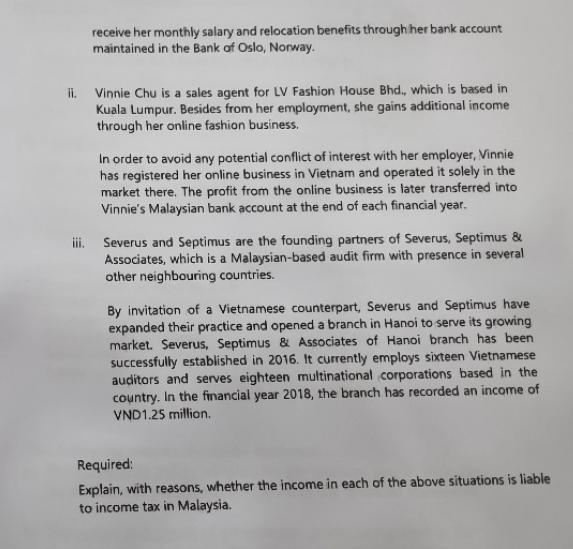

Dr. Oriana Percival, who is a British national, is a pharmacologist working in a pharmaceutical firm which headquarters in Oslo, Norway. The job requires her to be constantly relocated across the globe to serve the firm's numerous research laboratories and clinical studies. In January 2018, Dr. Oriana is seconded to Malaysia for a period of three years to collaborate with the Ministry of Health, Malaysia in developing a new dengue vaccine. One of the terms of her transfer states that she is to receive her monthly salary and relocation benefits through her bank account maintained in the Bank of Oslo, Norway. II. Vinnie Chu is a sales agent for LV Fashion House Bhd., which is based in Kuala Lumpur. Besides from her employment, she gains additional income through her online fashion business. In order to avoid any potential conflict of interest with her employer, Vinnie has registered her online business in Vietnam and operated it solely in the market there. The profit from the online business is later transferred into Vinnie's Malaysian bank account at the end of each financial year. iii. Severus and Septimus are the founding partners of Severus, Septimus & Associates, which is a Malaysian-based audit firm with presence in several other neighbouring countries. By invitation of a Vietnamese counterpart, Severus and Septimus have expanded their practice and opened a branch in Hanoi to serve its growing market. Severus, Septimus & Associates of Hanoi branch has been successfully established in 2016. It currently employs sixteen Vietnamese auditors and serves eighteen multinational corporations based in the country. In the financial year 2018, the branch has recorded an income of VND1.25 million. Required: Explain, with reasons, whether the income in each of the above situations is liable to income tax in Malaysia.

Step by Step Solution

★★★★★

3.52 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

Dr Oriana Percivals income received through her bank account maintained in the Bank of Oslo Norway i...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started