Answered step by step

Verified Expert Solution

Question

1 Approved Answer

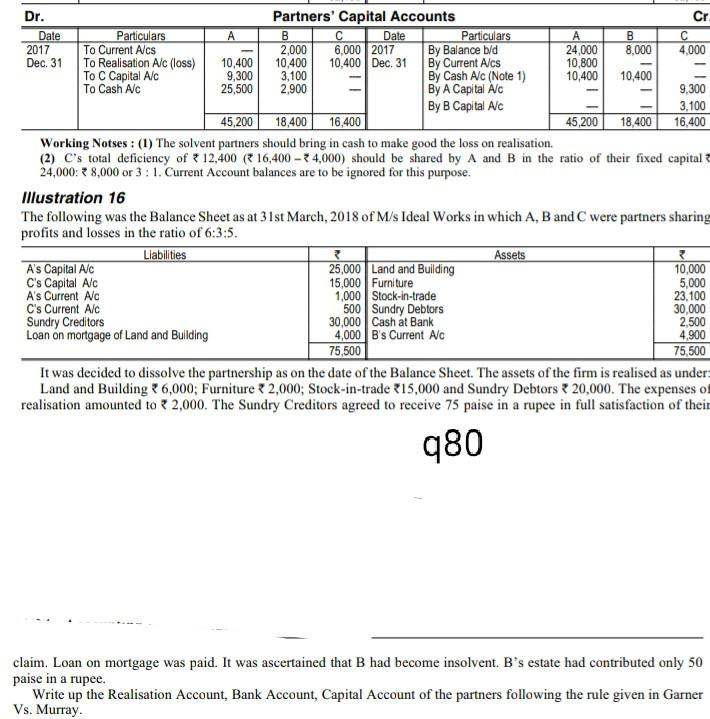

Dr. Partners' Capital Accounts Cr Date Particulars A B Date Particulars A B 2017 To Current Alcs 2,000 6,000 2017 By Balance b/d 24,000 8,000

Dr. Partners' Capital Accounts Cr Date Particulars A B Date Particulars A B 2017 To Current Alcs 2,000 6,000 2017 By Balance b/d 24,000 8,000 4,000 Dec. 31 To Realisation Alc(loss) 10,400 10,400 10,400 Dec. 31 By Current Alcs 10,800 To C Capital Alc 9,300 3,100 By Cash Alc (Note 1) 10,400 10,400 To Cash Alc 25,500 2.900 By A Capital Alc 9,300 By B Capital Alc 3,100 45,200 18,400 16,400 45,200 18,400 16,400 Working Notses: (1) The solvent partners should bring in cash to make good the loss on realisation. (2) C's total deficiency of 12,400 16,400 - 3 4,000) should be shared by A and B in the ratio of their fixed capital 24,000: 38,000 or 3: 1. Current Account balances are to be ignored for this purpose. Illustration 16 The following was the Balance Sheet as at 31st March, 2018 of M/s Ideal Works in which A, B and C were partners sharing profits and losses in the ratio of 6:3:5. Liabilities 3 Assets A's Capital A/C 25,000 Land and Building 10,000 C's Capital Alc 15,000 Furniture 5,000 A's Current Alc 1,000 Stock-in-trade 23.100 C's Current Alc 500 Sundry Debtors 30,000 Sundry Creditors 30,000 Cash at Bank 2,500 Loan on mortgage of Land and Building 4,000 B's Current Nc 4,900 75,500 75,500 It was decided to dissolve the partnership as on the date of the Balance Sheet. The assets of the firm is realised as under Land and Building 26,000; Furniture ? 2,000; Stock-in-trade 215,000 and Sundry Debtors 20,000. The expenses of realisation amounted to ? 2,000. The Sundry Creditors agreed to receive 75 paise in a rupee in full satisfaction of their 980 claim. Loan on mortgage was paid. It was ascertained that B had become insolvent. B's estate had contributed only 50 paise in a rupee. Write up the Realisation Account, Bank Account, Capital Account of the partners following the rule given in Garner Vs. Murray

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started