Question

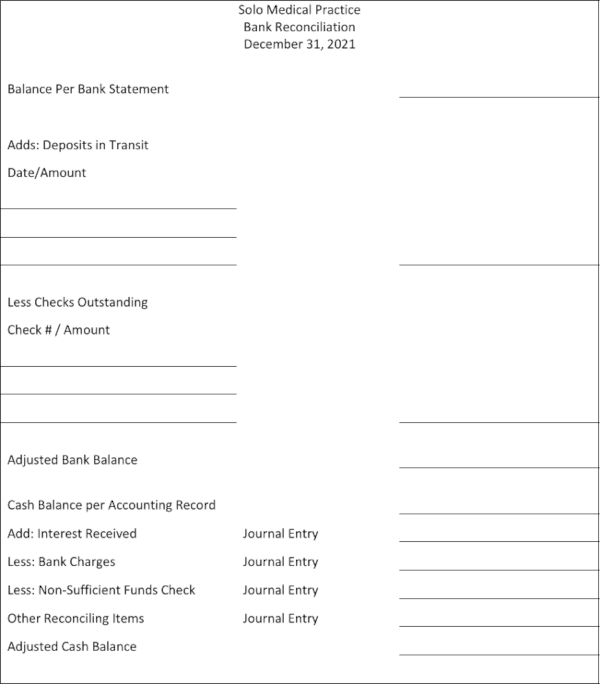

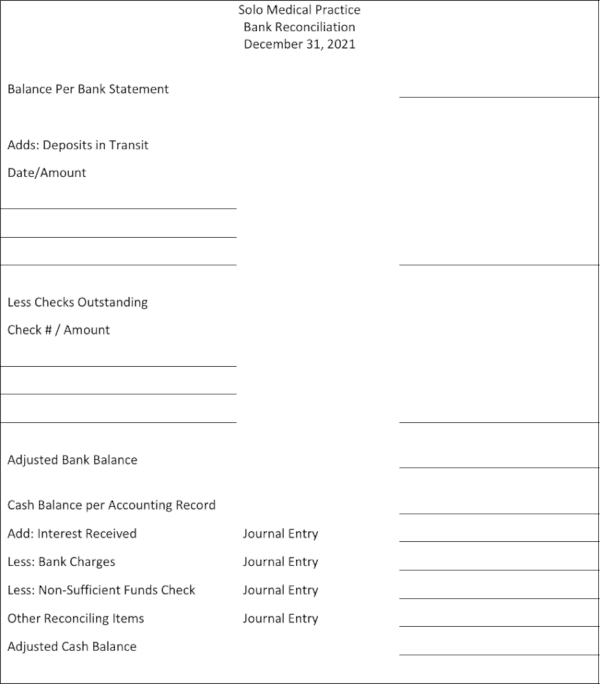

Dr. Solo is preparing a single journal entry for December 31, 2022. The bank statement shows a balance of $10,500 on that day. Three checks

Dr. Solo is preparing a single journal entry for December 31, 2022. The bank statement shows a balance of $10,500 on that day. Three checks were made out on that day: one for $250 for medical supplies, the second for $175 for computer software, and the third for $105 for hand sanitizers. A deposit for $9,000 is not showing on the bank statement. For December, the bank has credited interest to the account for $85 and charged a bank service fee of $55. There is a non-sufficient funds check for $55.00. You will prepare the journal entry to record and complete the bank reconciliation to determine the adjusted cash balance per the facility's accounting records. What is the total of outstanding checks?

Dr. Solo is preparing a single journal entry for December 31, 2022. The bank statement shows a balance of $10,500 on that day. Three checks were made out on that day: one for $250 for medical supplies, the second for $175 for computer software, and the third for $105 for hand sanitizers. A deposit for $9,000 is not showing on the bank statement. For December, the bank has credited interest to the account for $85 and charged a bank service fee of $55. There is a non-sufficient funds check for $55.00. You will prepare the journal entry to record and complete the bank reconciliation to determine the adjusted cash balance per the facility's accounting records. What is the cash balance per accounting records?"

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Lets address both parts of the question systematically Part 1 Total of Outstanding Checks Three chec...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started